Shares of Metro Brands Ltd. dropped to their lowest in nearly three months on Friday after its net profit and revenue missed analysts' estimates.

The company's net profit fell 13% year-on-year to Rs 98.8 crore in the quarter ended December 2023, according to an exchange filing. That compares with the Bloomberg forecast of Rs 126.6 crore.

Metro Brands Q3 Earnings Highlights (Consolidated, YoY)

Revenue up 6.1% at Rs 635.5 crore. (Bloomberg estimate: Rs 729.2 crore)

Ebitda down 3% at Rs 199 crore. (Bloomberg estimate: Rs 235.4 crore)

Margin at 31.31% vs 34.27% (Bloomberg estimate: 32.3%)

Net profit down 13% at Rs 98.8 crore. (Bloomberg estimate: Rs 126.6 crore).

The growth in turnover was mainly driven by store additions as revenue per store remained muted in the third quarter, according to Motilal Oswal Financial Services.

Taking into account the impact of the shift in the festive season, cumulative revenue in stores for the second and third quarters grew 8% in comparison to a 15% growth in the year-ago period, indicating a weak operating performance, the brokerage said.

However, Motilal maintains a 'buy' rating on the stock.

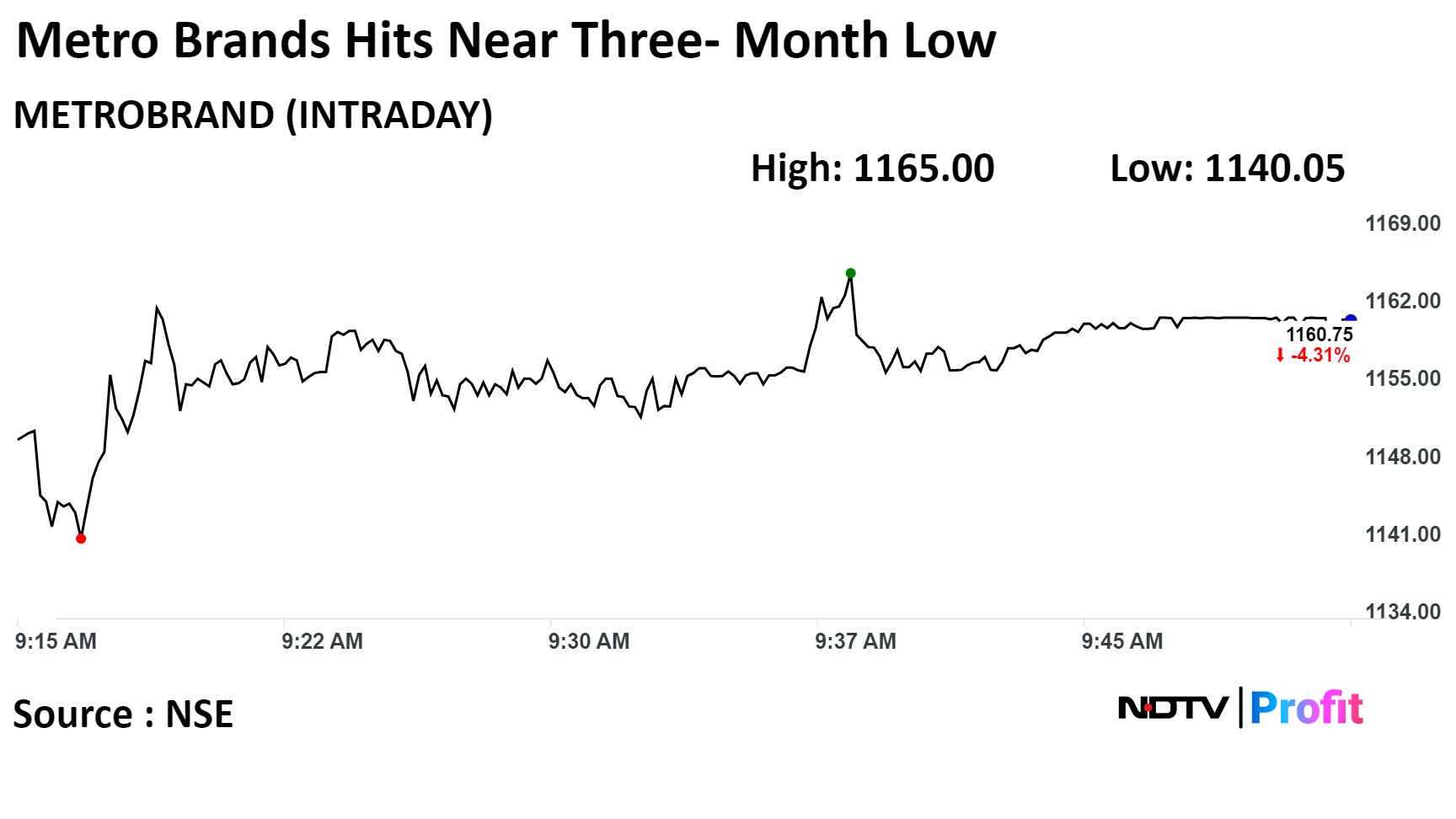

On the NSE, Metro's stock fell as much as 6% during the day to Rs 1,140.05 apiece, the lowest since Oct. 26. It was trading 4.27% lower at Rs 1,161.30 apiece, compared to a 0.8% advance in the benchmark Nifty 50 at 9:56 a.m.

The share price has risen 32.83% in the last 12 months. The total traded volume so far in the day stood at 11 times its 30-day average. The relative strength index was at 30.38.

Nine out of 18 analysts tracking the company have a 'buy' rating on the stock, four recommend a 'hold' and five suggest a 'sell', according to Bloomberg data. The average of 12-month analyst price targets implies a potential upside of 10%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.