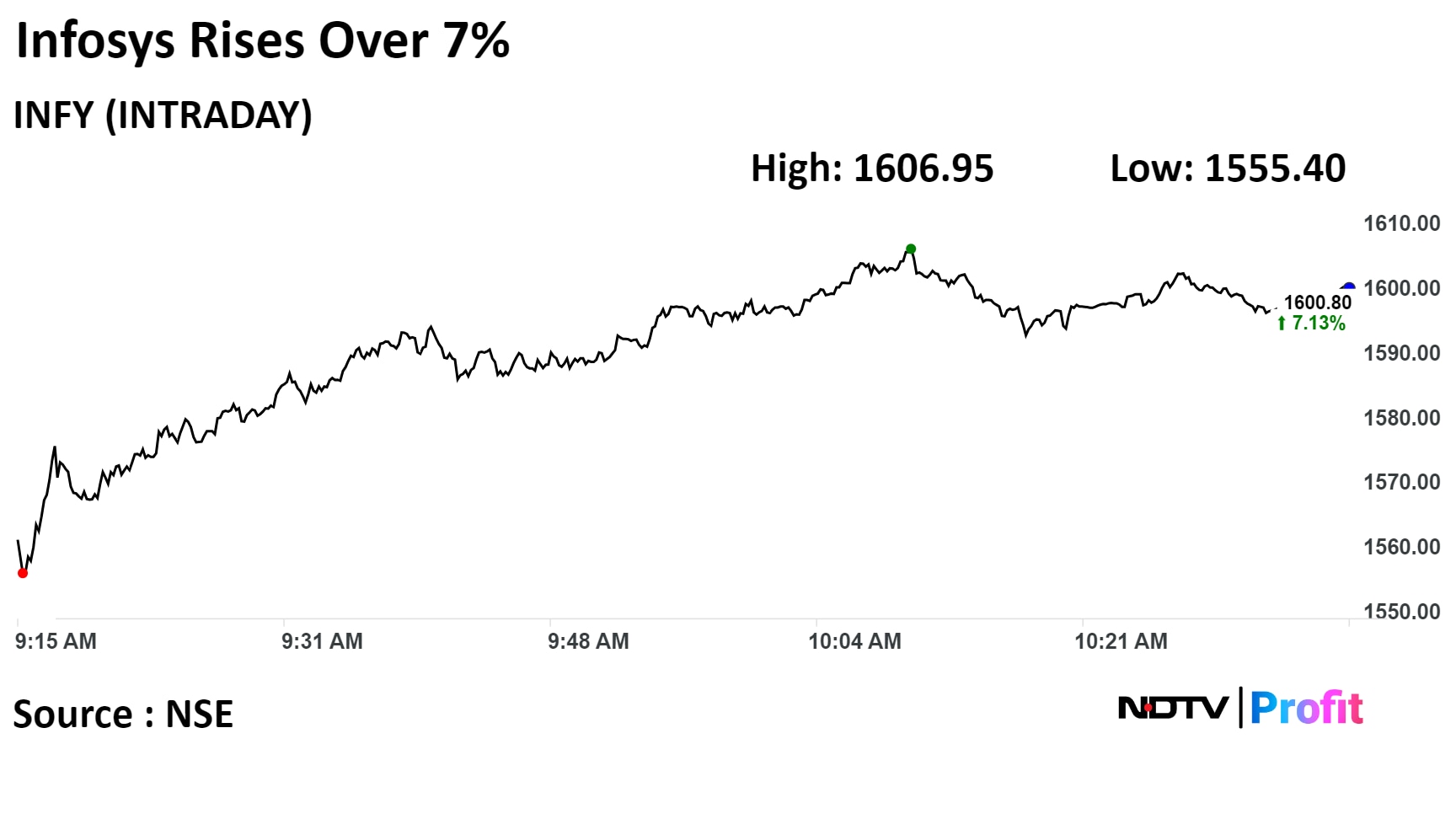

Shares of Infosys Ltd. rose over 7% as brokerages see growth potential on the back of new deal wins, even as its third-quarter profit missed analysts' estimates.

The company is likely to see strong traction in the large deal pipeline despite an adverse demand environment, Motilal Oswal said in a report. The brokerage maintained a 'buy' rating on Infosys with a price target of Rs 1,750 apiece.

HDFC Securities also sees growth visibility from improvements in deals inked with JLR and BSNL. Further, the brokerage said deal market-share gains versus Accenture outsourcing may offset the impact of leakage in the renewals.

HDFC Securities maintained 'add' on Infosys with a target price of Rs 1,515 apiece.

The IT company's net profit declined 1.64% sequentially to Rs 6,113 crore for the quarter ended December 2023, according to an exchange filing. This is compared to a Bloomberg estimate of Rs 6,628 crore.

Following this, the company has revised its revenue growth guidance to a tighter, narrower band of 1.5–2% in the fiscal ending March 31, 2024, from the 1-2.5% anticipated a quarter ago.

The company still aims to achieve operational profitability of 20–22% in FY24, despite a margin erosion in the third quarter.

Infosys Q3 Results: Key Highlights (QoQ)

Revenue down 0.44% to Rs 38,821 crore (Bloomberg estimate: Rs 38,318 crore).

Ebit down 3.78% at Rs 7,961 crore (Bloomberg estimate: Rs 7,929.5 crore).

Ebit margin at 20.50% vs 21.21% (Bloomberg estimate: 20.50%).

Net profit down 1.64% at Rs 6,113 crore (Bloomberg estimate: Rs 6,628 crore).

Shares of the company rose as much as 7.55%, the highest since Feb. 16, 2023, before paring gains to trade 6.91% higher at 10:34 a.m. This compares to a 0.76% advance in the NSE Nifty 50.

The stock has risen 7.87% in 12 months. Total traded volume so far in the day stood at 8.0 times its 30-day average. The relative strength index was at 62.77.

Of the 45 analysts tracking the company, 25 maintain a 'buy' rating, 12 recommend a 'hold', and eight suggest a 'sell', according to Bloomberg data. The average 12-month consensus price target implies an upside of 8.7%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.