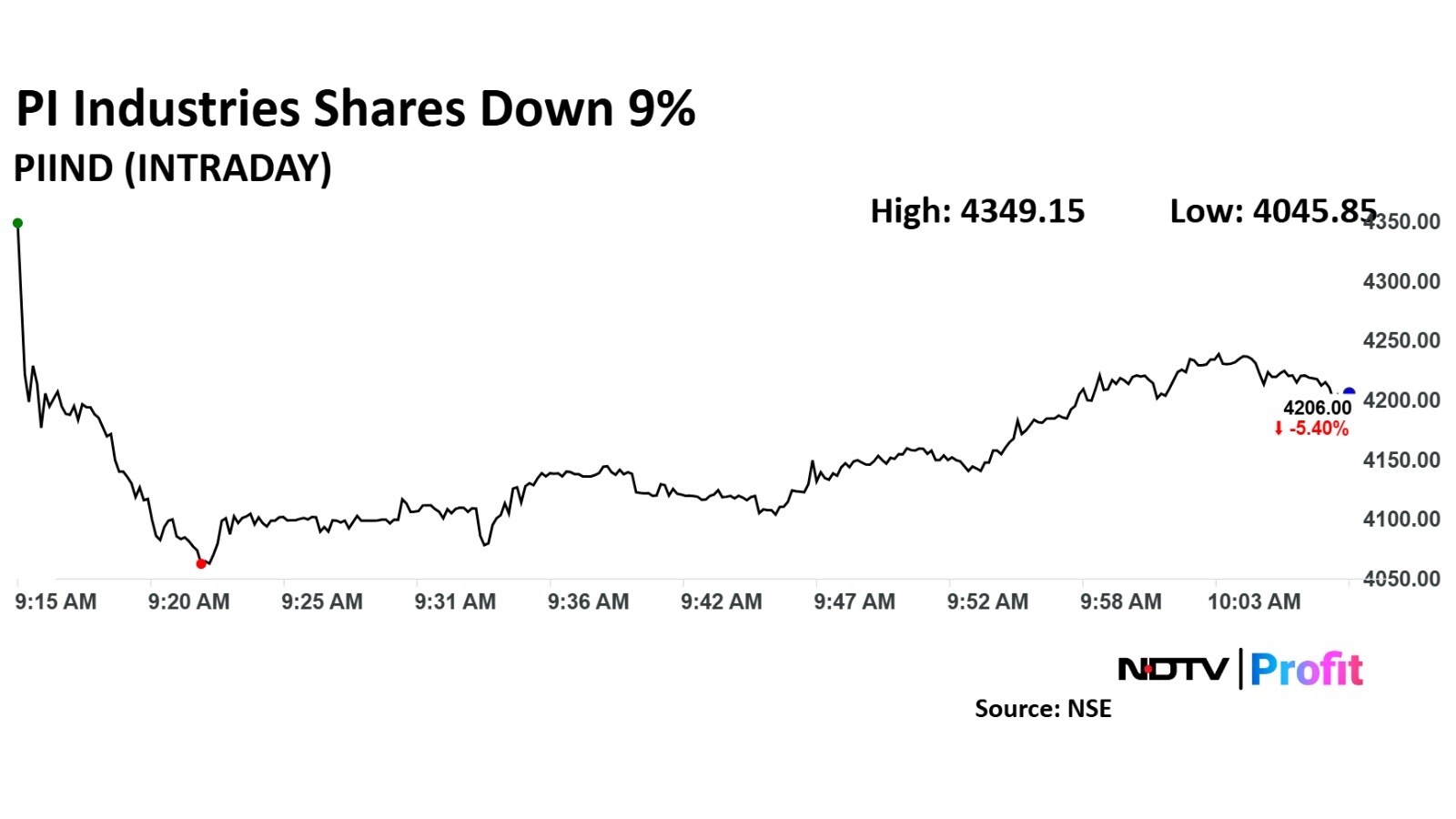

PI Industries shares were down as much as 9% after its revenue missed analyst estimates for the second quarter. It reported a revenue of Rs 2,221 crore versus a forecast of Rs 2,297 crore.

PI Industries Q2 Earnings highlights (YoY, Consolidated)

Revenue rose 4.9% to Rs 2,221 crore vs. Rs 2,116.9 crore (Estimate: Rs 2,297 crore).

Ebitda increased 14% to Rs 628.2 crore vs. Rs 551.4 crore (Estimate: Rs 638 crore).

Ebitda margin expanded 230 basis points to 28.3% vs. 26% (Estimate: 27.8%).

Net profit climbed 6% to Rs 508.2 crore vs. Rs 480.5 crore (Analyst Estimate: Rs 474 crore).

Jefferies noted that results were in line with expectations, crediting new products for steady growth. Domestic performance was on track, and pharma revenue slightly outperformed. Ebitda beat estimates, driven by a favourable product mix in custom synthesis manufacturing, though widening pharma losses weighed.

The management has lowered its revenue growth forecast to high single digits, down from an earlier 15%, citing pharma weakness for the fiscal.

PI Industries share price fell as much as 9% during the day to Rs 4,045.85 apiece on the NSE. It was trading 5.13% lower at Rs 4,218 apiece, compared to an 0.26% advance in the benchmark Nifty 50 as of 10:11a.m.

It has risen 13.94% in the last 12 months and 19.74% on a year-to-date basis. The total traded volume so far in the day stood at 29 times its 30-day average. The relative strength index was at 35.06.

Eighteen out of the 29 analysts tracking PI Industries have a 'buy' rating on the stock, five recommend a 'hold' and six suggest a 'sell', according to Bloomberg data. The average of 12-month analyst price targets implies a potential upside of 11.5%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.