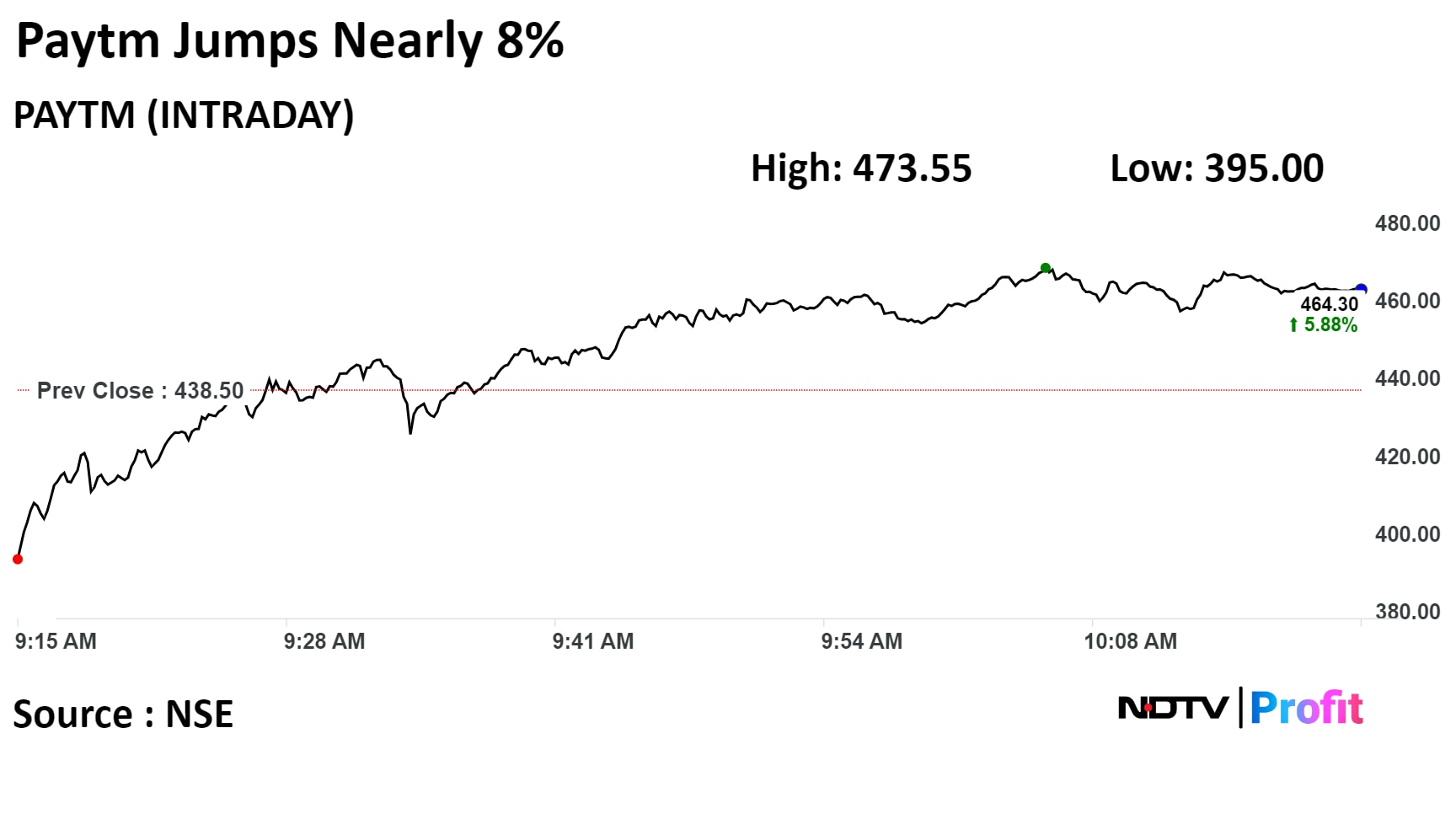

Shares of One97 Communications Ltd. jumped 8% on Tuesday after being locked in the lower circuit for three consecutive sessions as buyers finally returned after the stock's worst rout since listing.

The stock has fallen around 39% from Jan. 3, after the Reserve Bank of India found major supervisory concerns and persistent non-compliance from the company's payment banks and restricted Paytm Payments Bank from undertaking any fresh deposit or credit transactions from Feb. 29.

Adding to the negative sentiment were several media reports that the Enforcement Directorate was investigating the company for money laundering activities. However, the company clarified in an exchange filing on Sunday that the ED was not holding any such investigations on the company, its founders, or the chief executive officer.

"While the regulatory action will no doubt have a lasting impact on investors' assessments of a business model's risk and of the management's ability to handle regulatory risk, we expect the company to successfully execute the operational changes required to overcome the restrictions," Bernstein said in a report.

The brokerage maintained an 'outperform' rating on the stock but reduced the price target to Rs 600 from Rs 950, with an upside of 37.39%.

After the stock hit a 20% lower circuit for two consecutive days, Morgan Stanley on Friday bought 50 lakh shares, or a 0.79% equity stake, of Paytm operator One97 Communications at Rs 487.2 apeice for a total consideration of Rs 244 crore through an open market transaction.

Shares of One97 Communications Ltd. rose as much as 8%, the highest level since Feb. 2, before paring gains to trade 6.45% higher as of 10:30 a.m. This compares to a 0.08% advance in the NSE Nifty 50.

The stock has fallen 16.39% in the past 12 months. Total traded volume so far in the day stood at 28 times its 30-day average. The relative strength index was at 22.96, indicating that the stock may be oversold.

Of the 15 analysts tracking the company, six maintain a 'buy' rating, four recommend a 'hold,' and five suggest a 'sell', according to Bloomberg data. The average 12-month analysts' price target implies an upside of 62.5%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.