Shares of Sanghi Industries Ltd. were locked in upper circuit on Friday after its independent directors found Ambuja Cements Ltd.'s revised acquisition offer to be fair and reasonable.

The directors found the acquisition offer of up to Rs 818.74 crore by Ambuja Cements in accordance with the regulation, a company statement said. The recommendation was approved by the members on Jan. 9.

This was in line with the opinion of DHC Advisory LLP, an accounting and consultancy firm hired by Sanghi Industries to review the offer.

Ambuja Cements had acquired 56.74% share in Sanghi Industries in August last year. The Adani group company acquired an additional 2.23% on Dec. 5, 2023 and made an open offer to further its stake by 26%, which will launch on Jan. 15.

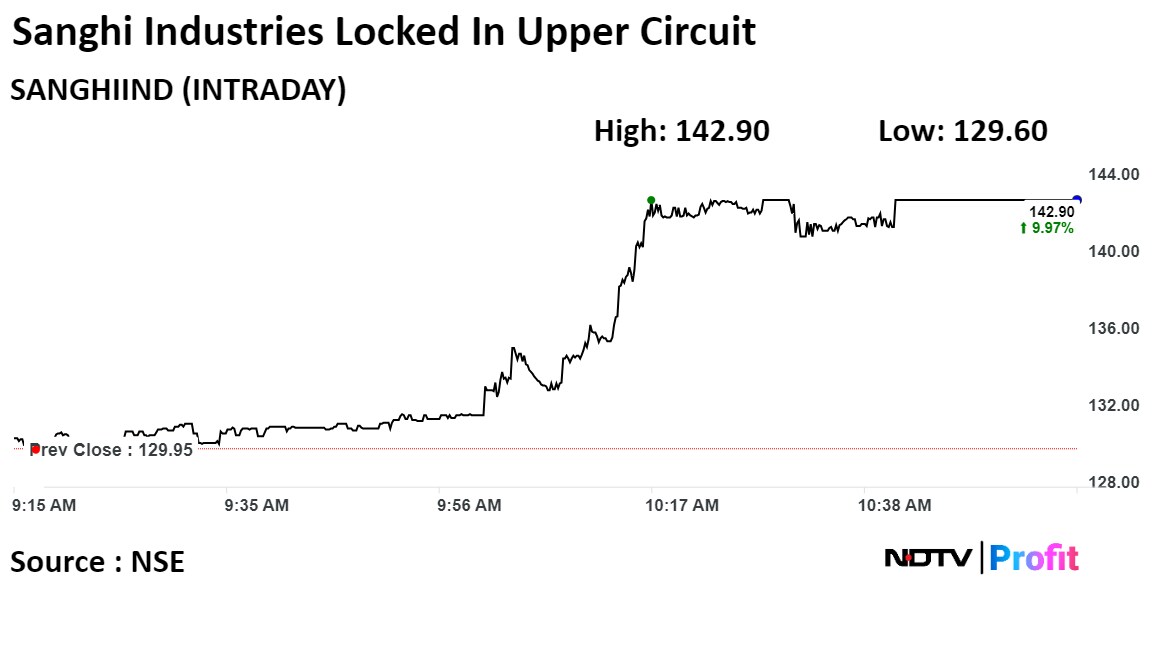

Shares of Sanghi Industries jumped 9.97%, the highest since Jan. 8, 2018, before being locked in the upper circuit, as of 10:55 a.m. This compares to a 0.83% advance in the NSE Nifty 50.

The stock has risen 93.37% in the last 12 months. Total traded volume so far in the day stood at 7 times its 30-day average. The relative strength index was at 71, indicating that it was overbought.

Both the analysts tracking the company maintain a 'buy' rating, according to Bloomberg data. The average 12-month analysts' consensus price target implies an upside of 91.2%.

Disclaimer: NDTV is a subsidiary of AMG Media Networks Limited, an Adani Group Company.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.