Shares of PVR Inox Ltd. gained 6% on Monday as the success of Deepika Padukone and Prabhas starrer Kalki 2898 AD prompted Nuvama to reiterate a 'buy' rating on the stock.

The film promises to help recover the film industry from its dry spell in April and May, the brokerage said in a note. The brokerage attributed the recent dullness in the film landscape to a weak content calendar, a heatwave across the country, general elections, and the IPL. But it sees a change in plot with the release of Kalki 2898 AD, which made Rs 141 crore in box office collection as of Sunday.

"The overall picture has a lot more to offer—for instance, a compelling Hollywood line-up, a recovery in ad revenues, and a focus on net debt reduction (Rs 1,36.7 crore in fiscal 2024)," the note said. Nuvama has set a target price of Rs 1995 per stock.

The positive outlook stems from the expectation that the Indian advertisement market will grow by 11.8% to Rs 1,22,200 crore. This would benefit PVR Inox because, as the dominant multiplex player, it earns 30–35% of ad revenues from long-term deals with advertisers.

The management's priority is to be net debt-free over the next few years, and the company is adopting a Capex-light franchise-owned company-operated model, the note said.

PVR Inox's has shown decent growth in its food and beverage segment, with its spending per head on food and beverages improving by 8.4% year-on-year in the fourth quarter of fiscal 2024.

Additionally, the brokerage noted the company's future plans, including its strategic partnership with Devyani International to establish food courts in shopping malls in India, which will give it a robust pre-ticketing F&B service.

In fiscal 2025, the multiplex chain plans to open 120 new screens, expand its presence in South India, and evaluate the monetisation of owned real estate assets from the Inox merger to reduce debt.

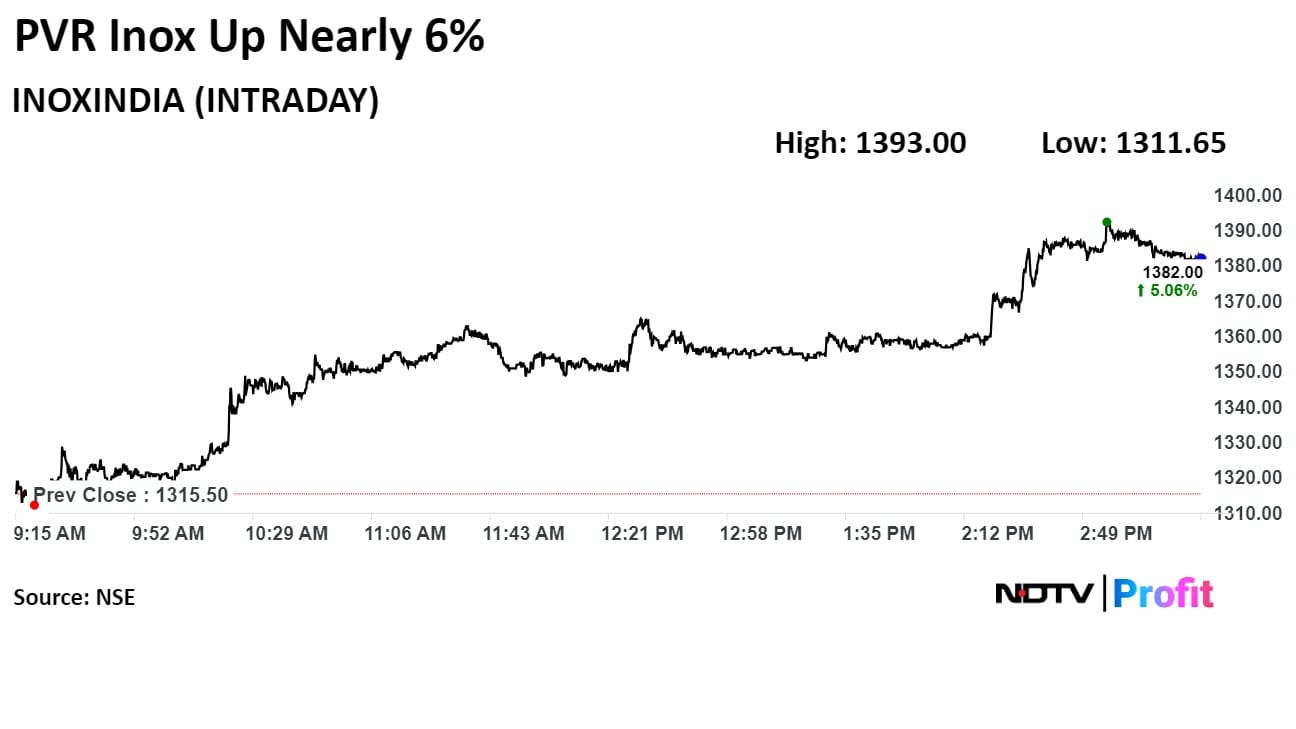

Shares of PVR Inox rose as much as 6% during the day to Rs 1,513 apiece on the NSE. It was trading 4.88% higher at Rs 1,496.85 apiece, compared to a 0.52% advance in the benchmark NSE Nifty 50 as of 3:23 p.m.

The stock has risen 8.59% in the last 12 months but fell 9.83% on a year-to-date basis. The total traded volume so far in the day stood at 5.2 times its 30-day average. The relative strength index was 67.46.

Twenty out of the 25 analysts tracking PVR Inox have a 'buy' rating on the stock, three recommend a 'hold' and two suggest a 'sell', according to Bloomberg data. The average of 12-month analyst price targets implies a potential upside of 13.8%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.