Shares of IndusInd Bank Ltd. gained 2% on Wednesday after Bernstein's positive outlook on the bank, thanks to its 'non-banking financial company-like' loan book composition, positioning for a potential rate easing cycle, and exposure to attractive market segments, it said.

The stock has a target price of Rs 1,800 per share, reflecting a 28% upside. The brokerage values the bank at a price-to-book value ratio of 1.9 times its estimated book value per share for fiscal 2025. Bernstein expects IndusInd Bank's return on equity to be around 15–16% for fiscals 2024–2026. It also expects loan growth of 18%.

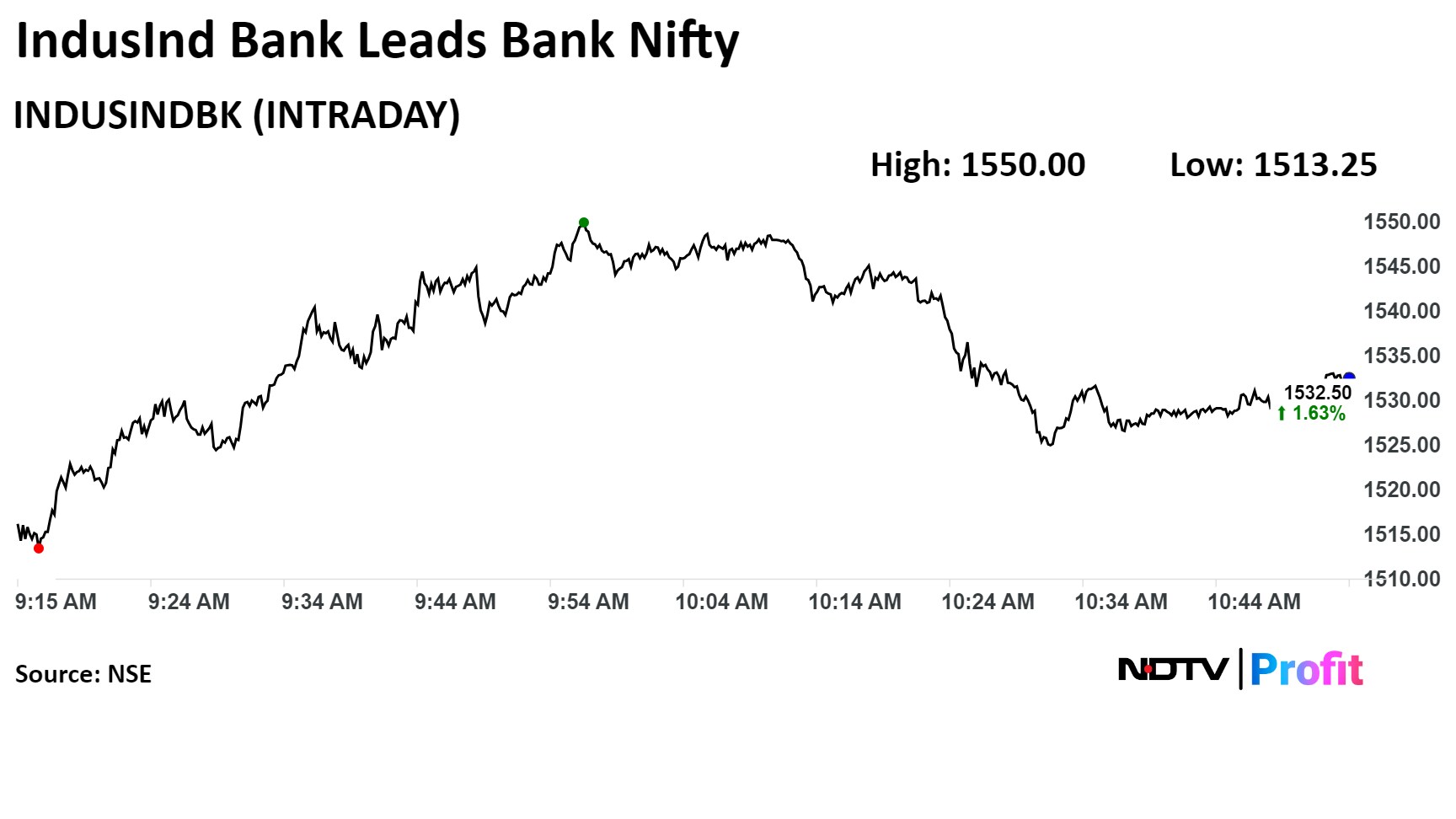

IndusInd Bank's top performance in the Bank Nifty further underscores its strong market position.

Shares of the lender rose as much as 2.79% intraday, the highest level since April 15. They pared gains to trade 1.46% higher at Rs 1,529.85 apiece as of 10:46 a.m., compared to a 0.4% decline in the NSE Nifty 50.

The stock has fallen 4.38% year-to-date, but risen 11.23% in the last 12 months. Total traded volume so far in the day stood at 0.92 times its 30-day average. The relative strength index was at 59.13.

Out of 49 analysts tracking the company, 43 maintain a 'buy' rating, five recommend a 'hold' and one suggests 'sell', according to Bloomberg data. The average 12-month analysts' consensus price target implies an upside of 19.8%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.