Shares of Indegene Ltd. fell nearly 2% on Thursday after Citi Research initiated coverage on the stock with a 'sell' rating. It has set a target price of Rs 510 apiece, implying a potential downside of 7.1% from the previous close.

The brokerage expects the company to benefit from the accelerated digitalisation of life sciences industry and mining opportunities in existing marquee clients. Its EBIT margin is also expected to remain stable in the current and next financial years, according to a note.

Citi valuates the digital-first life sciences commercialisation company's price to earnings ratio at 28 times for the second quarter of the current fiscal on decent growth potential due to bright prospects of client mining. It has assigned the multiple roughly at a 10–15% discount to mid-tier sector multiple of 32 times, factoring in ongoing patent cliff and client concentration.

Indegene has multiple growth drivers, including relationships with peers, domain expertise and the life sciences industry's openness to adopt digital solutions makes it well-positioned for market potential, it said.

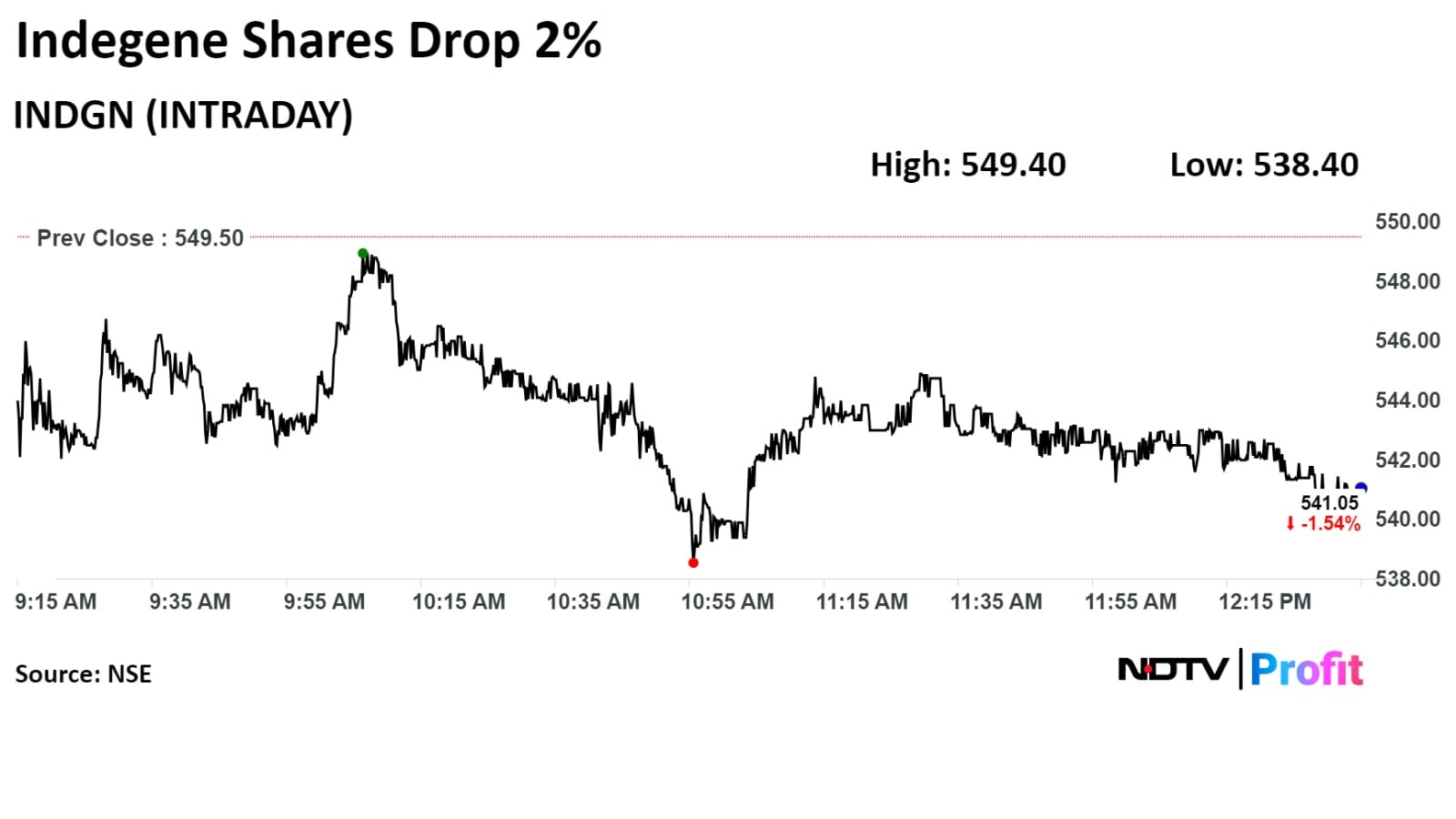

Indegene stock fell as much as 2.02% during the day to Rs 538.40 apiece on the NSE. It was trading 1.32% lower at Rs 542.25 apiece, compared to a 0.17% advance in the benchmark Nifty at 12:05 p.m.

The share price has fallen 5.02% in the last 12 months. The relative strength index was at 42.40.

An analyst tracking Indegene has a 'sell' rating on the stock, according to Bloomberg data. The average of 12-month analyst price targets implies a potential downside of 6.1%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.