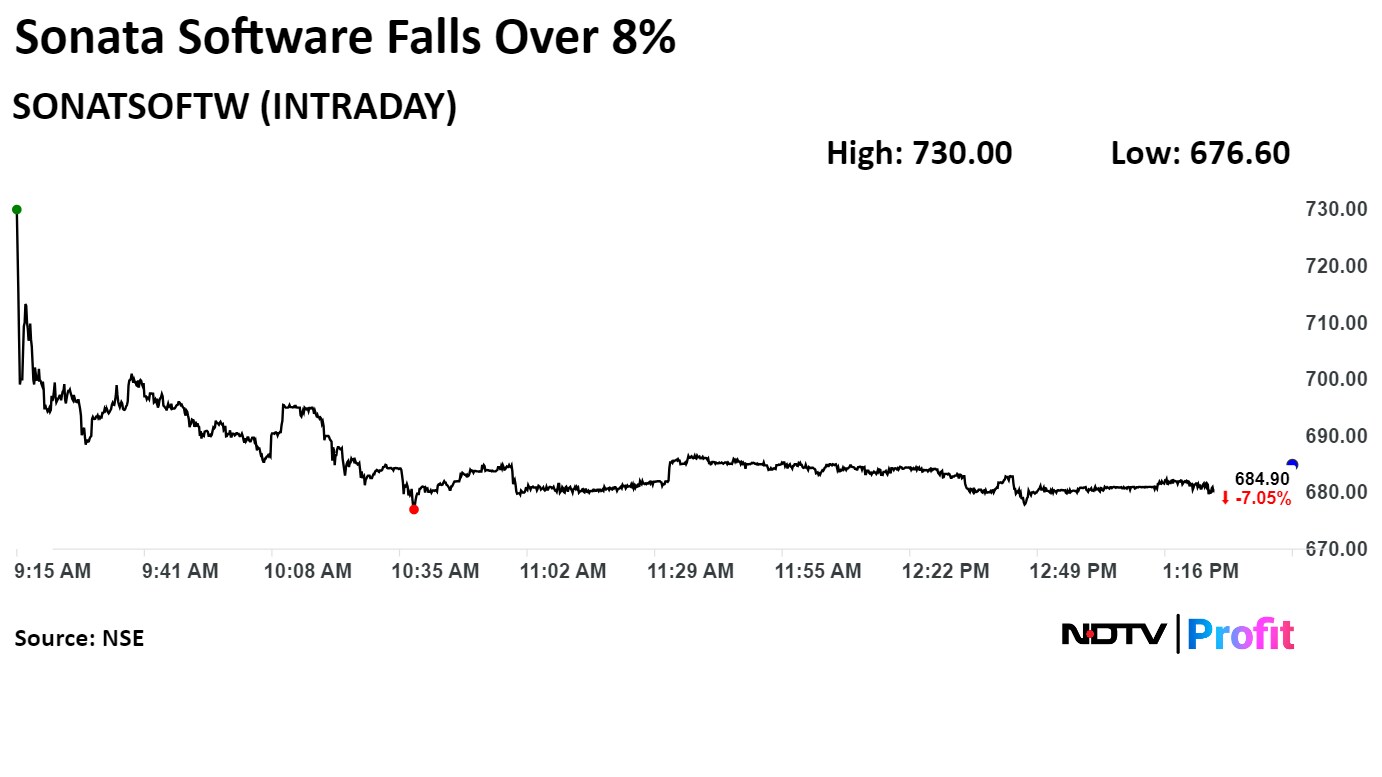

Shares of Sonata Software Ltd. plunged to over one-week low on Thursday after the company's net profit fell in the first quarter of fiscal 2025.

Its consolidated net profit declined 12.06% year-on-year to Rs 105.6 crore during the April-June quarter, from Rs 120.1 crore. This is even as the company won three large deals during the quarter.

Its revenue from operation rose 25.40% on annual basis to Rs 2,527.43 crore, from 2,015.5 crore.

Although the company continued to win large deals, and has 49 deals in pursuit, the conversion to pipeline is being delayed. Traction in artificial intelligence, Microsoft fabric, strong growth in quant to drive growth in the near future, IDBI Capital said in a note.

IDBI Capital has revised the rating to 'hold' and kept the target price unchanged at Rs 770 per share, it said in a note on Thursday.

Sonata Software Q1 FY25 (Consolidated, YoY)

Revenue up 25.40% to Rs 2,527.4 crore from Rs 2,015.5 crore.

Net profit down 12.06% at Rs 105.6 crore from Rs 120.1 crore.

Shares of Sonata Software Ltd. declined 8.18%, the lowest level since July 23, before paring loss to trade 7.13% lower at Rs 683 per share as of 1:42 p.m. This compared to a 0.14% advance in the NSE Nifty 50.

The stock has gained 30.04% in 12 months, and declined 8.35% year-to-data basis. Total traded volume so far in the day stood at 4.0 times its 30-day average. The relative strength index was at 51.74.

Out of seven analysts tracking the company, five maintain a 'buy' rating, and two recommend a 'hold', according to Bloomberg data. The average 12-month analysts' consensus price target implies an upside of 5.5%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.