Shares of KEC International Ltd. surged 10% to hit a record high on Thursday after it secured multiple orders worth total Rs 1,025 crore in transmission and distribution and cable businesses.

The secured orders are for projects in India, Africa, and the Americas, according to an exchange filing. In India, it has an order for a 765 kV Geographic Information System Substation from Power Grid Corp. of India. The company received an order for a 225 kV composite project, including transmission lines, substations, and underground cabling, in West Africa and an order for the supply of towers, hardware, and poles in the Americas, the filing said.

The business has also secured orders for the supply of various types of cables in India and overseas.

With the above orders, the company's year-to-date order intake has surpassed Rs 4,000 crore, a growth of over 70% compared to last year, said Managing Director and Chief Executive Officer Vimal Kejriwal. "These orders, along with the orders announced earlier during the year, reaffirm our confidence in achieving the targeted growth going forward," he said.

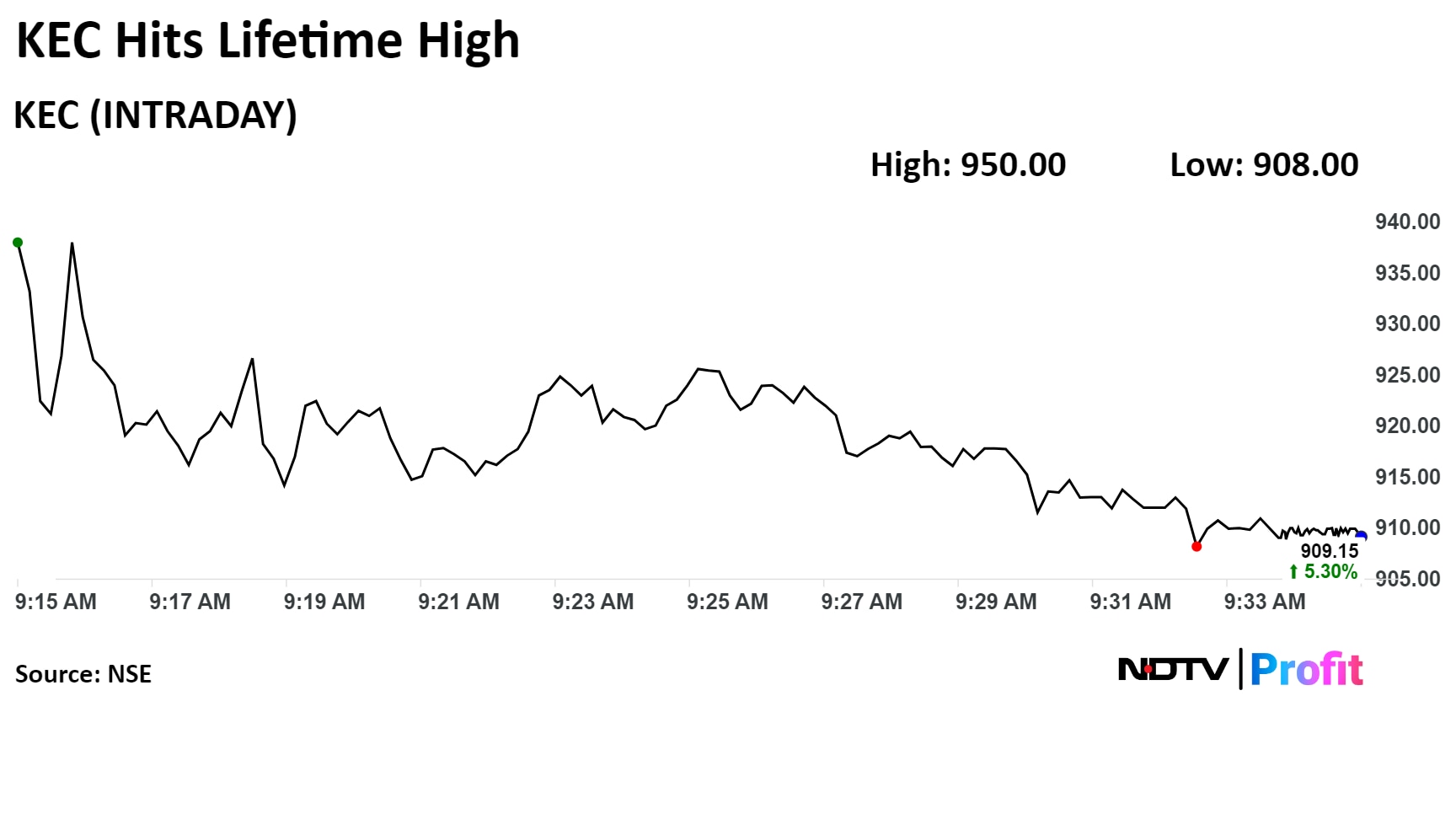

Shares of the company rose as much as 10.03%, before paring gains to trade 5.58% higher at Rs 912.65 apiece as of 10:15 a.m. This compares to a 0.32% advance in the NSE Nifty 50.

The stock has risen 54.85% year-to-date and 65.29% in the last 12 months, according to NSE data. The total traded volume so far in the day stood at 2.31 times its 30-day average. The relative strength index was at 64.68.

Out of 23 analysts tracking the company, 12 maintain a 'buy' rating, five recommend a 'hold' and six suggest a 'sell', according to Bloomberg data. The average 12-month analysts' consensus price target implies a downside of 11.7%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.