Shares of HDFC Bank Ltd. rose nearly 4% to an all-time high after the fall in foreign institutional investors' holdings paved the way for the increasing the lender's weight in the MSCI Emerging Market Index.

The private sector bank reported a reduction in foreign institutional investors' shareholding to 54.83% in the June 2024 quarter, down from 55.54% in the previous quarter. This change aligns with the MSCI Index's requirement of keeping FII shareholding below 55.5%. Currently, the bank's weight stands at 3.95%, but with the shareholding drop, it could rise to between 7.2% and 7.5%.

The foreign holding in the bank came in below the MSCI's threshold which makes it eligible for a jump in index weight, Jefferies said in a note. This could be positive for the near term while strong deposit growth and improving net interest margins could be key drivers in the medium term, the brokerage said.

Nuvama expects the scrip to gain momentum and cross Rs 1,900 per share until official announcement on Aug. 13. "Domestic funds bought because of reasonable valuation and should continue to hold."

The rally in the lender's stock drove the gains in the NSE Nifty 50. The Nifty Bank also rose nearly 2% during the day to a fresh high, led by the Federal Bank Ltd. and HDFC Bank.

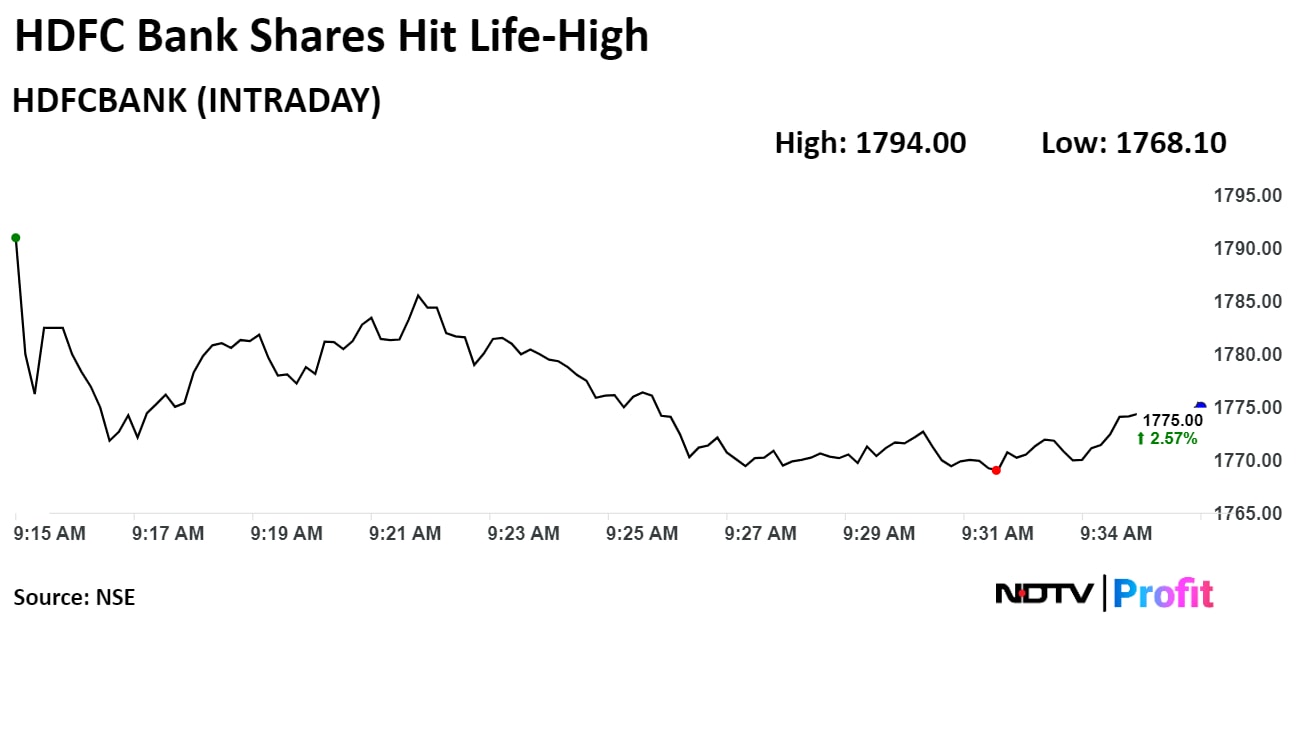

HDFC Bank's stock rose as much as 3.66% during the day to Rs 1,794 apiece on the NSE. It was trading 2.32% higher at Rs 1,770.75 per share, compared to a 0.56% advance in the benchmark Nifty at 9:24 a.m.

The share price has risen 2.9% in the last 12 months and 3.7% on a year-to-date basis. The total traded volume so far in the day stood at 9.3 times its 30-day average. The relative strength index was at 78, implying that the stock may be overbought.

Forty-five out of the 50 analysts tracking the bank have a 'buy' rating on the stock and five recommend 'hold', according to Bloomberg data. The average of 12-month analyst price targets implies a potential upside of 5.1%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.