JSW Infrastructure Ltd. shares hit a fresh life high on Friday after it's subsidiary signed a pact to acquire majority stake in logistics service provider Navkar Corporation Ltd. The stock went up as much as 5.35% in early trade following the acquisition pact.

JSW Ports Logistics Pvt., a subsidiary of JSW Infrastructure, will acquire around 10.6 crore shares of Navkar Corp., representing 70.37% of the total shareholding, at Rs 95.61 per share. This is at a discount of 14.74% from Thursday's closing price.

The deal will trigger a mandatory open offer for additional 26% stake, or 3.91 crore shares, at Rs 105.32 per share. This marks a discount of 6.09% from the previous close.

The acquisition is subject to approval from certain regulatory bodies, according to an exchange filing on Thursday.

Navkar operates one container freight station and Gati Shakti Cargo Terminal at Somathane, Panvel, and two such freight stations at Ajivali, Panvel. It also runs an inland container depot at Morbi, Gujarat.

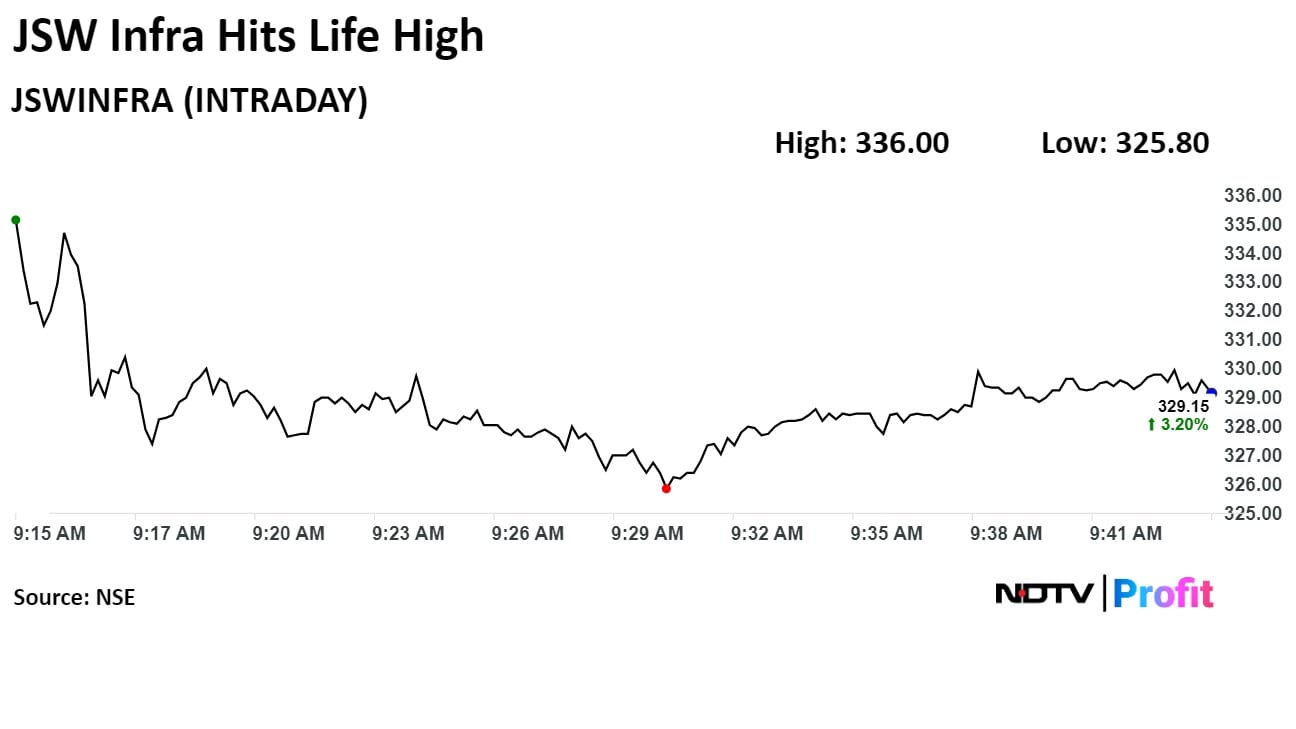

JSW Infrastructure's stock rose as much as 5.35% during the day to Rs 336 apiece on the NSE. It was trading 3.2% higher at Rs 329.15 apiece, compared to a 0.45% advance in the benchmark Nifty as of 9:40 a.m.

The share price has risen 109.38% in the last 12 months and 57.95% on a year-to-date basis. The total traded volume so far in the day stood at 2.3 times its 30-day average. The relative strength index was at 69.15.

Five out of the eight analysts tracking JSW Infrastructure have a 'buy' rating on the stock, one recommends 'hold' and two suggest 'sell', according to Bloomberg data. The average of 12-month analyst price targets implies a potential downside of 20.6%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.