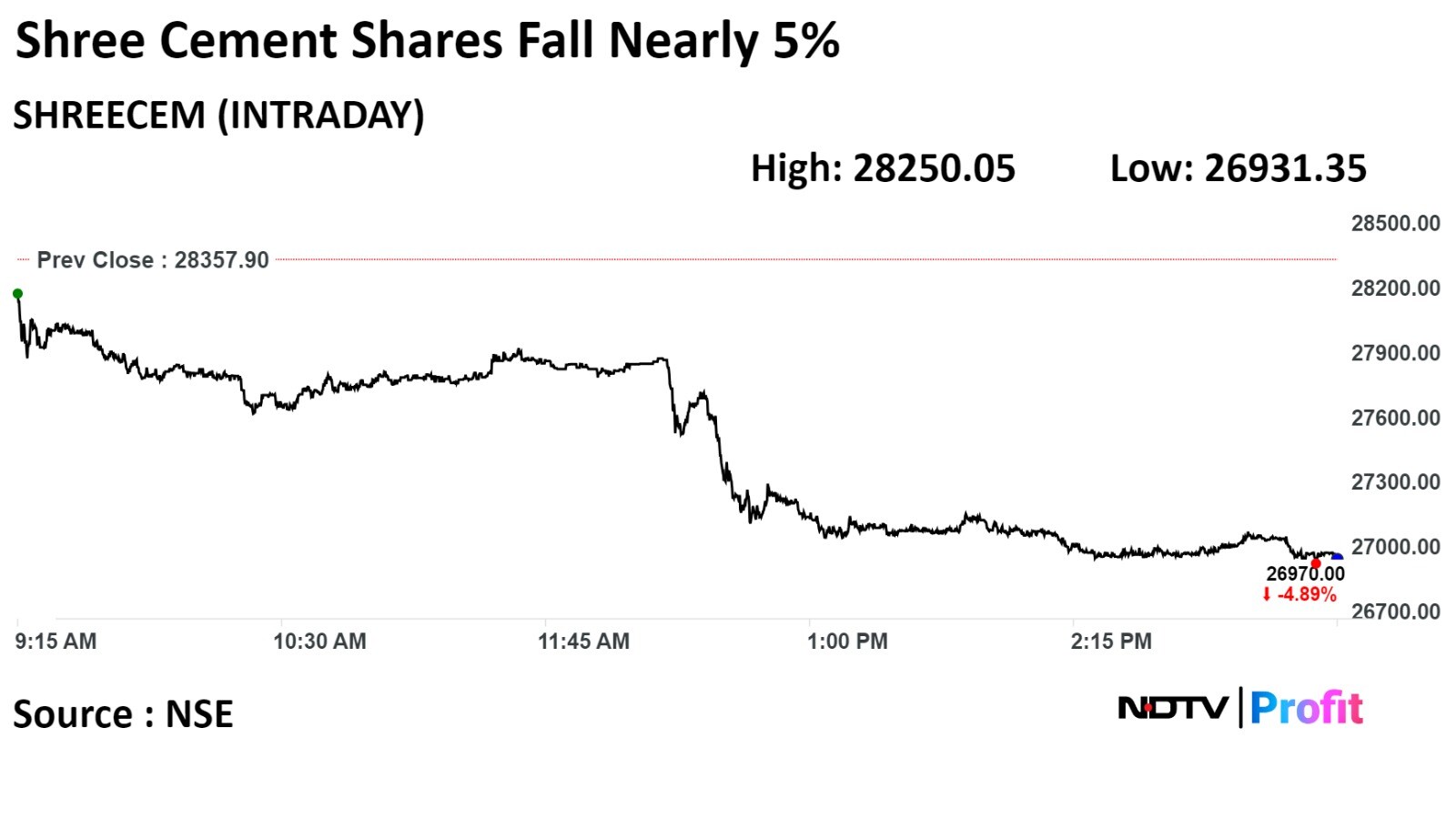

Shares of Shree Cement Ltd. closed nearly 5% lower on Friday, after reports of an income tax demand of Rs 5,000 crore.

The exchange has sought clarification from Shree Cement with reference to the news. The reply is awaited.

Last June, the IT department conducted raids in five locations of the company's premises, in connection with the deductions claimed under Section 80IA of the Income Tax Act for the period from April 2014 to March 2023, according to media reports.

Earlier in June, a tax evasion of Rs 23,000 crore was found in searches at multiple locations of Shree Cement in Rajasthan, sources told NDTV.

On the NSE, Shree Cement's stock fell as much as 5.03% during the day to Rs 26,931.35 apiece, the lowest since Dec. 1. It closed 4.71% lower at Rs 27,023.3 apiece, as compared with a 0.24% advance in the benchmark Nifty 50.

The share price has risen 13.86% in the last 12 months. The relative strength index was at 37.7.

Ten out of the 41 analysts tracking the company have a 'buy' rating on the stock, 14 recommend 'hold' and 17 suggest 'sell', according to Bloomberg data. The average of 12-month analyst price targets implies a potential downside of 7%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.