Bernstein has initiated coverage on Muthoot Finance Ltd. with an 'outperform' rating, saying that the stock is the "best play" in the segment with gold being the top-most financial asset among Indian households and amid the willingness to use it as a collateral.

The brokerage has a higher target price against the consensus at Rs 2,000 apiece, implying a potential upside of 14.4% from the previous close. Healthy growth will mean that the current cyclically high valuation multiple will sustain for longer than what the consensus expects, it said.

"Indian households have more gold than any financial asset, including bank deposit," the brokerage said. As of 2023, it stood at Rs 167 lakh crore, out of which 15% has been used as collateral, according to Bernstein's report.

It underscored that a very healthy risk-adjusted yield and some operating leverage kicking in with scale has enabled the lender to maintain a very healthy return on assets through cycles, with an average RoA of 5.8% over the decade.

"The healthy profitability and decent loan growth has resulted in a TSR (total shareholder return) that's comparable with the best of the banks," it said. "In comparison with the nearest peer, Manappuram Finance, it is much larger in the core gold loan business and has seen faster growth despite its larger size."

"We expect the growth for public sector banks to moderate, given the review of their operating practices, while one of the larger NBFCs (IIFL) is likely to see muted growth, given recent regulatory action," it said.

The report also showed a gradual shift in preference from unorganised to organised gold lenders. In the last 10 years, the share of unorganised lenders has reduced to 65% from 75%. In the next few years, the brokerage expects the gold-loan segment to benefit from healthy gold prices and a slowdown in alternate borrowing sources, such as digital unsecured loans.

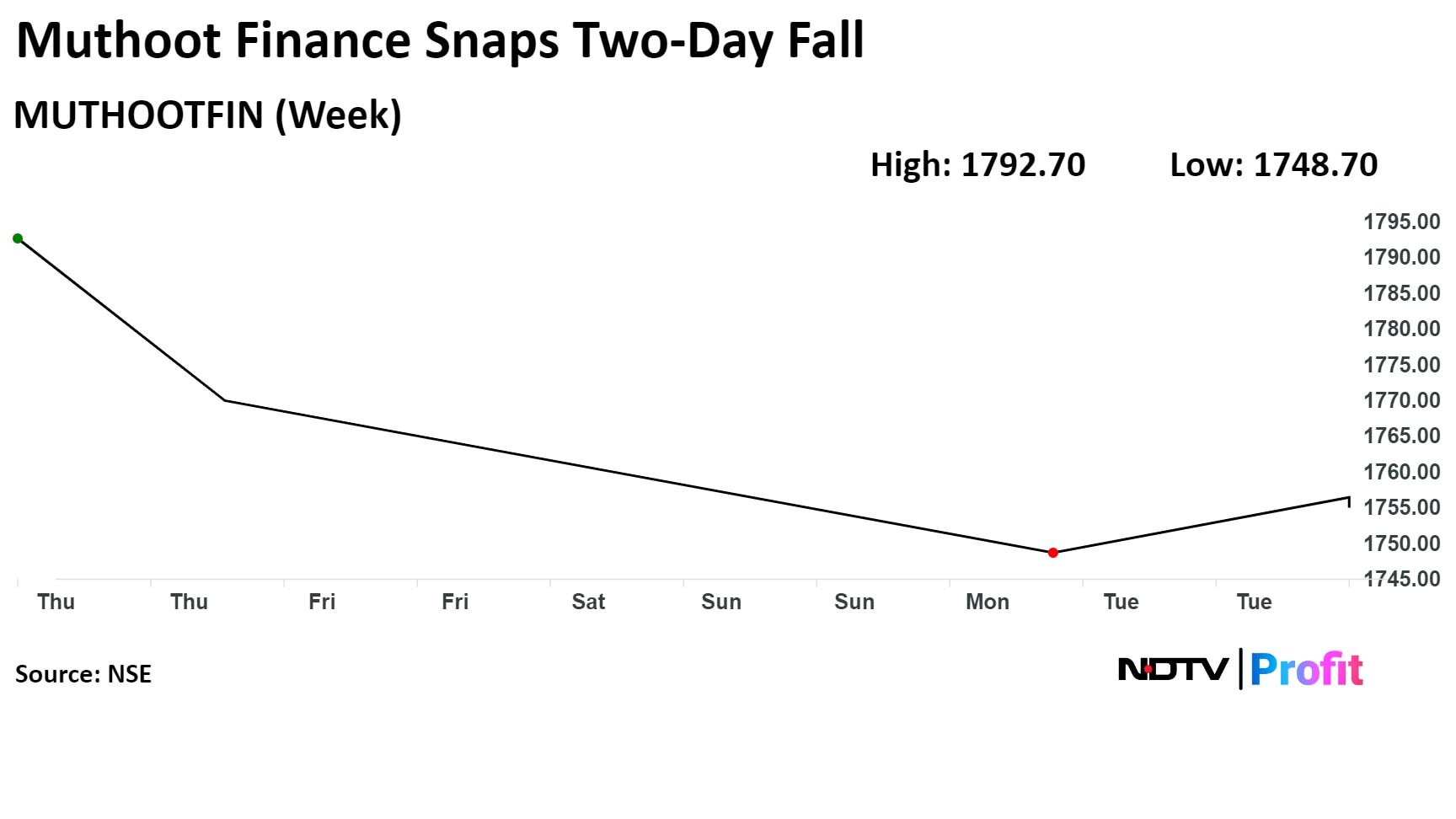

Muthoot Finance's stock rose as much as 1.2% during the day to Rs 1,769.75 apiece on the NSE. It pared gains to trade 0.23% higher at Rs 1,752.75 per share, compared to a 0.41% decline in the benchmark Nifty at 10:26 a.m.

The share price has risen 18.8% on a year-to-date basis and 41.48% in the last 12 months. The total traded volume so far in the day stood at 0.09 times its 30-day average. The relative strength index was at 55.

Fifteen out of the 21 analysts tracking the company have a 'buy' rating on the stock, two recommend 'hold' and four suggest 'sell', according to Bloomberg data. The average of 12-month analyst price targets implies a potential upside of 4.4%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.