Shares of Reliance Industries Ltd. rose on Thursday after announcing that it would merge its television and streaming business with Walt Disney Co.'s India unit.

The two companies have signed a binding, definitive agreement to form a joint venture that will combine the digital streaming and television assets of Viacom18 and Star India, RIL said in a statement on Wednesday.

Here's what brokerages say on the merger:

Morgan Stanley

The earnings contribution of the joint venture with Disney will likely be low, or in the single digits, said the brokerage in a note on Thursday.

The merger deal is creating a pathway for the oil-to-telecom conglomerate to leverage its digital platform and enhance returns or monetisation.

Reliance Industries, with this merger deal with Walt Disney Co.'s India unit consolidating India's media business, similar to what was seen between 2016 and 2019,

For Disney, Morgan Stanley sees the merger as an opportunity to improve OI in its sports segment.

The brokerage is unclear whether the merger deal will be accretive or dilutive to adjusted EPS in FY25.

If the consolidated entity becomes successful in the hyper-India market, it will increase the value of Disney's stake over time.

As the broader television market in India pivots towards streaming, it will leave the new JV, Netflix, and Amazon Prime as market leaders.

Motilal Oswal

It says the merger will give RIL a large pie in the media business.

Motilal Oswal maintains a 'buy' rating on RIL with a target price of Rs 3,210.

The brokerage said RIL had bagged a lucrative deal, underscoring its dealmaking prowess.

The joint venture will have 70.5 crore viewers across India.

The joint venture will also have exclusive right to distribute Disney's films in India.

It'll be an uphill task to fulfill the annual obligation from FY26.

Emkay Global

New entity may alter the paradigm of the industry being the single-largest player in broadcasting and digital space.

RIL can also exploit its large user base in the telecom segment, with bundling of packs.

This dominant position can attract the CCI's scrutiny, which could be a speed breaker.

The brokerage does not anticipate major value accretion for RIL from this deal immediately.

The deal would hurt other industry players like Zee Entertainment Enterprises Ltd.

Elara Capital

India's M&E market for print, TV and digital is poised to post a CAGR of 8.2% over 2022 to 2025.

It said the merger could impact other linear TV broadcasters, such as Sun TV, Zee and Sony.

Merger may result in improved profitability for the combined entity.

Merged entity can enhance its subscription revenue by increasing subscription prices.

May also have a pay-based mechanism via Jio Cinema/Hotstar at a larger scale.

Monopoly in sports properties may lead to higher ad revenues.

There might be initiatives such as a Jio Prime offering, access to content at an affordable or free price.

Merger will require Competition Commission of India's approval

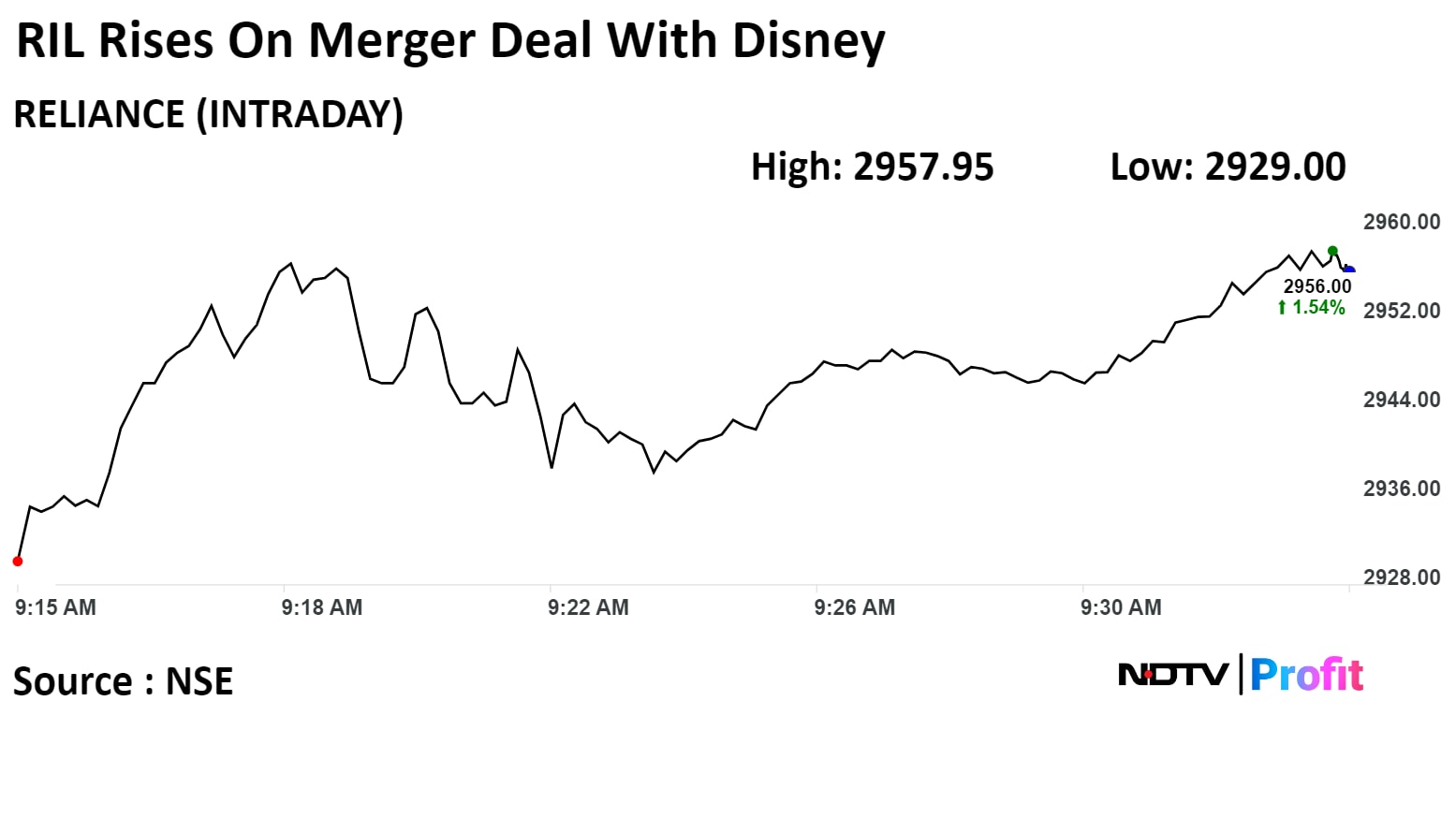

RIL's stock rose as much as 1.59% during the day to Rs 2,957.45 apiece on the NSE. It was trading 1.38% higher at Rs 2,951.45 per share, compared to a 0.07% advance in the benchmark NSE Nifty 50 at 9:32 a.m.

The share price has risen 37.59% in the last 12 months. The total traded volume so far in the day stood at 1.5 times its 30-day average. The relative strength index was at 59.76.

Out of 33 analysts tracking the company, 27 have a 'buy' rating on the stock, four recommend 'hold' and two suggest 'sell', according to Bloomberg data. The average of 12-month analyst price targets implies a potential upside of 8.9%.

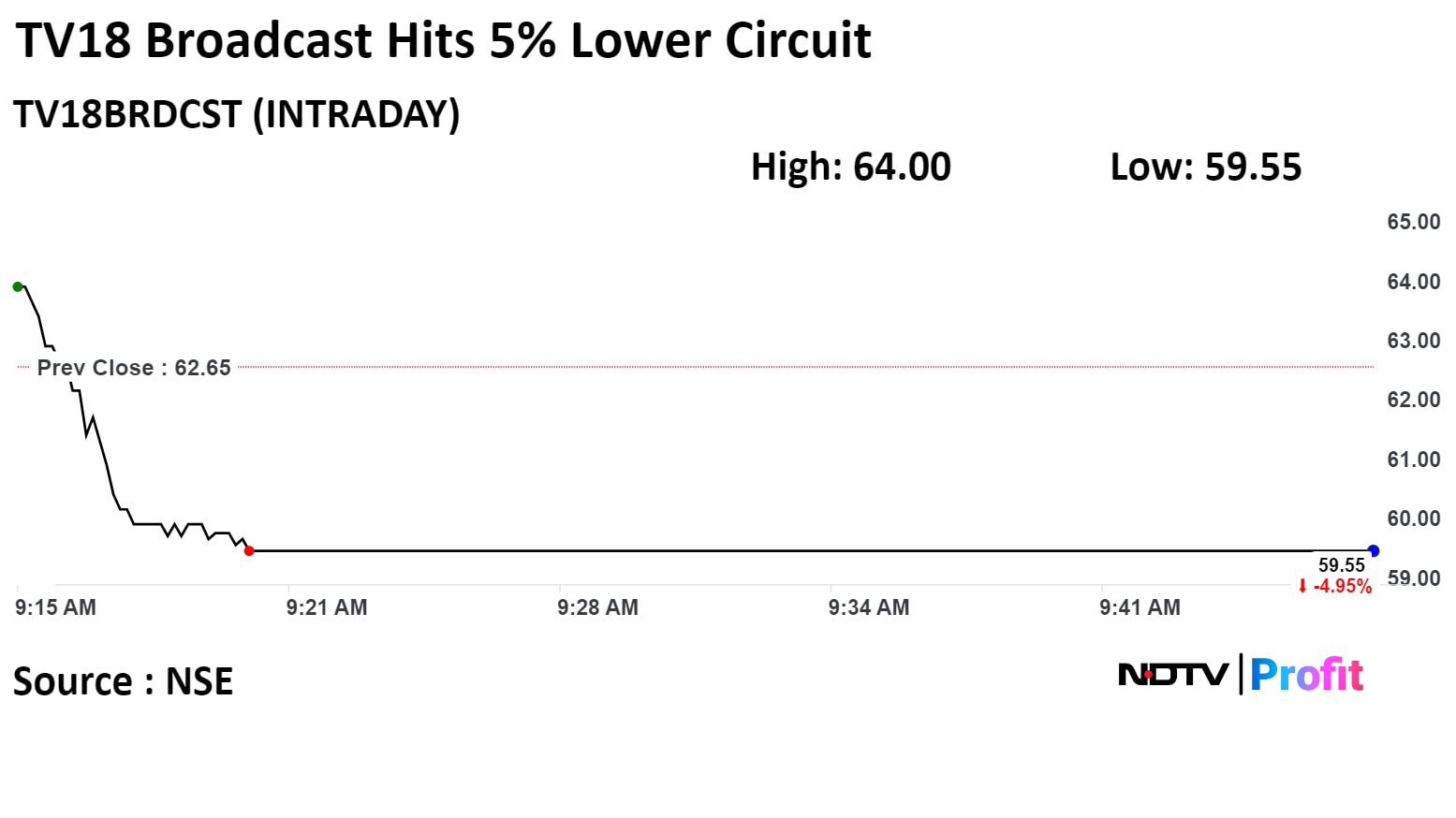

Meanwhile, TV18 Broadcast Ltd, a media unit of the Reliance Group, hit a lower circuit of 4.95% on the NSE to Rs 59.55 apiece, the lowest since Feb. 19. It continued to trade at lower circuit as of 9:40 a.m., compared to a 0.01% advance in the NSE Nifty 50 Index.

The share price has risen 86.68% in the last 12 months. The total traded volume so far in the day stood at 1.5 times its 30-day average. The relative strength index was at 45.1.

An analyst tracking the company has a 'sell' rating on the stock, according to Bloomberg data.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.