Shares of Godrej Consumer Products Ltd. fell over 5% on Monday as the company's third-quarter consolidated sales in rupee terms registered a "low-single-digit" decline.

The FMCG company's organic domestic business' underlying volume growth was in the mid-single digits and its inorganic business grew in double digits, according to its business update released on Friday.

The company's Indonesia business saw a double-digit growth and high-single-digit constant currency growth, but its Africa, U.S., and Middle East businesses reported a flattish to mild decline in volume growth.

Latin business revenue has been severely impacted on account of the sharp devaluation of the Argentine peso, which has impacted revenue in the past nine months due to hyperinflation. Godrej said this would have a negative impact of mid-single digit on the consolidated sales.

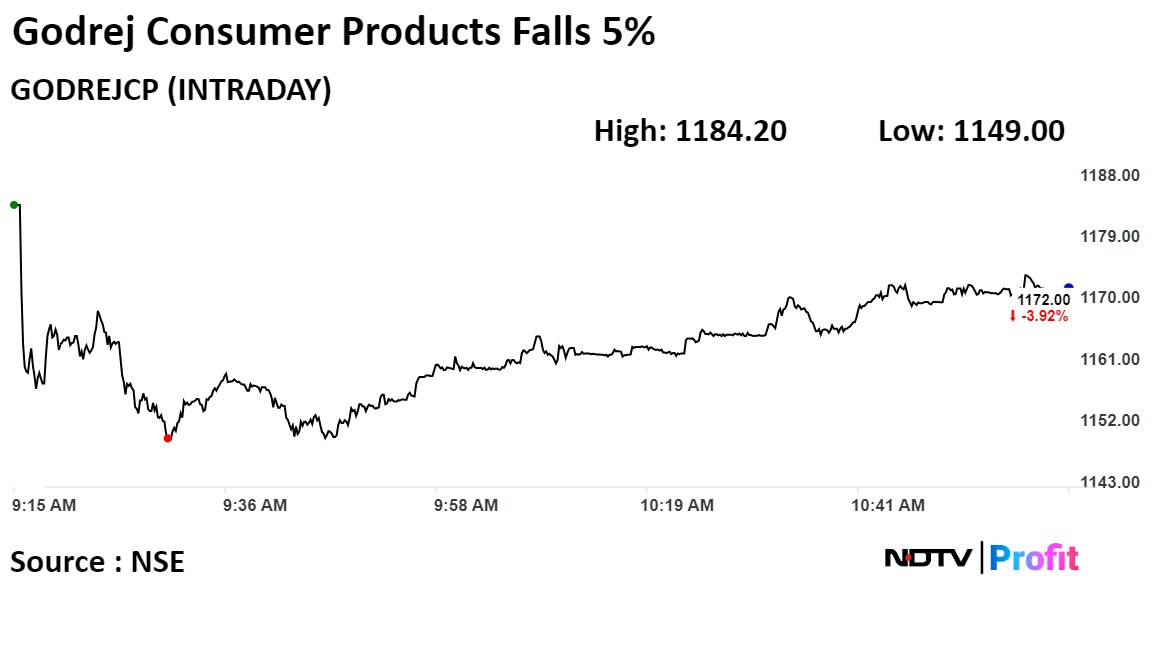

Shares of Godrej Consumer Products fell as much as 5.81% during the day to Rs 1,149 apiece on the NSE. It was trading 4.12% lower at Rs 1,169.60 apiece compared to a 0.43% advance in the benchmark Nifty 50 at 11:15 a.m.

The share price has risen 29% in the last 12 months. The total traded volume so far in the day stood at eight times its 30-day average. The relative strength index was at 68.25.

Twenty-eight out of 37 analysts tracking the company have a 'buy' rating on the stock, seven recommend a 'hold' and two suggest a 'sell', according to Bloomberg data. The average of 12-month analyst price targets implies a potential upside of 28.3%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.