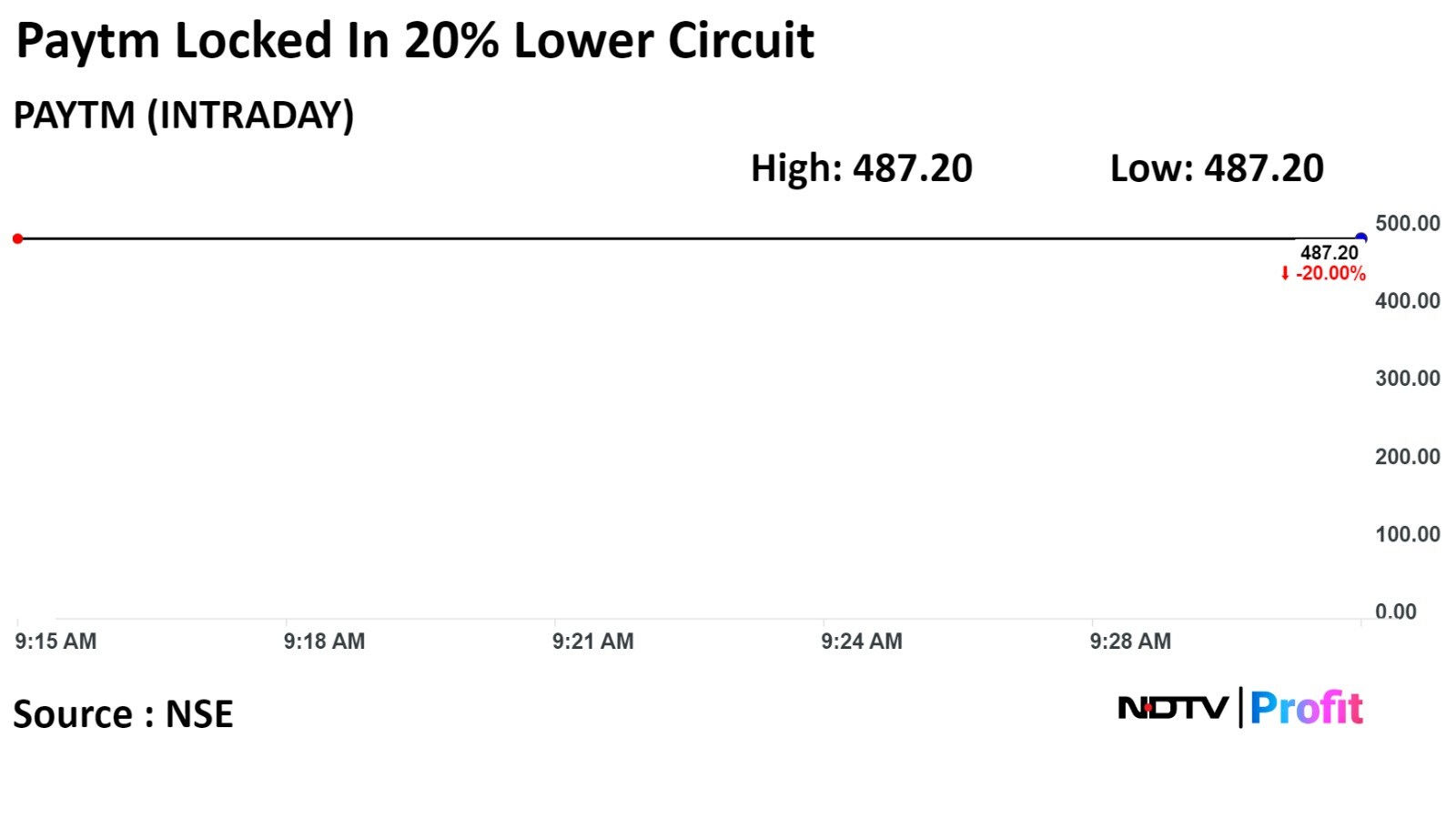

Shares of One97 Communications Ltd. were locked in a 20% lower circuit for the second straight day, wiping out Rs 7,732 crore in investor wealth on Friday after the crackdown by the Reserve Bank of India.

The banking regulator found persistent non-compliance and major supervisory concerns at the company's payments bank.

Following this, One97 Communications, in an exchange filing, said that it will from now on be working only with other banks and not its own payments bank.

The stock has tumbled 36% in two session wiping out Rs 17,394 crore in investors wealth. Paytm shares fell to their lowest level since Dec. 23, 2022.

According to the regulator's statement, the following supervisory restrictions have been introduced:

No further deposits or credit transactions are allowed in any customer account after Feb. 29.

Withdrawal or utilisation of deposit balances is allowed without restrictions, to the extent of said balances.

No other banking services, apart from withdrawal or utilisation of balances, are to be allowed after Feb. 29.

The nodal accounts of One97 Communications Ltd. and Paytm Payments Services Ltd. are to be terminated at the earliest, but not later than Feb. 29.

For transactions initiated on or before Feb. 29, all settlements need to be concluded by March 15, and no further transactions are permitted.

The company said in an exchange filing that depending on the nature of the resolution, it expects this action to have a worst-case impact of Rs 300 to 500 crore on its annual Ebitda going forward.

However, the company expects to continue on its trajectory to improve its profitability, it said.

NDTV Profit previously reported that the RBI's move to block fresh deposits at Paytm Payments Bank may have been in preparation of its licence cancellation.

Shares of Paytm were locked in 20% lower circuit of Rs 487.20 apiece, its lowest level since Dec 23, 2022, on Friday. The scrip has fallen 7.19 % in the last twelve months.

The total traded volume so far in the day stood at 7.6 times its 30-day average. The relative strength index was at 21, indicating the stock may be oversold.

Of the 15 analysts tracking the company, six maintain a 'buy' rating, five recommend a 'hold,' and four suggest a 'sell', according to Bloomberg data. The average of 12-month analyst price targets implies an upside of 59.5%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.