Shares of power financiers and public sector banks declined on Monday after the Reserve Bank of India rolled out draft norms calling for higher provisions than standard requirements to finance projects. Brokerages believed this is negative for the lenders.

The new prudential framework by the regulator will raise the provisioning requirements significantly, which will reduce lenders' profitability by 50%, Bernstein said in a note.

After this, Power Finance Corp. and REC Ltd. declined over 13% as sentiment for the stocks turned negative following the new guidelines on financing projects. Further, Indian Renewable Energy Development Agency declined nearly 7%.

In contrast to Bernstein's view, CLSA believes there'll be less impact on non-banking financial businesses like PFC and REC compared to banks because of differences in accounting practices.

NBFCs follow Indian Accounting Standard, so difference between RBI and Ind-AS rules will have to be adjusted by impairment reserves. The overall impact will not be seen in Power Finance Corp. or REC's profit and loss statement, but in capital adequacy ratios, CLSA said in a note.

As far as banks are concerned, CLSA said the higher provision under new norm is a deterrent for lenders.

The RBI's draft direction for a prudential framework to finance projects in infrastructure, non-infrastructure and commercial real estate demand higher provisioning for finance exposure, which will be negative, especially for PSU banks and other lenders in the space, Citi Research said in a note on Monday.

It's difficult to measure company-specific impact due to the limited data available on the stage of projects and the financial exposure of lenders, the brokerage said.

Additional provisioning requirements will be 0.5–3% of banks' net worth, according to IIFL Finance Ltd. That could be an impact on tier-1 and tier-2 ratios, it said.

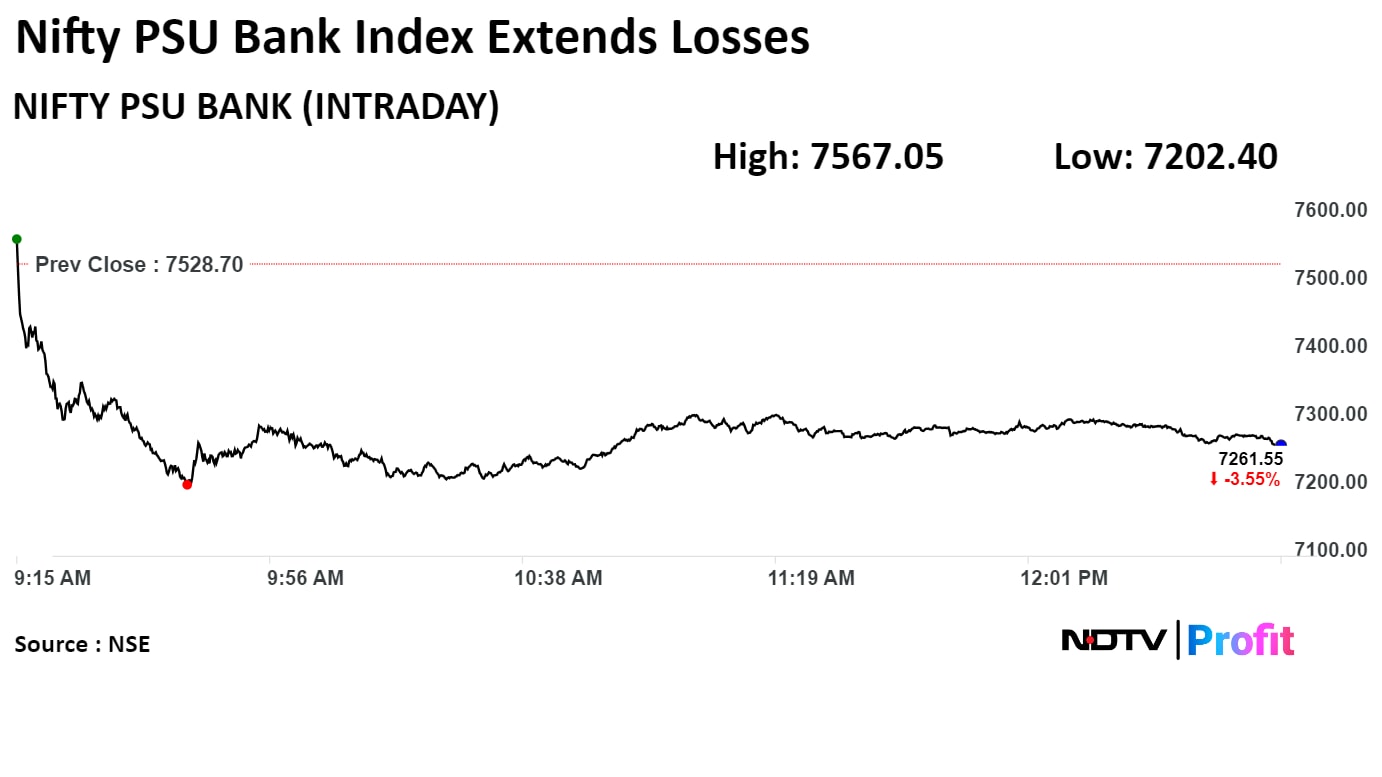

The NSE PSU declined 4.33% to 7,202.40 on Monday, touching the lowest level since April 25.

Nifty PSU Bank Falls To Over One-Week Low

On NSE, REC Ltd., and Power Finance Corp. fell the most among their peers. In case of PSU bank stocks, Punjab National Bank, Bank of India, and Canara Bank were the top loser.

Indian Bank and State Bank of India fell the least among their peers on NSE.

Brokerages' Take

Bernstein

Proposed guidelines suggest 5% of standard provisions to be set aside for under-construction project finance advances.

Sharp increase from the current standard provisioning requirement of 0.4%

Provisioning requirement only gradually reduces to 2.5% and then 1%

The norms will increase provisioning requirements significantly; reduce profitability by as much as 50%.

Organic equity accrual is severely impaired, Bernstein said in a note.

Citi Research

RBI's prudential framework on project financing requires much higher provisions, which is negative for corporate lenders.

The provisional requirement will be done in a phased manner 2%/3.5%/5% by FY25/26/27.

In construction phase, 5% provisional requirement, 2.5% in operational phase, and 1% if the project has positive operating cash flow to cover repayment obligation.

In case of cumulative DCC deferments, more than one-to-two years in infrastructure and non-infrastructure projects respectively. Banks shall keep additional provision of 2.5% over and above the applicable standard asset provisions.

IIFL

RBI issued draft harmonised prudential framework for lenders.

Tighten certain lending criteria, which should improve the project viability in our view.

Phased increase standard asset provisioning to 1-5% of loans from current 0.4%.

Additional provisioning requirement to be 0.5-3% of banks' networth

No ROE impact on power financiers, but can hurt tier-1, 2 ratios and weigh valuations.

CLSA

RBI issued draft guidelines to harmonise the prudential framework for all lenders financing projects in infrastructure and non-infrastructure spaces.

A three-year glide path has been given to achieve 5% standard asset provisioning: 2% by FY25, 3.5% by FY26 and 5% by FY27.

There'll be no impact on Power Finance Corp, REC's Profit & Loss statements, but in capital adequacy because of accounting differences, according to the brokerage.

Banks now have to maintain minimum exposure in a consortium and they can sell their exposure only after the construction phase is over. This and higher provision requirement are big deterrent for lenders in CLSA's view.

The new regulation may reduce risk of higher competition from banks in renewable segment.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.