Shares of Oberoi Realty Ltd. hit a record high on Wednesday after its fourth-quarter profit beat analysts' estimates. The company's net profit rose 64.1% year-on-year to Rs 788 crore in the quarter ended March 2024, according to an exchange filing. Analysts tracked by Bloomberg estimated the net profit at Rs 461 crore.

Oberoi Realty Q4 Results Highlights: (Consolidated, YoY)

Revenue up 36.8% to Rs 1,315 crore. (Bloomberg estimate: Rs 1,301 crore)

Ebitda at Rs 789 crore vs Rs 369 crore (Bloomberg estimate: Rs 592 crore)

Margin at 60% vs 38.3% (Bloomberg estimate: 45.5%)

Net profit rose 64.1% to Rs 788 crore. (Bloomberg estimate: Rs 461 crore)

Board declares interim dividend of Rs 2 per share.

Approved the equity raise of Rs 2,000 crore and debt raise of Rs 2,000 crore.

The company also passed a resolution for the issue of non-convertible debentures, up to an aggregate amount of Rs 2,000 crore, on a private placement basis.

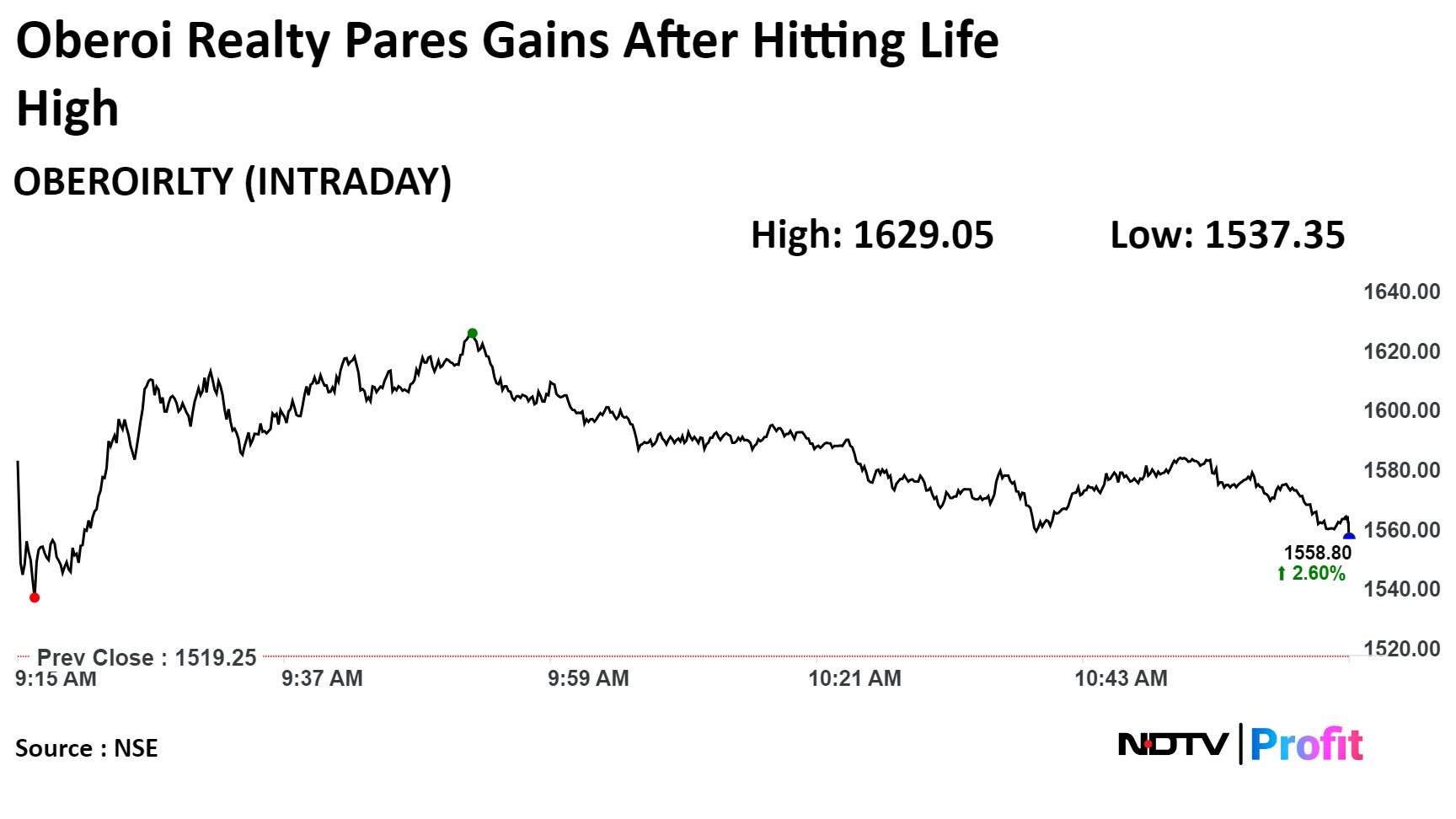

Shares of the company rose as much as 7.23% to Rs 1,629.05 apiece, the highest level. It pared gains to trade 3.08% higher at Rs 1,566.70 apiece, as of 11:16 a.m. This compares to a flat NSE Nifty 50 Index.

The stock has risen 8.84% on an year-to date basis and 68.99% in the last 12 months. Total traded volume so far in the day stood at 8.10 times its 30-day average. The relative strength index was at 62.33.

Out of 23 analysts tracking the company, eight maintain a 'buy' rating, eight recommend a 'hold,' and seven suggest a 'sell,' according to Bloomberg data. The average 12-month consensus price target implies a downside of 7.2%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.