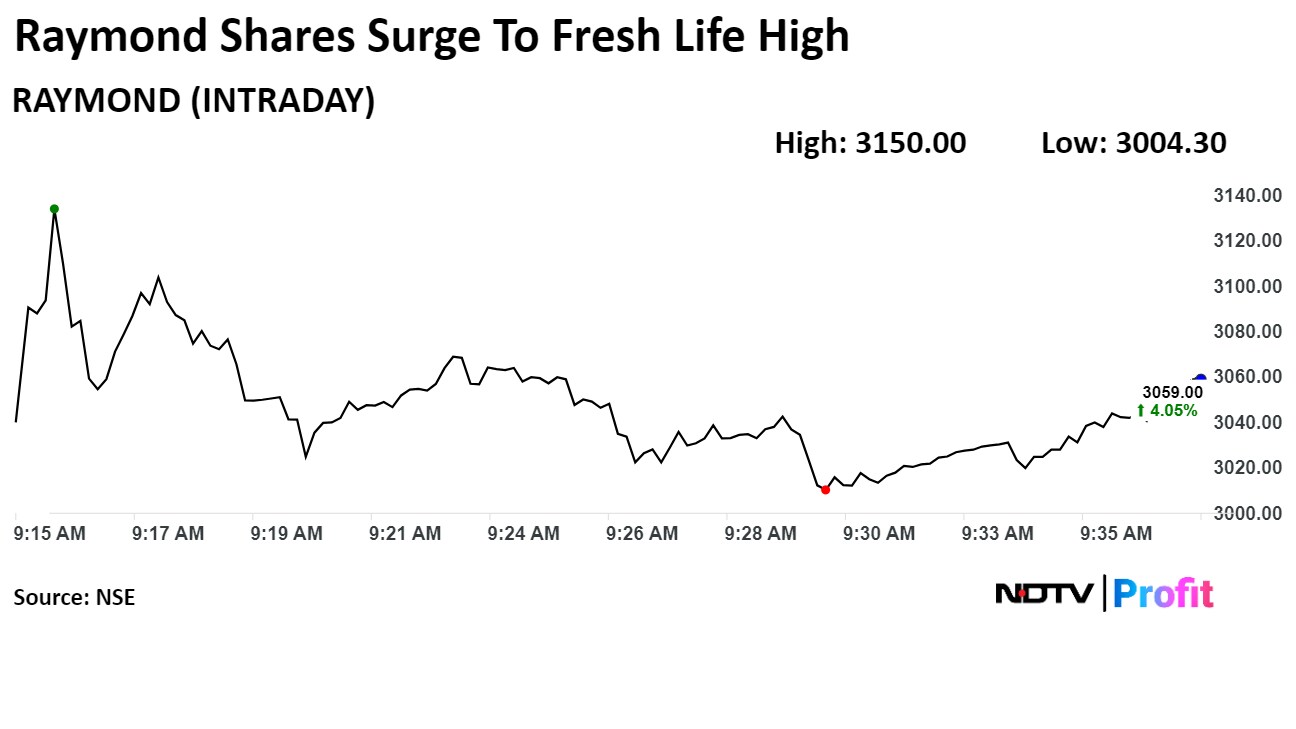

Shares of Raymond Ltd. surged to life high on Friday after its board approved the demerger of its realty arm with an aim to consolidate the entire real estate business of the group under one single entity.

The company will issue 6.65 crore shares of Raymond Realty Ltd., its realty arm, with a face value of Rs 10 per share upon demerger, it said in an exchange filing on Thursday.

According to an exchange filing, investors will receive one share of Raymond Realty for each share they hold in the parent firm. The current promoter ownership of the Mumbai-based garment maker is 49.01%.

The demerger plan aims to exploit the growth potential of the real estate business and attract a fresh set of investors and strategic partners to participate in the real estate business, Raymond said.

It is very clear that the group aims to unlock value for its shareholders, Amit Agarwal, chief financial officer, Raymond Group told NDTV Profit in an interview. "When the business matures up to a certain level then we want to show that it is a pure-play, net debt-free listed business."

The demeger will take place between 14-16 months, and the total potential of this business over the next 7-8 years is in the range of Rs 32,000 crore to Rs 35,000 crore, Agarwal said. "In the next 3-4 years this company can hit a revenue of Rs 4,000 crore with 25% Ebitda margin."

After receiving the required approvals, the scrip will list on the National Stock Exchange and BSE.

Shares of Raymond Ltd. rose as much as 18.50%, before paring gains to trade 17.92% higher at Rs 3,466.92 apiece at 11:41 a.m. This compares to a 0.09% decline in the benchmark Nifty 50.

The stock has risen 98.27% in the last 12 months and 100.91% year-to-date. Total traded volume so far in the day stood at 14 times its 30-day average. The relative strength index was at 80.70, which implied the stock is overbought.

Five out of the six analysts tracking the company have a 'buy' rating on the stock and one suggest a 'sell', according to Bloomberg data. The average of 12-month analyst price targets implies a potential downside of 14%

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.