Shares of Entero Healthcare Solutions Ltd. surged to hit 20% upper circuit on Friday after Jefferies initiated coverage with a 'buy' rating and target price of Rs 1,510 apiece, implying an upside of 50% from Wednesday's closing price.

The company trades at a 40% discount to its closest comparable peer, Meduplus' FY26 price to earnings consensus valuations because of its B2C nature and lacks a direct competitor, the brokerage said.

The brokerage firm expects operating leverage to play out over fiscal 2024–26. "Over FY24–26, we estimate a 44% revenue CAGR and an 8-times increase in adjusted PAT as economies of scale kick in," it said.

In addition, the brokerage believes that the company is well-placed to achieve 20% organic growth in a short span. Entero has created a network of over 80,000 retailers, suggesting that one in 10 retailers buys from Entero and 3,400 hospitals due to its wide reach and product offering, the brokerage said.

It also likes the company's ancillary businesses, which include marketing services to pharma firms and private label products, which supplement the distribution business.

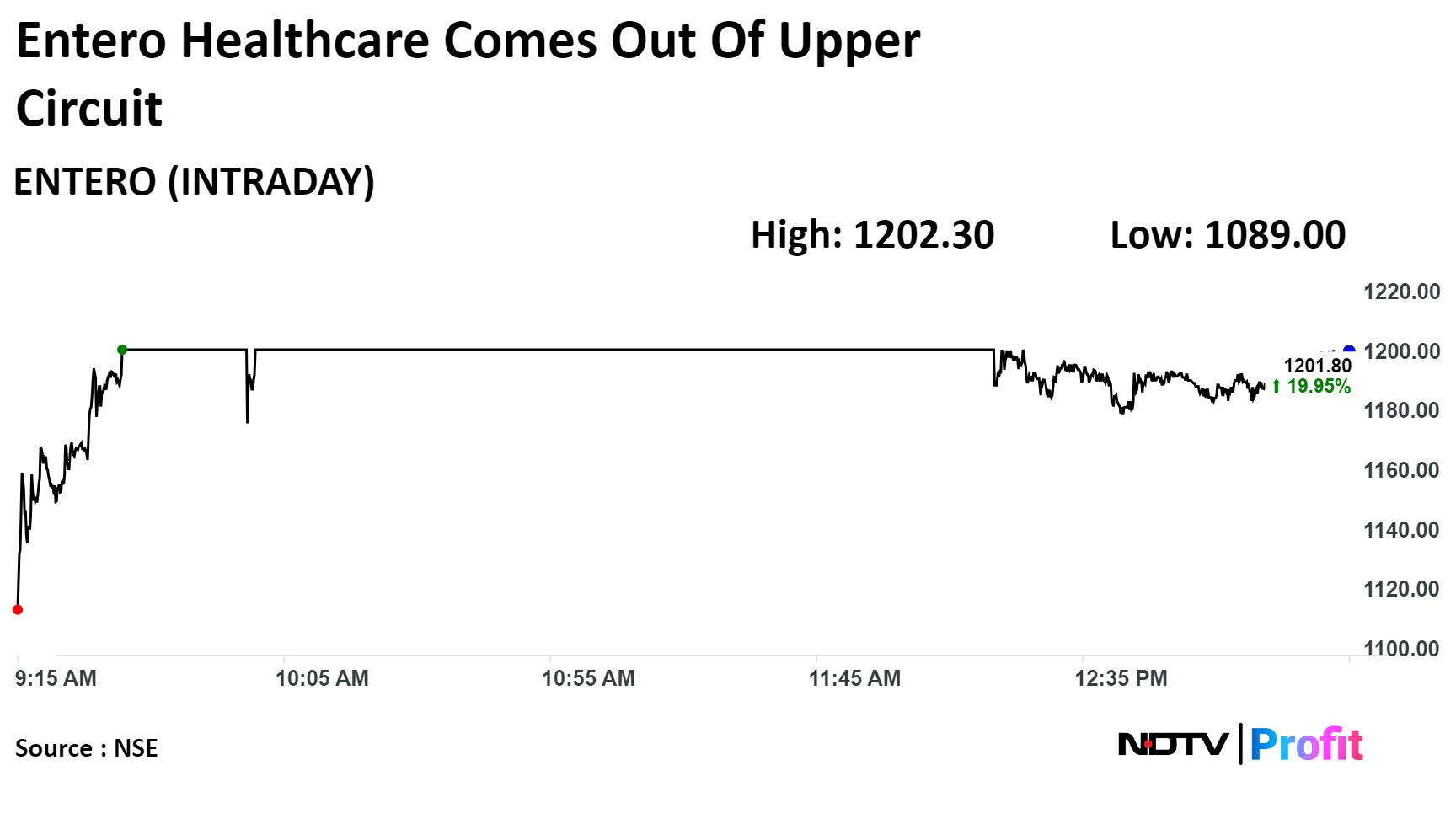

Shares of the company surged as much as 20% to Rs 1,202 apiece, the highest level since Feb 16. It pared gains to trade 19.07% higher at Rs 1,192.35 apiece as of 1:46 p.m. This compares to a 0.84% decline in the NSE Nifty 50.

Total traded volume so far in the day stood at 6.7 times its 30-day average. The relative strength index was at 69.54.

One analyst tracking the company has a buy rating for the stock, according to Bloomberg data. The average 12-month consensus price target implies a upside of 26.1%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.