Shares of IIFL Finance Ltd. hit a 20% lower circuit on Tuesday after the Reserve Bank of India banned the company from disbursing gold loans with immediate effect.

The regulator has found material supervisory concerns in IIFL Finance's gold loan portfolio. However, the RBI has said that the company can continue servicing its existing loans. "These practices, apart from being regulatory violations, also significantly and adversely impact the interests of the customers," the central bank had said in a statement.

In response to the cease-and-desist order, IIFL Finance reaffirmed its commitment to rectify the observations made by the RBI. "We reaffirm our commitment to rectify observations of the RBI in our gold loan portfolio to comply with RBI findings at the earliest and will continue with our endeavour to provide gold loan services in the overall interest of customers," it said in an exchange filing on Monday.

All other businesses, except gold loan, to continue as usual, IIFL Finance said in a management concall on Tuesday. The company has approached the RBI for a special audit to resolve issues.

"Most of our co-lending partners make their own assessment of quality and weight," it said. "We have adequate liquidity in the foreseeable future (and) will make sure to comply with the RBI circular on auctioning gold."

Gold testing is a manual and subjective process, and the audit team is generally more conservative, which may differ from how branches look at value, IIFL said.

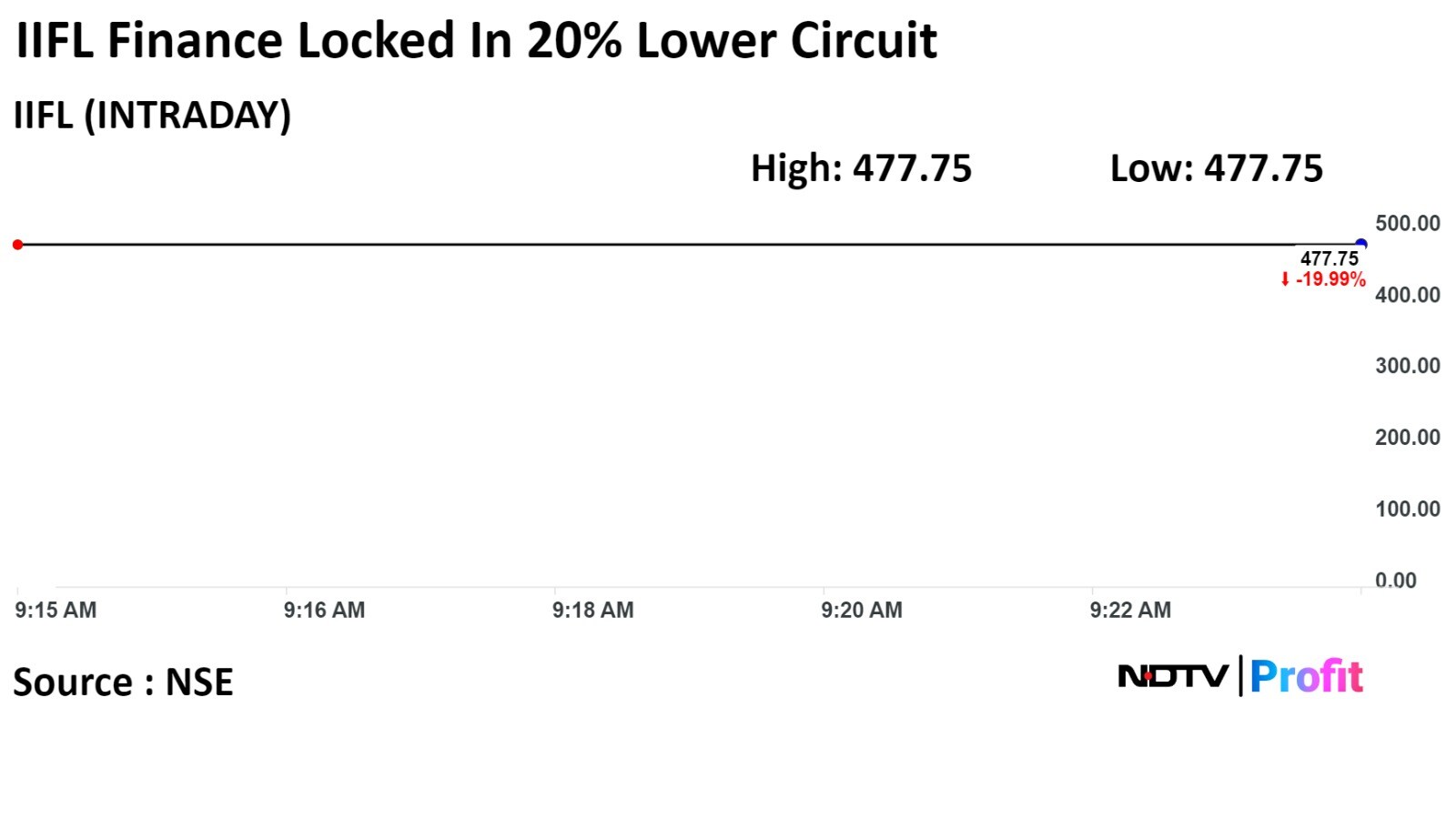

IIFL Finance's stock fell as much as 19.99% during the day to hit a lower circuit of Rs 477.75 apiece on the NSE. This is compared to a 0.12% decline in the benchmark Nifty 50 as of 9:25 a.m.

It has risen 5.25% in the past 12 months. The total traded volume so far in the day stood at 43 times its 30-day average. The relative strength index was at 26.5.

All seven analysts tracking IIFL Finance have a 'buy' rating on the stock, according to Bloomberg data. The average of 12-month analyst price targets implies a potential upside of 34.3%.

While the shares of IIFL Finance were locked in the lower circuit, its competitors' shares rose. Shares of Manappuram Finance Ltd. and Muthoot Finance Ltd. rose by as much as 6% and 4.9% respectively as of 9:40 a.m.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.