Shares of NTPC Ltd. and Bharat Heavy Electricals Ltd. rose on Tuesday after Finance Minister Nirmala Sitharaman announced that India was forming a joint venture between the companies to set up an 800 megawatt commercial plant during the 2024 Budget Speech.

The union government will provide the required support for the JV in the budget proposed.

The proposed full-scale power plant will use advanced ultra supercritical technology, which helps in producing electricity in the most efficient way with minimal pollution to the environment, Sitharaman said.

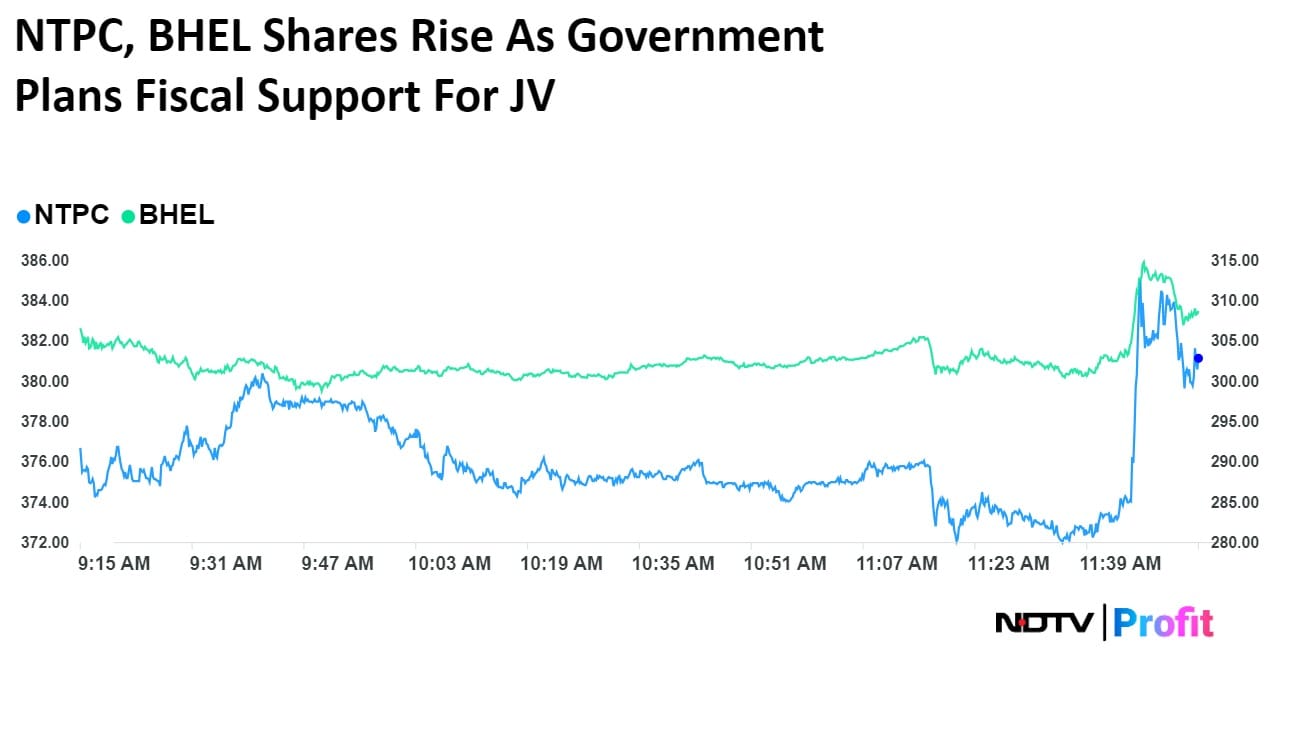

Shares of NTPC Ltd. rose as much as 3.25%, the highest level since July 16, before erasing all gains to trade 0.19% lower at Rs 372.80 as of 12:50 p.m. This is compared to a 0.90% decline in the NSE Nifty 50.

The stock has gained 70.62% in 12 months and 19.77% year-to-date. Total traded volume so far in the day stood at 1.85 times its 30-day average. The relative strength index was at 50.03.

Out of 24 analysts tracking the company, 20 maintain a 'buy' rating, one recommends a 'hold' and three suggest 'sell', according to Bloomberg data. The average 12-month analysts' consensus price target implies an upside of 11.3%.

Shares of Bharat Heavy Electricals Ltd. rose as much as 3.49%, the highest level since July 18, before paring gains to trade 0.26% higher at Rs 305.70 as of 12:51 a.m. This compares to a 0.90% decline in the NSE Nifty 50.

The stock gained 193.22% in 12 months and 19.86% on a year-to-date basis. Total traded volume so far in the day stood at 2.01 times its 30-day average. The relative strength index was at 48.06.

Out of 19 analysts tracking the company, five maintain a 'buy' rating, three recommend a 'hold' and 11 suggest 'sell', according to Bloomberg data. The average 12-month analysts' consensus price target implies a downside of 24.2%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.