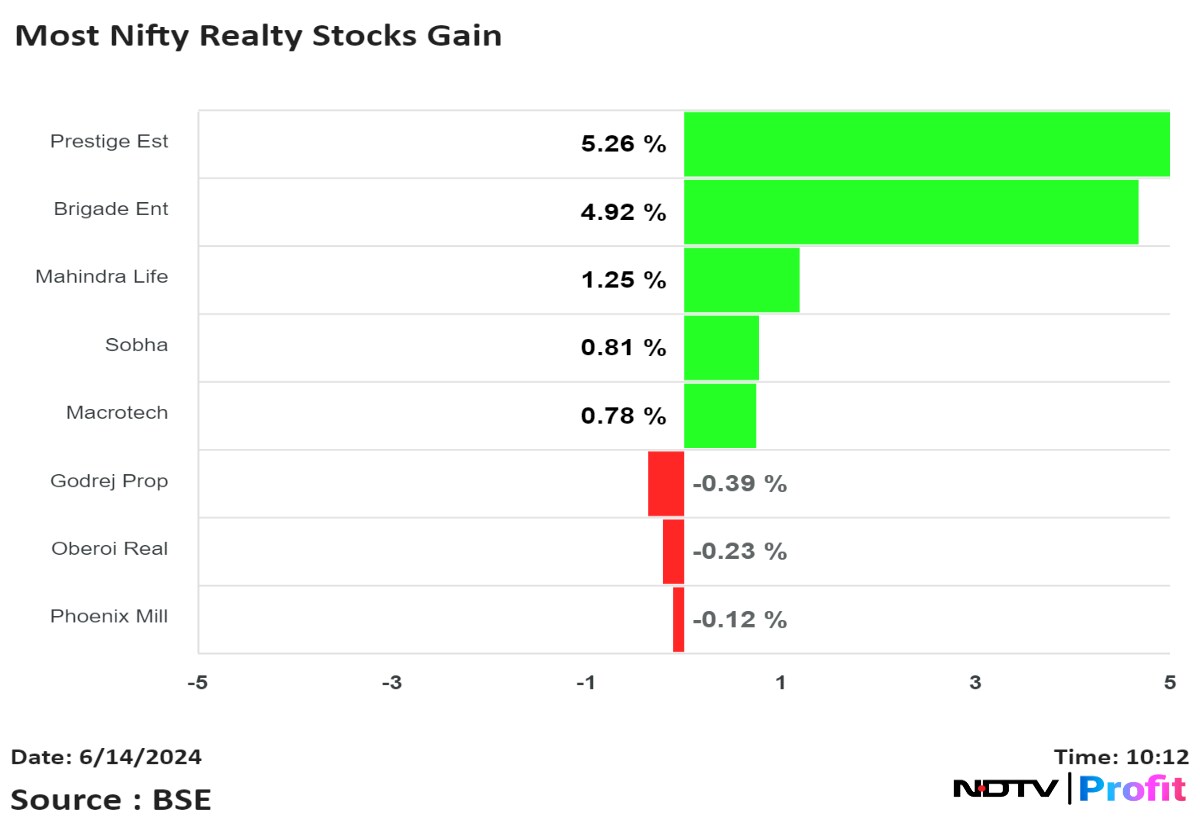

Nifty Realty hit a fresh record high for the second consecutive session on Friday led by gains in Prestige Estates Projects Ltd., Brigade Enterprises Ltd., and DLF Ltd. Among the index constituents, four stocks hit record highs on Friday.

The index rose as much as 1.34% to a new high of 1,134.90 on Friday. In the last 30 days, the index has added 18.26%, outperforming the benchmark Nifty 50, which rose 5.45%.

.png)

Prestige Estates at Rs 1,998, Macrotech Developers at Rs 1,560, Godrej Properties at Rs 3,057.85, and Oberoi Realty at Rs 1,953.05 were the stocks that hit their lifetime highs on Friday.

Brokerage firm CLSA raised the target price for Prestige Estates shares to Rs 2,320 apiece from Rs 1,875 apiece earlier, while retaining a 'buy' rating. Despite outperforming its peers so far this year, the stock's valuation is still at a discount, the brokerage said.

The industry's existing inventory is at multi-year low, and new launches are continuing to garner strong demand, Kotak Securities said. "We expect the sales momentum to continue unabated in fiscal 2025," it said.

Strong sales volume, a healthy year-over-year price improvement of 11%, and aggressive inventory liquidation at 82 million square feet led to inventory levels falling to 15 months in the financial year 2024, the brokerage said.

It also pointed out that the valuations for most residential real estate stocks stand at the higher end of their past trading range, reflecting the strong underlying business performance and changing investor interest.

Moreover, it said that developers continue to guide double-digit growth, aided by industry growth and market share gains. "We remain constructive, owing to the strong operational performance by the players, and prefer DLF, Brigade, and Signature Global."

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.