Shares of Hindalco Industries Ltd. rose over 5% after its wholly owned American subsidiary, Novelis Inc., filed confidentially for an initial public offering with the U.S. Securities and Exchange Commission.

Novelis has submitted a draft registration statement on Form F-1 with the SEC relating to the proposed IPO of its common shares, the company said in a news release on Tuesday.

The proceeds from the issue will go to the flagship company of the Aditya Birla Group, and Novelis will not receive any proceeds from the sale of common shares.

Hindalco acquired Novelis in 2007 in a $6 billion all-cash transaction, including debt.

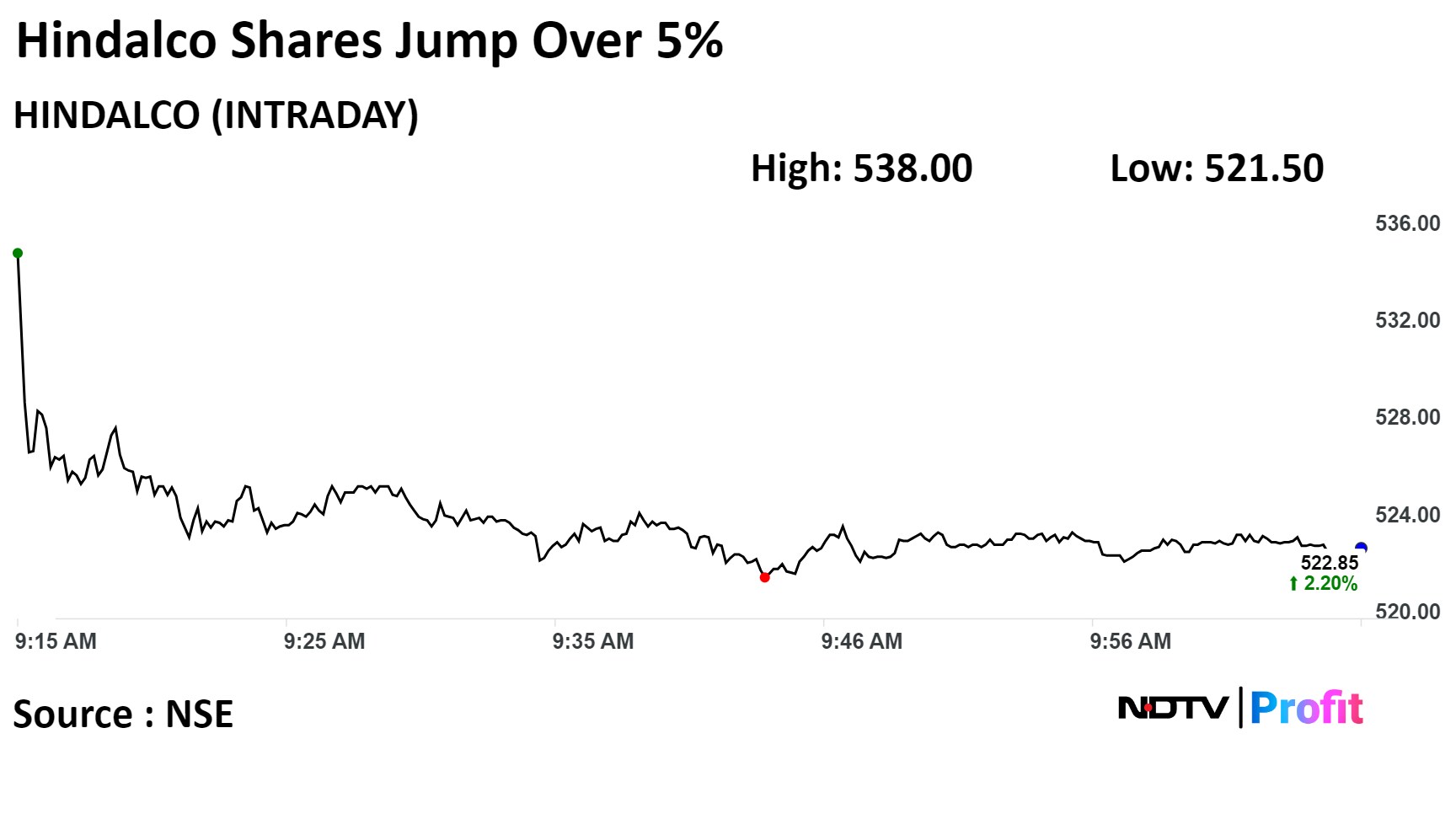

Hindalco's stock rose as much as 5.16% during the day to Rs 538 apiece on the NSE. It was trading 2.47% higher at Rs 524.25 apiece, compared to a 0.01% advance in the benchmark Nifty 50 as of 09:33 a.m.

It has risen 21.49% in the last 12 months. The total traded volume so far in the day stood at 8.1 times its 30-day average. The relative strength index was at 39.3.

Twenty-one out of the 25 analysts tracking Hindalco have a 'buy' rating on the stock, one analyst recommends a 'hold' and three suggest a 'sell', according to Bloomberg data. The average of 12-month analyst price targets implies a potential upside of 9.1%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.