Shares of IIFL Finance Ltd. and Piramal Enterprises Ltd. fell after the Reserve Bank of India banned banks and NBFCs from investing in alternative investment funds that have invested in debtor firms who have been their customers in the prior 12 months.

Banks and non-banking financial companies will have to liquidate such investments in 30 days.

Piramal's investment in AIFs stands at Rs 4,500 crore, according to Jefferies. While IIFL has invested Rs 1,100 crore in AIFs, it said.

If Piramal Enterprises and IIFL Finance have to provide against their entire AIF exposure, including pre 12 months, the hit to net worth could be 8% for Piramal and 10% for IIFL, Jefferies said. "We await more clarity, but impact from circular on PIEL/IIFL may be limited."

Jefferies has set a price target of Rs 855 for Piramal.

Key upsides include better-than-expected loan growth, led by stronger ramp-up in retail loans, better recoveries, and better-than-expected asset quality, the brokerage said.

It has a price target of Rs 760 for IIFL Finance. Downside risks for the stock include slowdown in core segments, higher-than-expected margin pressure, regulatory changes relating to microfinance and co-lending, and deterioration in asset quality and potential haircuts to investments in AIF/ ARCs, Jefferies said.

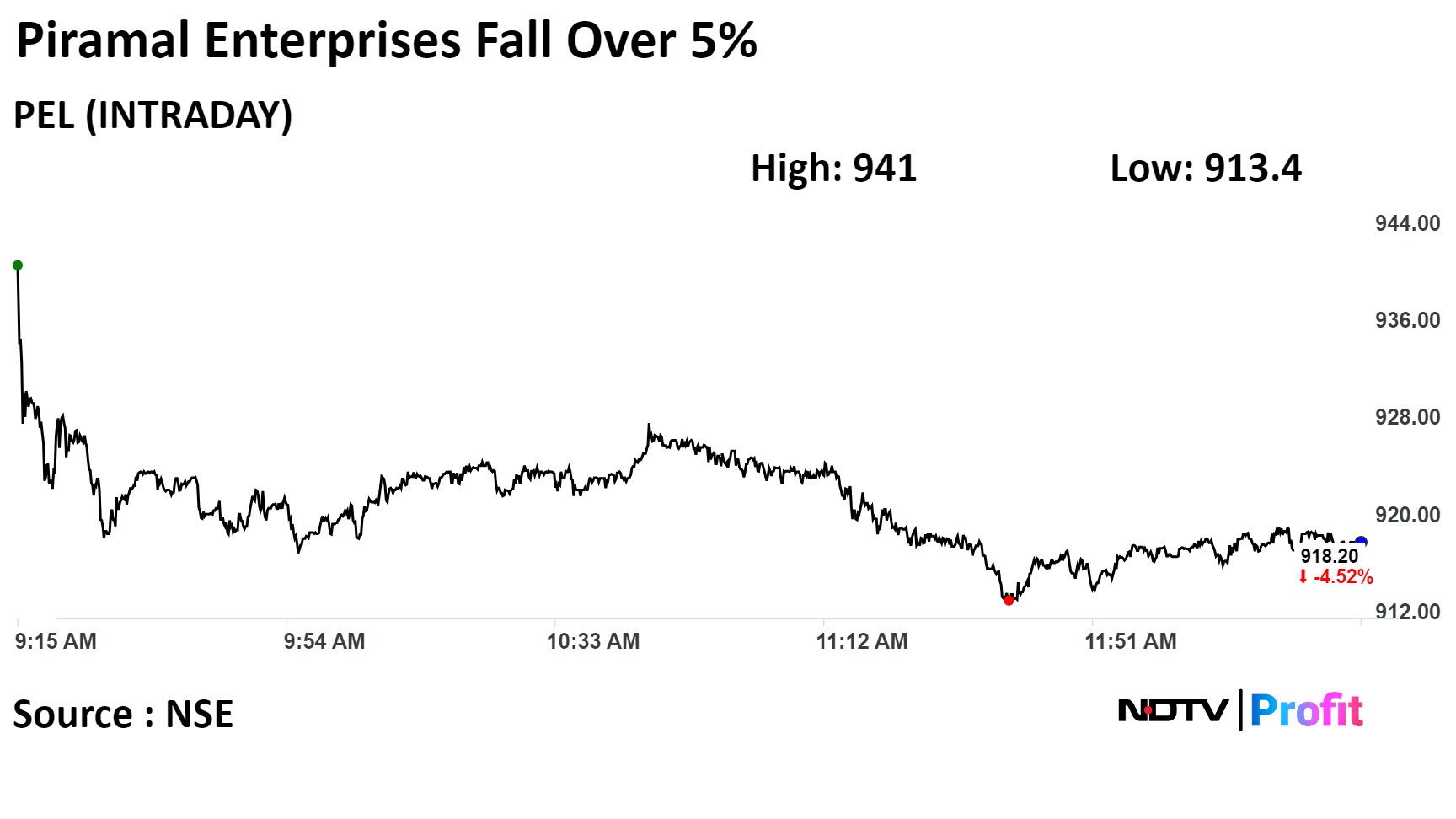

Shares of Piramal Enterprises fell as much as 5.14% before paring loss to trade 4.54% lower at 12:34 p.m. This compares to a 0.45% advance in the NSE Nifty 50.

The stock has risen 10.8% year-to-date. Total traded volume so far in the day stood at 5.2 times its 30-day average. The relative strength index was at 43.8.

Of the 10 analysts tracking the company, seven maintain a 'buy' rating and three suggest a 'sell', according to Bloomberg data. The average 12-month consensus price target implies an upside of 12%.

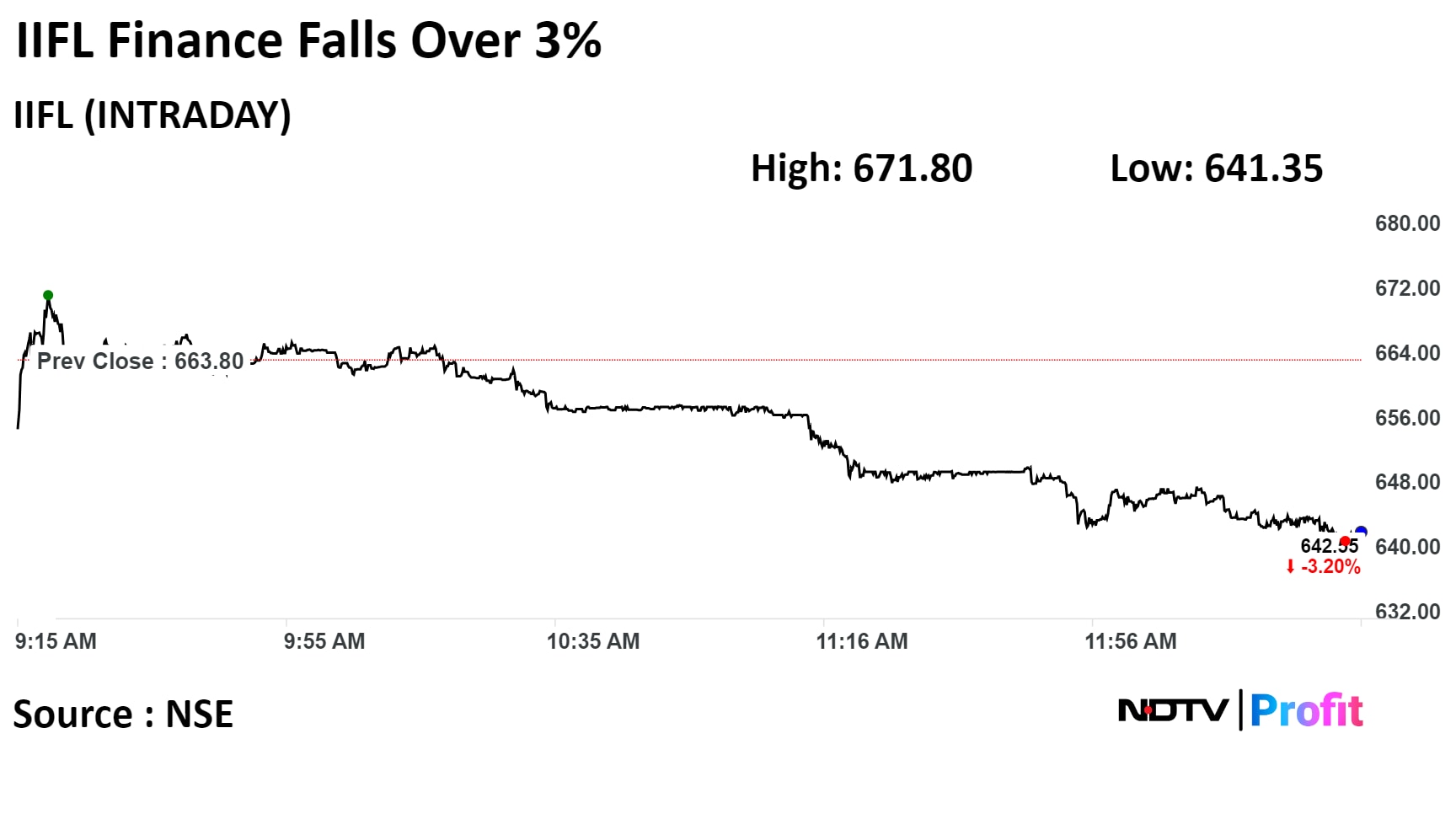

Shares of IIFL declined 3.7%, before paring some loss to trade 3.68% lower at 12:42 p.m. compared to a 0.45% advance in the NSE Nifty 50.

The stock has risen 33% year-to-date. The total traded volume so far in the day stood at 1.7 times its 30-day average. The relative strength index was at 52.82.

All six analysts tracking the company maintain a 'buy' rating, according to Bloomberg data. The average 12-month consensus price target implies an upside of 23%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.