HDFC Bank Ltd. shares extended their fall to the second consecutive session to record their worst fall since the market rout of June 4. The decline followed analysts' comments pointing to a weak June quarter after its business update.

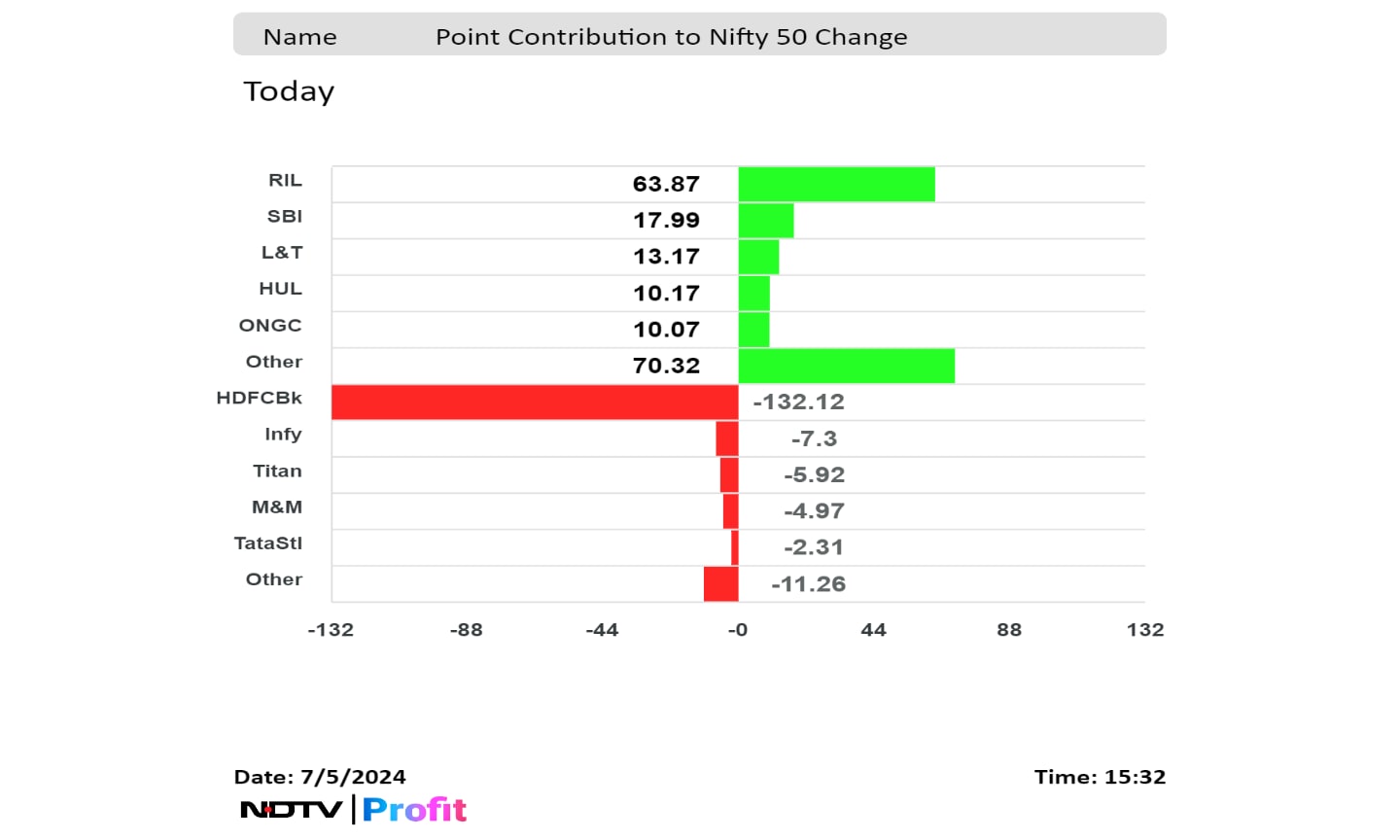

The stock dropped 4.58% in its two-day fall. It has fallen 3.35% this week, snapping a seven-week rally. The heavyweight weighed the Nifty by 132.48 points on Friday.

Brokerages believe that the bank's performance will be below its private peers given the current valuations after the lender reported a "slightly disappointing" business update for the first quarter of fiscal 2025.

HDFC Bank's June quarter gross advances declined 0.8% sequentially to Rs 24.87 lakh crore and the lender's deposit growth remained flat at Rs 2.37 lakh crore on a quarterly basis during the reporting quarter.

The lender's deposits were flat sequentially and below the Rs 29,700 crore mobilised in the first quarter of fiscal 2024, which was slightly disappointing, Jefferies said in a note on July 4. "We await trends in retail and wholesale deposits, which were provided up to 4Q."

The brokerage will look forward to trends in retail deposit, net interest margin, and operational expenditure in the results due on July 20.

The bank faced yet another weak first quarter for deposits and a sharp decline in corporate and wholesale loans, Bernstein said in a note.

In Friday's session, the stock has fallen as much as 4.92% to hit Rs 1,649, its lowest level since June 24. It closed at Rs 1,649.40, down 4.58% compared to 0.09% advance in the Nifty.

.png)

Of the 50 analysts tracking the lender, 45 maintain a 'buy' and five recommend 'hold', according to Bloomberg data. The average of 12-month analysts' price targets implies a return potential of 13.4%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.