Shares of One 97 Communications Ltd. rose to the highest level in over three months on Tuesday as the Paytm parent confirmed it is in talks with Zomato Ltd. to sell its entertainment business.

The potential sale of its entertainment vertical, which includes movies and events business, a component of the fintech company's marketing service is one option under discussion, One 97 Communications said in an exchange filing.

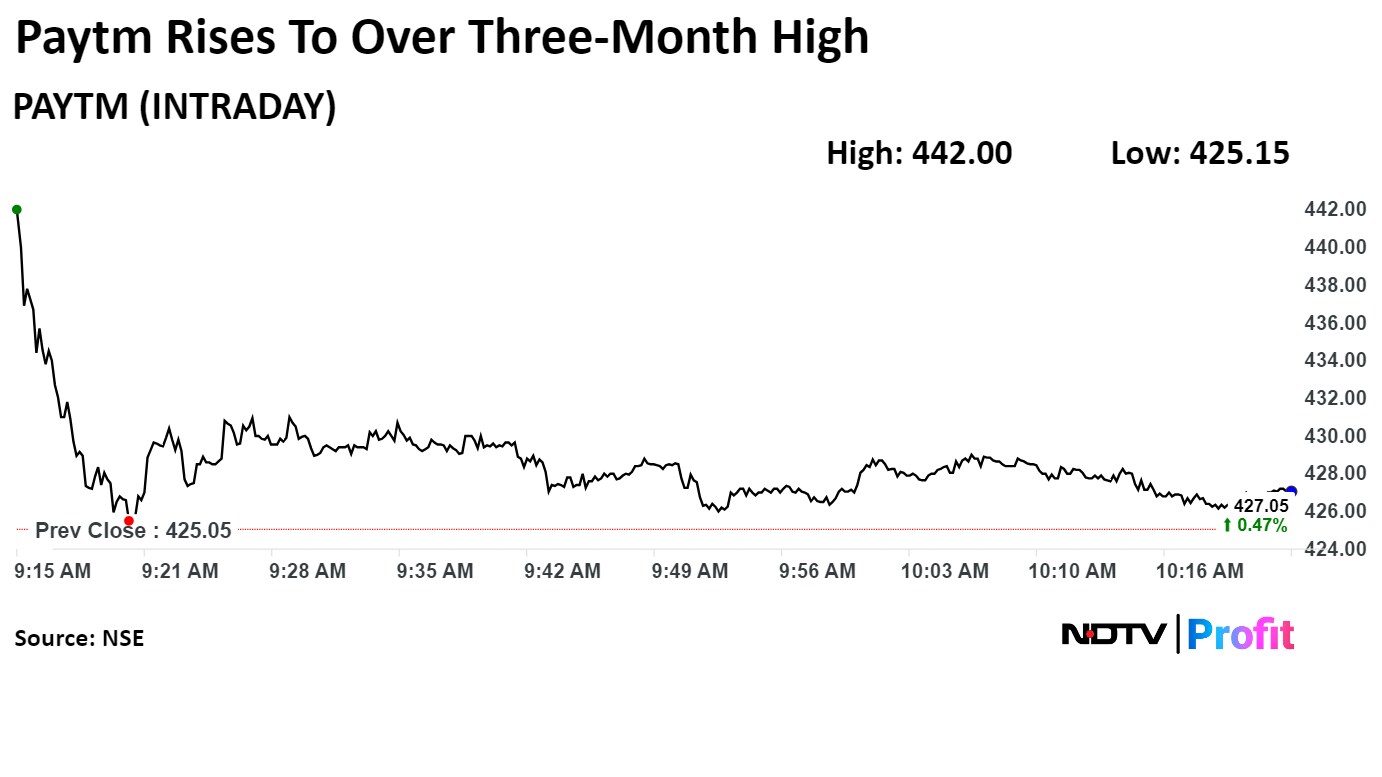

On the NSE, Paytm's stock rose as much as 3.99% during the day to Rs 442 apiece, the highest level since Feb. 27. It was trading 0.46% higher at Rs 427.15 per share, compared to a 0.25% advance in the benchmark Nifty at 10:22 a.m.

The share price has declined 32.85% on a year-to-date basis, and 50.82% in the last 12 months. The total traded volume so far in the day stood at 0.37 times its 30-day average. The relative strength index was at 64.79.

Out of the 17 analysts tracking the company, five have a 'buy' rating on the stock, and as many recommend 'hold', while seven suggest 'sell', according to Bloomberg data. The average of 12-month analyst price targets implies a potential downside of 4.7%.

In a separate exchange filing, Zomato also confirmed to be in talks to buy Paytm's entertainment business with an aim to strengthen its going-out business.

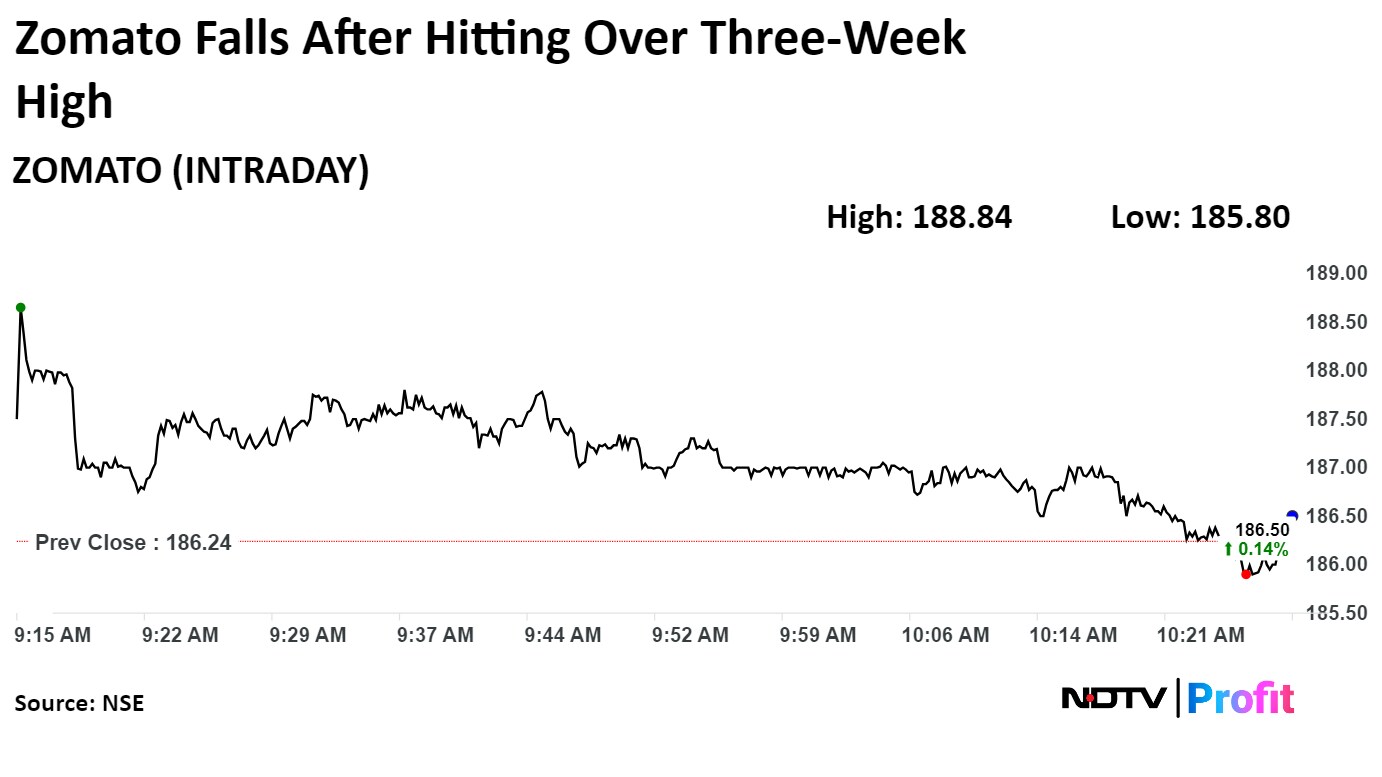

Zomato's stock rose as much as 1.4% during the day to Rs 188.84 apiece, the highest since May 23. It was trading 0.19% higher at Rs 186.60 per share, compared to a 0.36% advance in the Nifty as of 10:33 a.m.

The share price has risen 50.92% on a year-to-date basis and 148.81 in the last 12 months. The total traded volume so far in the day stood at 0.27 times its 30-day average. The relative strength index was at 53.29.

Twenty-four out of the 28 analysts tracking the company have a 'buy' rating on the stock, one recommends 'hold' and three suggest 'sell', according to Bloomberg data. The average of 12-month analyst price targets implies a potential upside of 19.1%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.