Information technology stocks added over Rs 25,000 crore to investors' wealth on Thursday as lower-than-expected US inflation data raised hopes for monetary policy easing in the world's largest economy.

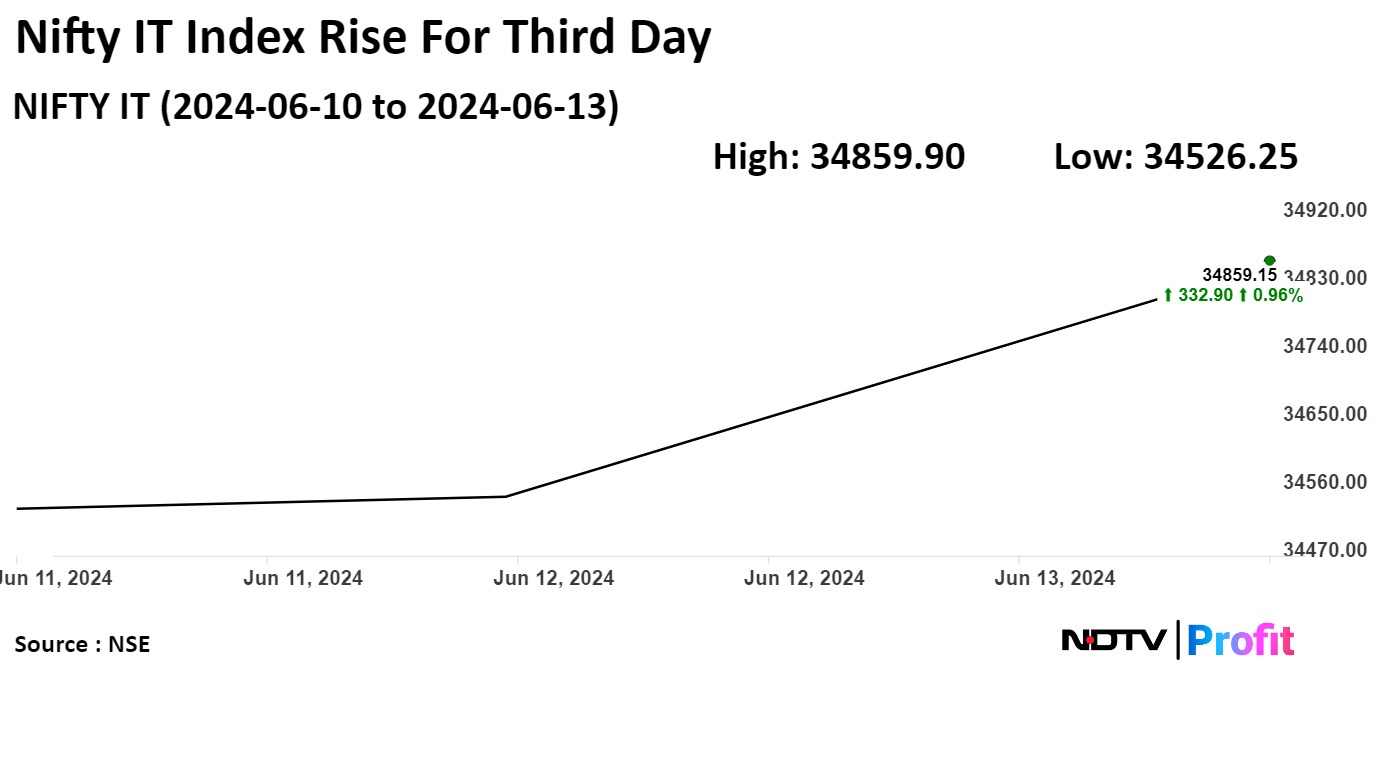

At 12:54 p.m., IT companies' market-cap rose by Rs 25,300 crore to Rs 31.23 lakh crore, according to data available on the NSE. Furthermore, all IT companies' shares rose to support the NSE Nifty IT index, which rallied for the third consecutive session.

The consumer price index fell to 3.3% on year in May, against the consensus estimate of a 3.4% rise, the US Labour Department data showed. This prompted traders to bet the Federal Reserve may cut interest rates by 50 basis points this year, unlike the 25 basis points the central bank has projected.

The Fed fund futures traders are factoring in a 41.9% chance of a 50-bps rate cut by the end of the calendar year 2024, against a 35.3% cut in mid-May, the CME FedWatch tool showed.

The Federal Open Market Committee projected a one-time 25-bps rate cut by the end of the year on Wednesday after concluding the June policy meeting, deviating from the 75-bps rate cut view given the March policy meeting.

The performance of the IT firms depends on macroeconomic conditions in the US, as most Indian IT companies conduct substantial business with American clients.

Book Profit In IT Stocks, Says HSBC's Van Der Linde

India's technology stocks may fall further after the recent decent rally, so it's a good time to temporarily take money away from this sector, according to Herald Van Der Linde, head of Asia Equity Strategy at HSBC.

A weak business as a result of the expected recession in the US has not materialised, Linde told NDTV Profit's Sajeet Manghat in an interview. IT businesses have also seen a revival due to the recent weakening of the rupee, said Linde.

On a 12-month-out basis, mostly the business will slow down, so that remains a risk, he said. "It's a sector that I structurally like, and I think it's seen a nice rally, so I may prefer to bench a little bit better at this particular portion in time."

The NSE Nifty IT index has gained 24.08% in the calendar year 2023 but declined 1.83% on a year-to-date basis.

On Thursday, the NSE Nifty IT rose 1.42% to 35,039.55, the highest level since June 10. It was trading 87.65 points, or 0.38%, higher at 23,410.60 as of 1:20 p.m.

Coforge Ltd. and LTIMindtree Ltd. were leading the rally in the NSE Nifty IT stocks. Intraday, both stocks have logged 2.68% and 2.85% gains, respectively.

Meanwhile, HCL Technologies Ltd. and Tata Consultancy Services Ltd. gained the least among other IT stocks.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.