Shares of Awfis Space Solution Ltd. gained over 8% on Thursday after it reported a profit in the quarter ended March 2024, the first quarter after listing.

The co-working space company reported a net profit of Rs 1.4 crore during the quarter, compared to a loss of Rs 13.8 crore a year ago, according to an exchange filing.

Income from sales of renting co-working spaces and ancillary services grew over 45% after adding 22 new centres, according to an exchange filing. The company switched from a straight lease model to an asset-light, low-risk managed aggregation model for space procurement, which helped to reduce capital expenditure.

Awfis Space Solution is a segment leader in office-space lending, with 181 centers across the country and a presence in both tier-1 and tier-2 cities.

Awfis Space Q4 Results: Highlights (Consolidated, YoY)

Revenue rose 45.2% to Rs 232 crore.

Ebitda rose 39.7% to Rs 67 crore.

Ebitda margin contracted 114 basis points to 28.9% versus 30%.

Net profit at Rs 1.4 crore versus net loss of Rs 13.8 crore.

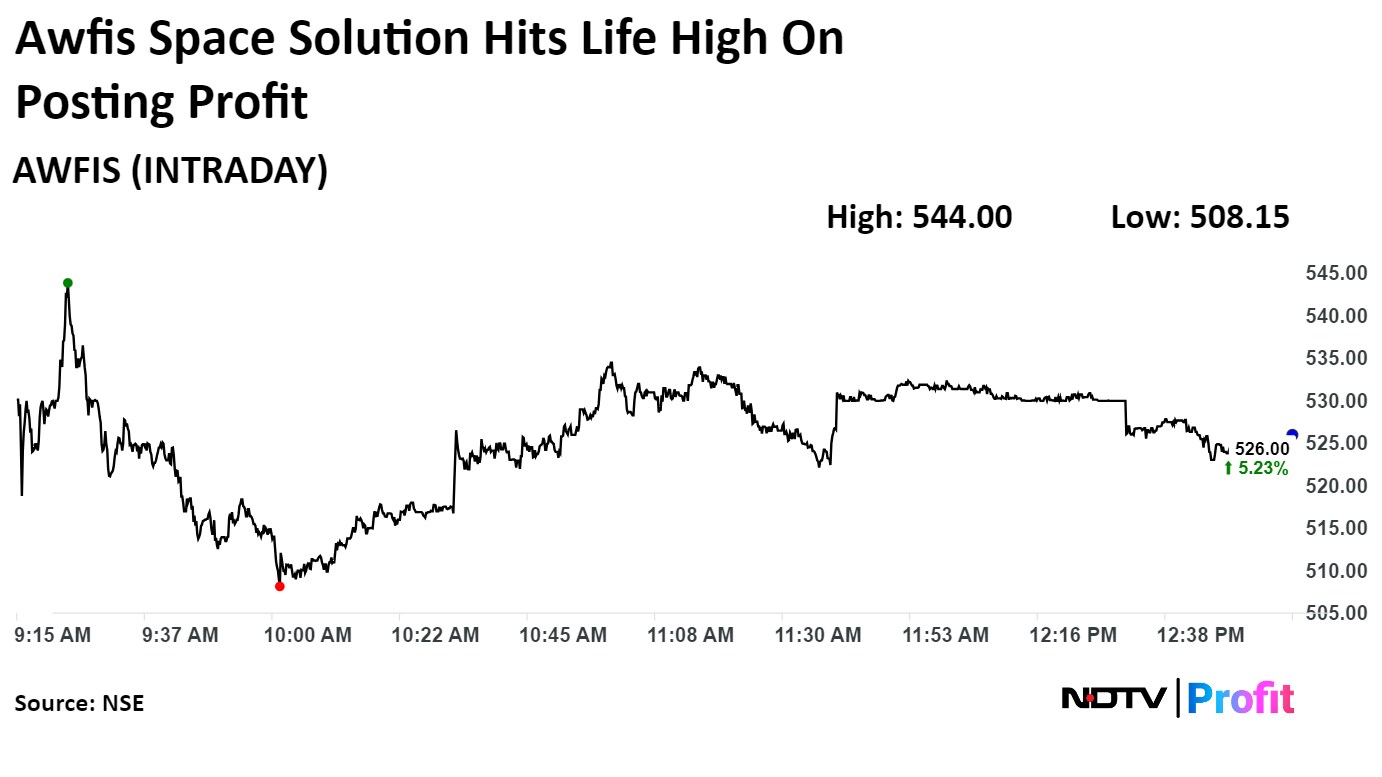

Shares of Awfis Space Solutions rose as much as 8.83%, the highest level since listing on May 30, before paring gains to trade 4.88% higher at Rs 524.25 apiece as of 12:58 p.m. This compares to a 0.14% advance in the NSE Nifty 50.

The stock has risen 24.30% since listing. Total traded volume so far in the day stood at 1.1 times its 30-day average. The relative strength index was at 75.40, implying the stock is overbought.

All five analysts tracking the company maintained a 'buy' rating, according to Bloomberg data. The average 12-month analysts consensus price target implies an upside of 13.5%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.