Shares of Godrej Properties Ltd. extended their record rally to a third consecutive session on Tuesday after selling over 2,000 homes on the launch day of its Bengaluru project.

The real estate developer reported sales worth Rs 3,150 crore in Godrej Woodscapes in Whitefield-Budigere Cross, Bengaluru, an exchange filing said.

Godrej Woodscapes is Godrej Properties' "most successful" launch in terms of value and volumes of sales, the filing said. It is also the sixth project to have recorded sales of over Rs 2,000 crore during launch in the last four quarters.

The real estate developer has achieved over 500% quarter-on-quarter growth in sales in Bengaluru with Godrej Woodscapes' success. Its sales in the city exceeded the FY24 South India sales number during April–June, the exchange filing said.

On Monday, the company hit a fresh high after it said it plans to develop land parcels in Pune and Bengaluru with a revenue potential of roughly Rs 3,000 crore. The stock has been scaling new highs for three days and has recorded a 3.23% gain since Friday.

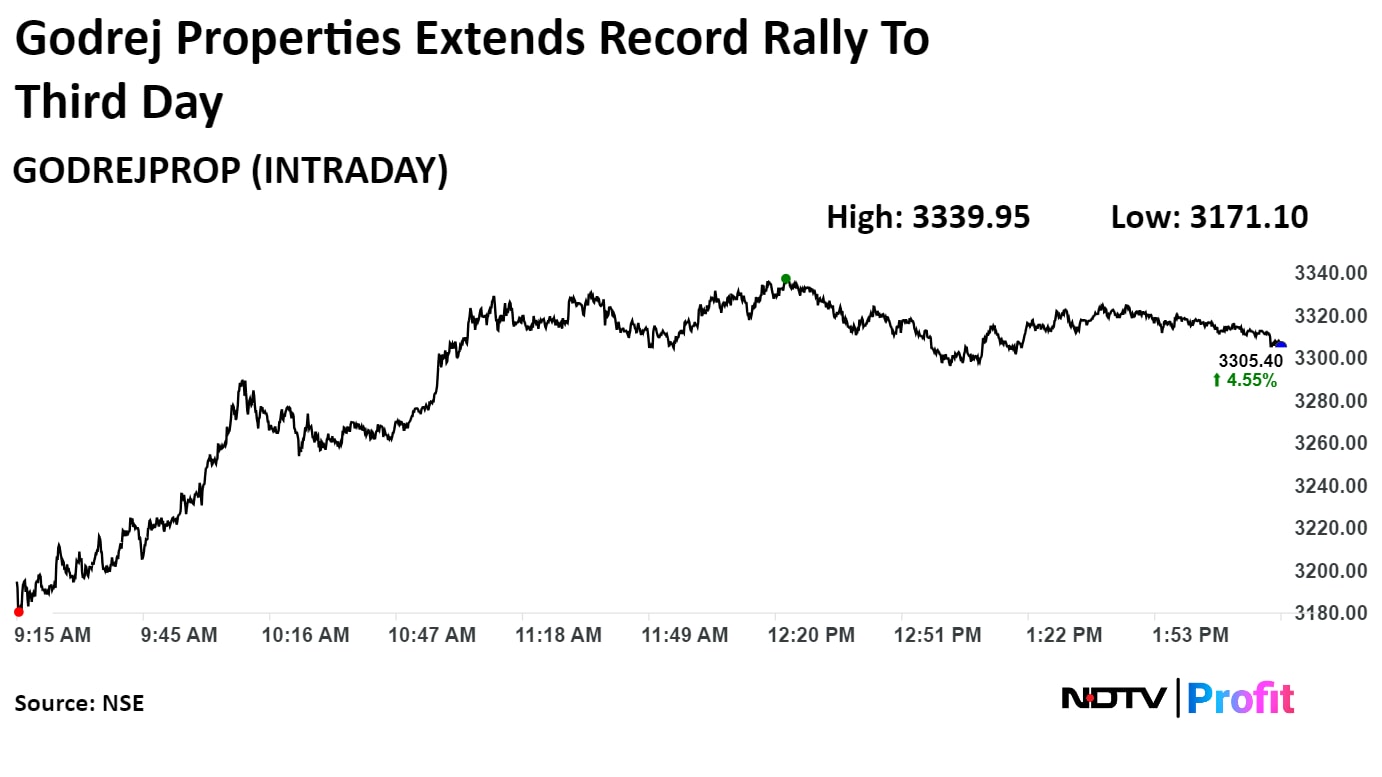

Shares of Godrej Properties rose 5.64%, the highest level since Jan. 5, 2010, when it was listed. They pared gains to trade 4.54% higher at Rs 3,305.10 per share as of 2:46 p.m., compared to a 0.12% decline in the NSE Nifty 50.

The stock has gained 108.90% in 12 months and 64.15% year-to-date. Total traded volume so far in the day stood at 3.1 times its 30-day average. The relative strength index was 68.14.

Out of 20 analysts tracking the company, 13 maintain a 'buy' rating, one recommends a 'hold' and six suggest'sell', according to Bloomberg data. The average 12-month analyst's consensus price target implies a downside of 17.2%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.