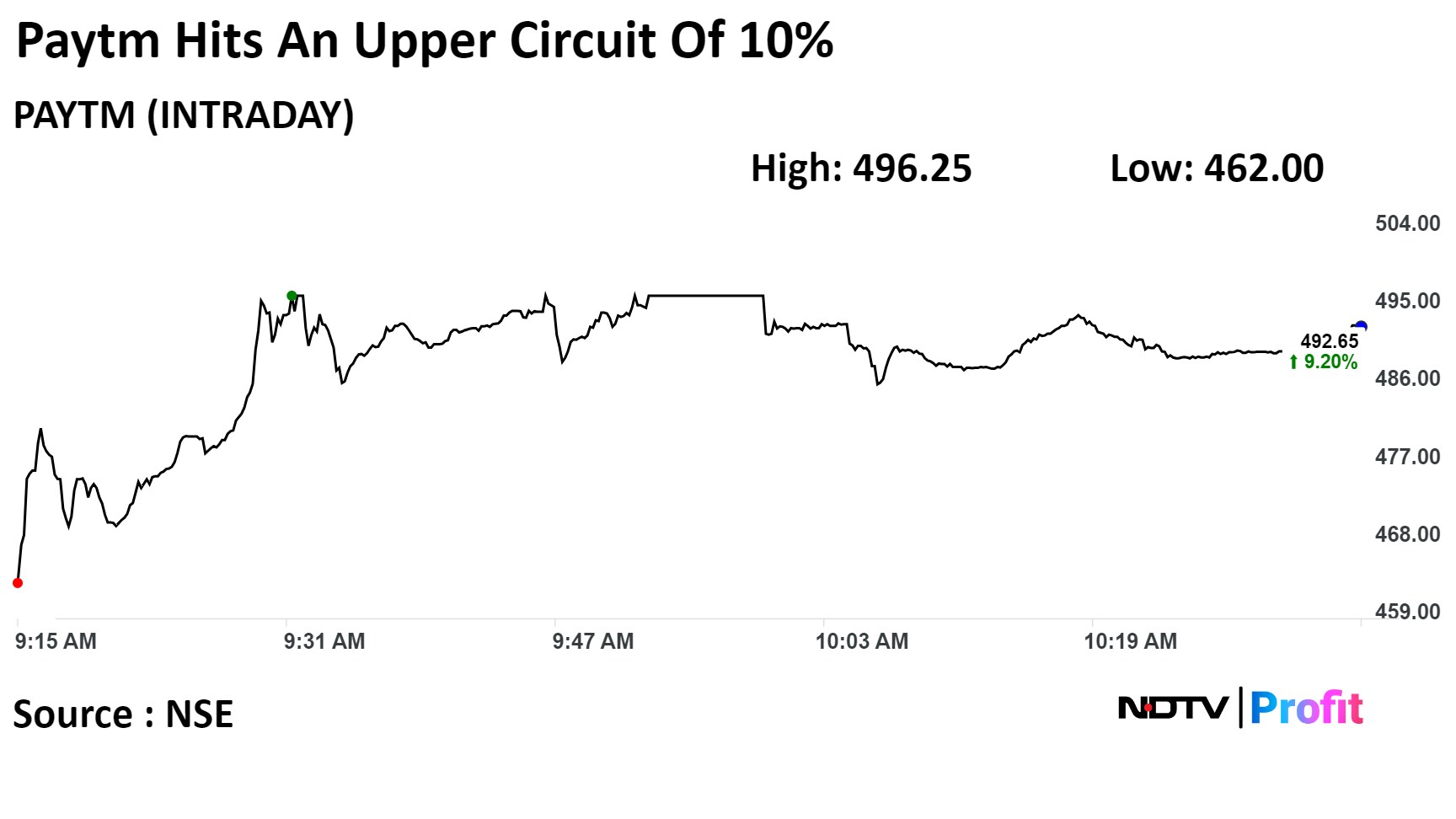

Shares of Paytm operator One97 Communications Ltd. extended gains for the second day to hit the upper circuit of 10% on Wednesday after being locked in the lower circuit for three consecutive sessions in its worst rout since listing, as buyers returned.

The stock has fallen around 42% by Feb. 5 from Feb. 1, after the Reserve Bank of India found major supervisory concerns and persistent non-compliance from the company's payment banks and restricted Paytm Payments Bank from undertaking any fresh deposit or credit transactions from Feb. 29.

"While the regulatory action will no doubt have a lasting impact on investors' assessments of a business model's risk and of the management's ability to handle regulatory risk, we expect the company to successfully execute the operational changes required to overcome the restrictions," Bernstein said in a report.

The brokerage maintained an 'outperform' rating on the stock but reduced the price target to Rs 600 from Rs 950, with an upside of 37.39%.

Paytm's Founder and Chief Executive Officer Vijay Shekhar Sharma met Finance Minister Nirmala Sitharaman on Tuesday. Sharma sought support from the Ministry of Finance, with regards to RBI's clamp down on the payments bank business and its impact on the fintech industry, people familiar with the matter told NDTV Profit, on the condition of anonymity.

Shares of One97 Communications Ltd. rose as much as 10%, the highest jump since Aug. 8, 2023, before paring gains to trade 8.64% higher at 10:23 a.m. This compares to a 0.33% advance in the NSE Nifty 50.

Total traded volume so far in the day stood at 5.7 times its 30-day average. The relative strength index was at 28, indicating that the stock may be oversold.

Of the 15 analysts tracking the company, six maintain a 'buy' rating, four recommend a 'hold,' and five suggest a 'sell', according to Bloomberg data. The average 12-month analysts' price target implies an upside of 48.5%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.