UltraTech Cement Ltd.'s non-controlling financial investment in India Cements Ltd. is a strategic move to acquire the company in the near future, according to analysts. This will help the cement company strengthen its presence in South India.

India Cements' acquisition has given UltraTech Cement an opportunity to buy the remaining stake. If the cement maker acquires the remaining stakes, the share of the top five players in the South will rise to 60% from 43% last year following the acquisition of Kesoram Industries Ltd. and Penna Cement by Ambuja Cement, according to Citi Research.

UltraTech Cement has acquired 23% stake at Rs 1,890 crore, valuing 100% equity at Rs 8,280 crore, Citi Research said.

The stake acquisition is from a large investor, and the management has not talked about a potential deal with the India Cements promoters, Motilal Oswal Financial Services said in a note on Friday.

Citi Research estimates UltraTech Cement will be able to acquire a 100% stake in India Cements at a similar valuation. Internal accruals will help fund the acquisition, the brokerage said in a note on Friday.

The Aditya Birla Group-owned market leader is increasing its capacity in South India, with a present 20% capacity. The company also aims to increase its India annual capacity to 169 million tonne in fiscal 2026, up from 147 million tonne at present, according to Citi Research.

Its leadership position in the industry, healthy operating performance, and large scale of operation warrant higher multiples, according to Motilal Oswal Financial Services.

UltraTech Cement's market share has risen significantly to 26% in fiscal 2024 from 16% in fiscal 2014 because its grey cement capacity has exceeded industry capacity, Motilal Oswal Financial Services said.

Although consolidation is visible, industry pricing trends are likely to remain range-bound over the medium term, with utilisation remaining below 80%, according to Citi Research.

Near-term profitability is likely to remain capped as most companies remain focused on utilisation. However, consolidation will be long-term for long-term profitability and return ratio, Emkay Global Research said in a note on Friday.

Brokerages' Take On UltraTech Cement's Stakes Buy

Motilal Oswal

Motilal Oswal maintains a 'buy' on UltraTech Cement with a target price of Rs 13,300 apiece, implying a potential upside of 13.51% fropm previous close.

The company is maintaining leadership position in industry.

UltraTech Cement added 104.2 million tonne per annum of capacity in the last decade.

Cost savings of Rs 200-300 per tonne to be achieved via higher green power share, logistic savings.

The brokerage expect compound annual growth rate of 18% and 20% in Ebitda and profit after tax, respectively, for fiscal 2024-2027.

Motilal Oswal expects capacity utilization to be at 82-86% over fiscal 2024-2027.

The brokerage expects EBbitda per tonne at Rs 1,150, Rs 1,190 and Rs 1,275 in fiscal 2025, 2026 and 2027, respectively.

Emkay Global Research

Emkay Global Research keeps a 'buy' on Ultratech Cement with a target price of Rs 11,200 apiece, implying a potential downside of 4.4%.

The brokerage believes stake in India Cement could increase and convert into a strategic investment ahead.

Profitability to be capped in the near term, according to Emkay Global Research.

Emkay Global continues to favor UltraTech Cement given strong growth/capex plans.

Recent deals, ongoing expansions to solidify company's presence in southern markets, Emkay Global Research said.

The brokerage expects capacity market share in South and pan-India to rise to 26% and 27%, respectively, by fiscal 2027.

Emkay Global Research expects market share of top four cement groups to rise to 59% by fiscal 2027.

Citi Research

Citi Research maintained a 'buy on UltraTech Cement with a target price of Rs 11,500 apiece, implying an upside potential of 3.2%.

Latest 22.8% acquisition of India Cements done at enterprise value per ton of $88.

UltraTech Cement could acquire 100% of India Cements via internal accruals.

The brokerage expects a compound annual growth rate of 12% in volume through fiscal 2024-2027.

The company in process of increasing exposure in Southern markets.

If firm buys remaining stake in India Cements, share of top five players in South to rise to 60%.

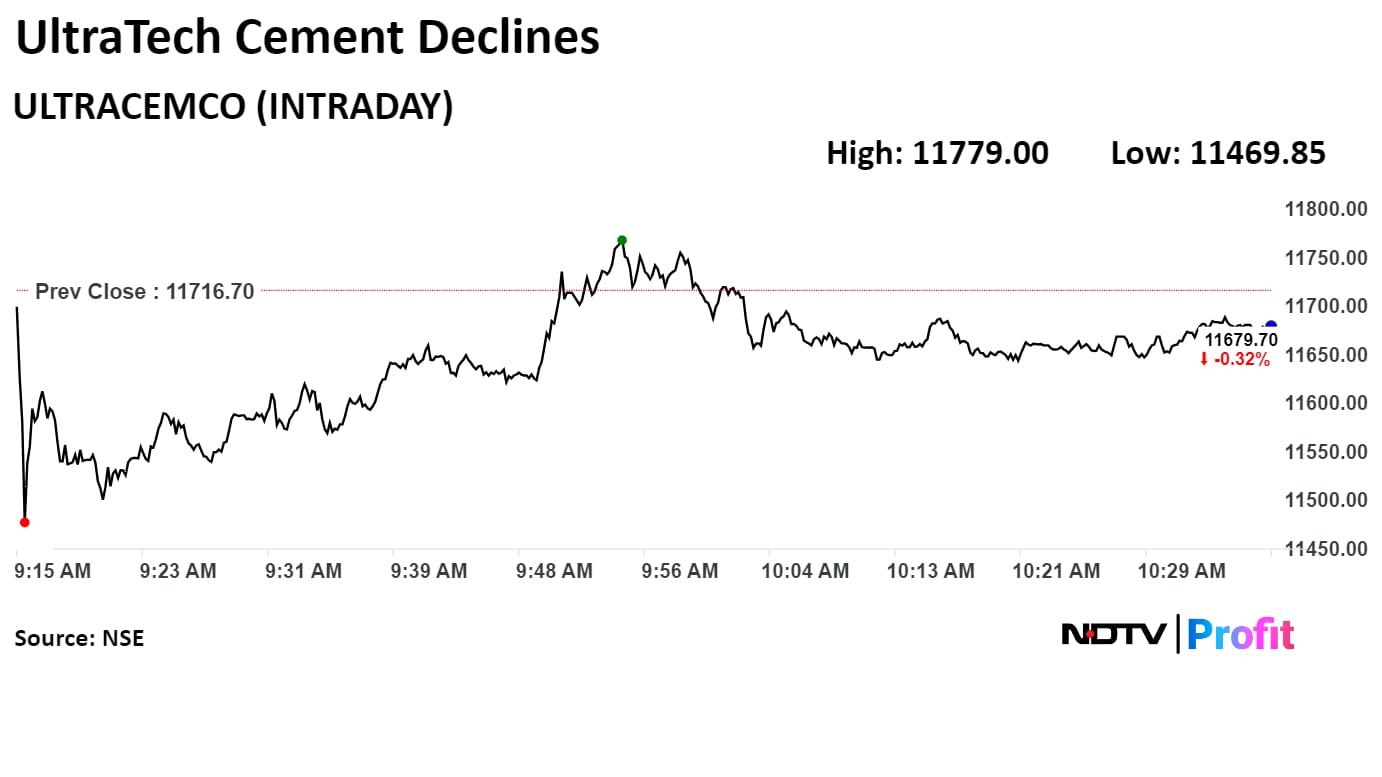

Shares of UltraTech Cement fell as much as 2.11% to Rs 11,469.85 apiece, the lowest level since Jun 27. It pared losses to trade 0.36% lower at Rs 11,675.00 as of 10:39 a.m., compared to 0.39% advance in the NSE Nifty 50 index.

The stock has risen 41.26% in 12 months and 11.6% on year to date basis . Total traded volume so far in the day stood at 2.0 times its 30-day average. The relative strength index was at 70.25.

Out of 42 analysts tracking the company, 34 maintain a 'buy' rating, four recommend a 'hold,' and four suggest 'sell', according to Bloomberg data. The average 12-month consensus price target implies a downside of 4.2%.

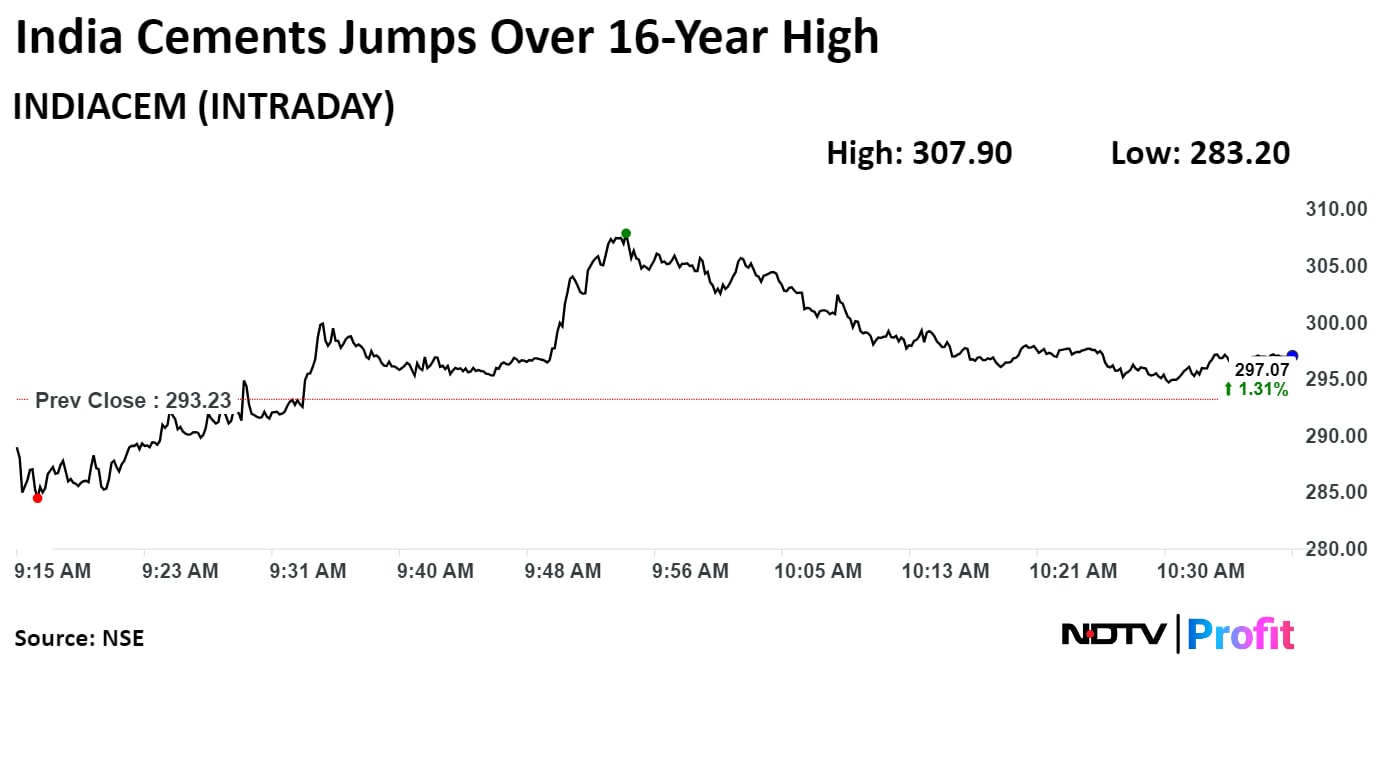

Shares of India Cements rose as much as 5.00% to Rs 307 apiece, the highest level since Jan 2, 2008. It pared gains to trade 0.88% higher at Rs 295.81 as of 10:40 a.m., compared to 0.41% advance in the NSE Nifty 50 index.

The stock has risen 37.91% in 12 months, and 14.71% on year to date basis. Total traded volume so far in the day stood at 5.0 times its 30-day average. The relative strength index was at 80.44.

Out of seven analysts tracking the company, one recommends a 'hold,' and six suggest a 'sell', according to Bloomberg data. The average 12-month consensus price target implies a downside of 42.5%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.