HSBC Global Research has raised its target price on ITC Ltd. to Rs 580 from Rs 480, maintaining a 'buy' rating on the stock. The revised target price implies a potential upside of 11.9% from the previous close of Rs 518.15.

The brokerage cited a stable taxation regime for ITC's cigarette business and growth prospects in its Fast Moving Consumer Goods-Others segment as key factors driving the valuation upgrade.

Cigarette Business

HSBC notes that the absence of a taxation increase for cigarettes in the July budget signals a more stable tax environment for ITC. The cigarette segment, being the largest value driver, is now operating under more favourable conditions, which should support gradual volume recovery and accelerate EBIT growth. HSBC also expects ITC to gain market share from illegal cigarettes due to this stable tax regime.

ITC VS FMCG Peers

HSBC pointed out that despite ITC's stock rally, driven by the market's preference for defensiveness, the company has lagged behind its FMCG peers over the past year, partly due to concerns over taxation. ITC's valuation discount compared to its FMCG peers has widened to a two-year high since April, despite the recent rally. HSBC believes this reflects ITC's improving appeal, based on an implied FY26 price-to-earnings ratio of 27x, which the brokerage finds tenable.

HSBC also highlighted the strong performance of FMCG-Others, which continues to outperform the peer group and has emerged as a formidable business with iconic brands. Other favourable trends include a Hotels upcycle and undemanding valuation relative to earnings growth.

Valuation Approach & Other Factors

HSBC uses a SOTP valuation method, leading to a higher target price of Rs 580. The valuation includes an increase in the estimated value of the cigarette segment, FMCG-Others, Hotels, Packaging & Printing Business, and Agri, with a slight decrease for ITC Infotech. The target price also factors in group net debt and non-core asset contributions.

Downside Risks

HSBC outlined three key downside risks to its outlook for ITC:

1. Excessive taxation shocks, which could adversely impact the share price.

2. Worse-than-expected cigarette volume growth.

3. Slower progress or loss of market share in growing categories within the FMCG-Others segment.

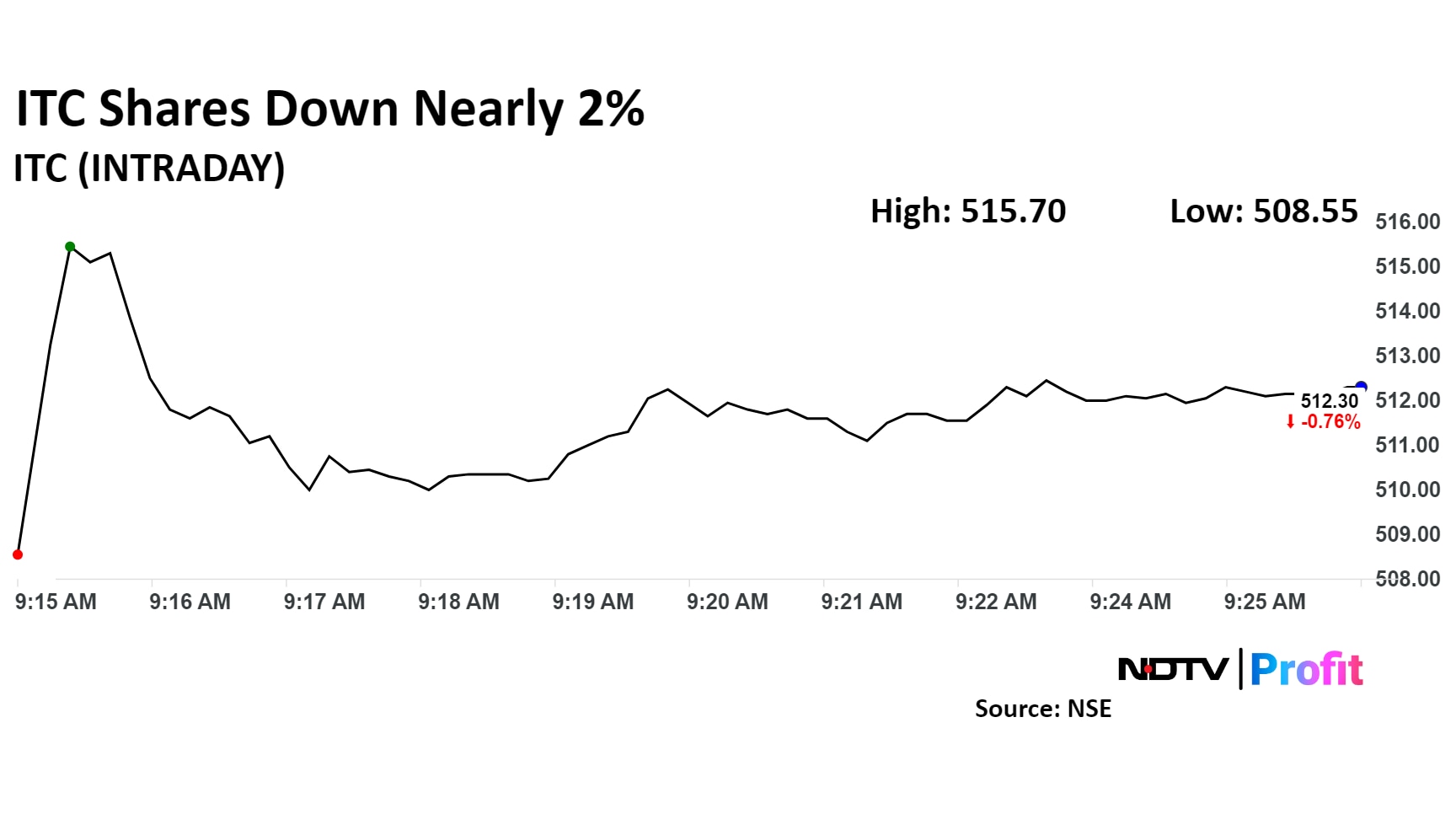

ITC Shares Today

ITC Ltd. stock fell as much as 1.48% during the day to Rs 508.55 apiece on the NSE amidst a broader market decline. It was trading 0.91% lower at Rs 511.50 apiece, compared to a 1.02% decline in the benchmark Nifty 50 as of 9:22 a.m.

It has risen 16.46% in the last 12 months and 10.8% on a year-to-date basis. The relative strength index was at 51.72.

Thirty four out of the 39 analysts tracking ITC have a 'buy' rating on the stock, three recommend a 'hold' and two suggest a 'sell', according to Bloomberg data. The average of 12-month analyst price targets implies a potential upside of 6.2%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.