Shares of Godrej Properties Ltd. hit a new record high on Monday after the company said it plans to develop land parcels in Pune and Bengaluru with a revenue potential of roughly Rs 3,000 crore.

The company said it is developing nearly 11 acres of land for group housing and high-street retail in Pune's Hinjewadi, according to an exchange filing today. The project has a development potential of approximately 22 lakh square feet and a projected revenue of around Rs 1,800 crore, it said.

The land parcel is located close to the planned Megapolis Metro Station, providing access to major IT hubs in Hinjewadi, Pune, as well as schools, hospitals, shops, restaurants, and upscale hotels.

“This further enhances our presence in Pune and fits within our strategy of strengthening our presence across key micro-markets in India,” said Gaurav Pandey, managing director and chief executive officer at Godrej Properties.

Separately, on Saturday, the company said it has acquired nearly seven acres of land in Thanisandra, North Bengaluru, to construct a high-end residential project with a developable potential of nearly nine lakh square feet and an estimated revenue of Rs 1,200 crore.

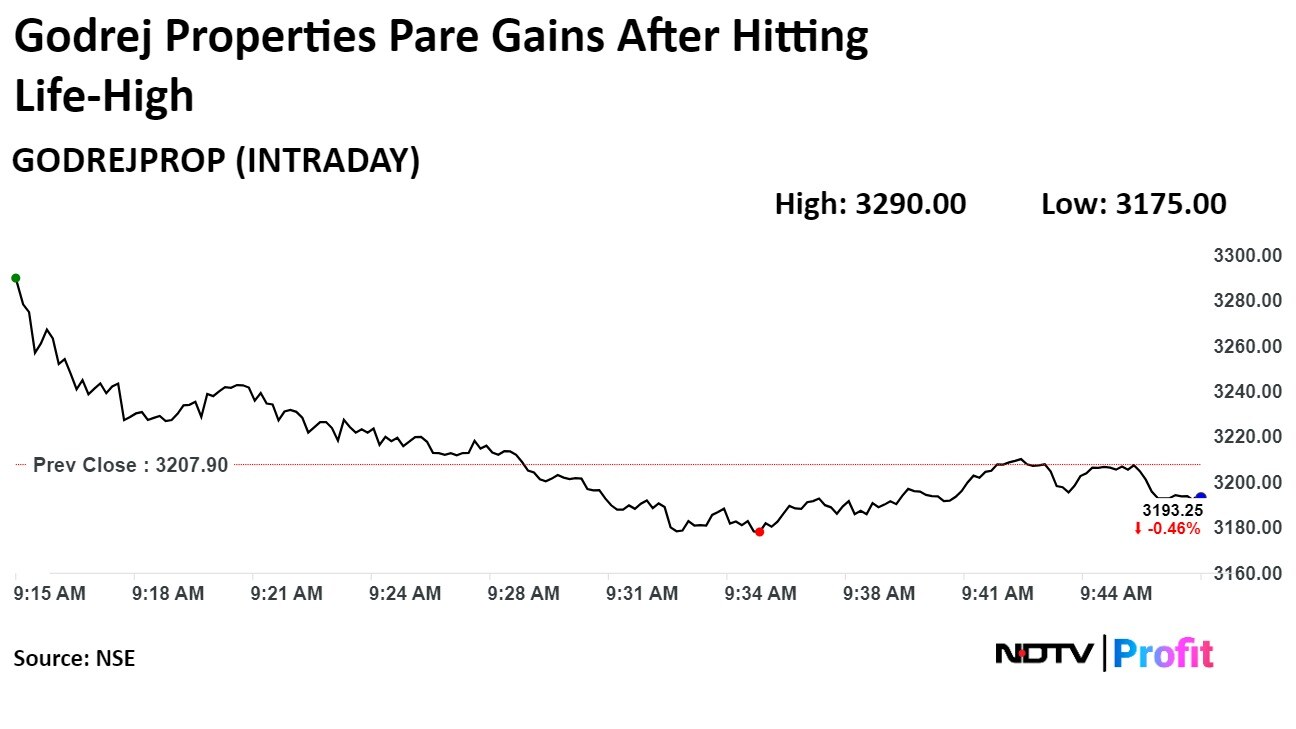

Shares of Godrej Properties rose as much as 2.56% during the day to Rs 3290 apiece on the NSE. It was trading 0.42% lower at Rs 3,194.45 apiece, compared to a 0.24% advance in the benchmark NSE Nifty 50 as of 9:47 a.m.

The stock has risen 101.8% in the last 12 months and 58.26% on a year-to-date basis. The total traded volume so far in the day stood at 2.6 times its 30-day average. The relative strength index was at 64.39.

Thirteen out of the 20 analysts tracking Godrej Properties have a 'buy' rating on the stock, one recommends a 'hold' and six suggest a 'sell', according to Bloomberg data. The average of 12-month analyst price targets implies a potential downside of 14.2%.

Motilal Oswal On Godrej Properties

The brokerage shared a note on Godrej Properties on Thursday.

Maintains a 'buy' rating on the stock and a target price of Rs 3,600 apiece, implying a potential upside of 16% from the previous close.

Pre-sales guidance of Rs 27,000 crore in fiscal 2025 implies 20% growth.

Increases in cash flows and Rs 3,000 in surplus cash to support higher spending.

Remains confident at company meetings or surpasses its launch guidance.

A turnaround in cash flows and profitability is expected to drive stock re-rating.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.