Shares of Nazara Technologies Ltd. jumped to their highest level on Thursday, after the company announced the approval of a preferential equity issue to raise Rs 900 crore.

The company has also increased stake in Sportskeeda parent Absolute Sports, to 91%.

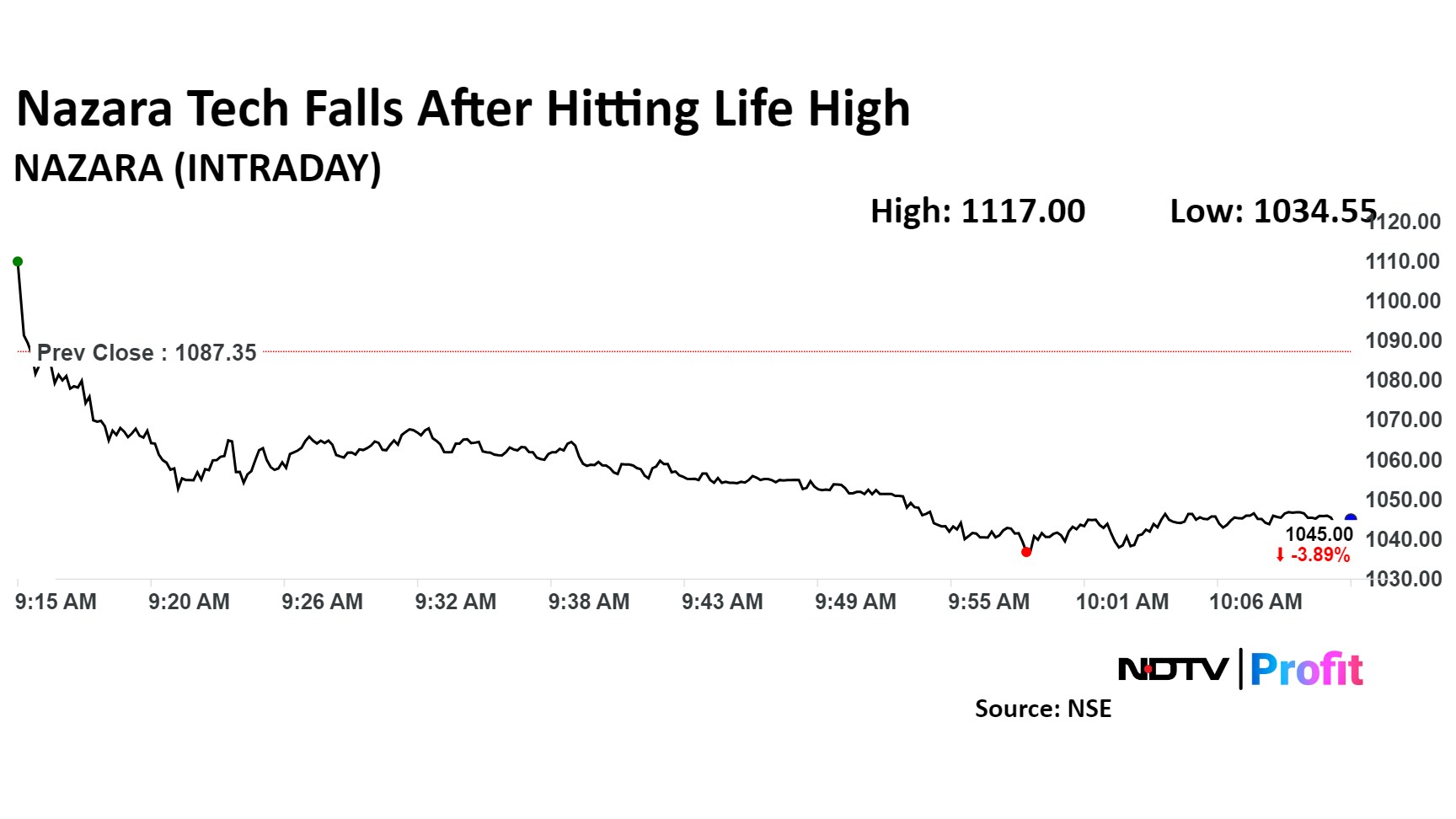

However, soon after hitting their highest level, shares of the company fell and snapped an eight-session rally. Before Thursday, the stock had surged 18% in the last eight sessions.

This capital infusion will fuel strategic acquisitions, fund business expansion, and enhance the company's ability to seize new growth opportunities, it said.

The preferential equity issue will be placed with marquee investors such as SBI Mutual Fund, Junomoneta Finsol (an associate of Plutus Wealth), Think Investments, Discovery Investments, Mithun and Siddharth Sacheti, Cohesion Investments, Chartered Finance and Leasing, Ratnabali Investments and Aamara Capital, further strengthening Nazara's financial foundation for long-term expansion, the filing said.

The company has an additional 19.35% stake in Absolute Sports Pvt. for Rs 145.5 crore, with 50% of the consideration paid in cash and the remaining amount in stock, it said.

Shares of the company rose as much as 2.73%, the highest level, before erasing gains to trade 3.7% lower at Rs 1,048.95 apiece, as of 10:16 a.m. This compares to a 0.55% rise in the NSE Nifty 50.

The stock has risen 37.14% year-to-date and 73.77% in the last 12 months. Total traded volume so far in the day stood at 0.84 times its 30-day average. The relative strength index was at 65.92.

Of the 11 analysts tracking the company, five maintain a 'buy' rating, two recommend a 'hold' and four suggest 'sell', according to Bloomberg data. The average 12-month analysts' consensus price target implies a downside of 10.1%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.