Godrej Consumer Products Ltd.'s share price dropped as much as 1.56% in trade on Tuesday after the company's preliminary business update for the September quarter indicated pressure from rising palm oil costs, impacting margins.

The update indicated that consolidated EBITDA growth would be slower than expected due to tough operating conditions in India, largely driven by inflation in palm oil prices and competitive pressures.

In a statement filed with exchanges, Godrej Consumer outlined management's focus for fiscal year 2025 on achieving high-single-digit underlying volume growth for both its standalone and Indonesia businesses, along with mid-teens consolidated EBITDA growth. While the company remains on track to meet UVG targets, the operating environment in India has affected its ability to meet the EBITDA growth forecast.

"Palm oil costs have risen by high teens since March, and we have decided not to pass on the entire increase to consumers in one step," the company said in the statement.

The company will continue to invest in long-term growth initiatives, such as the rural van program and new category development, which has led to flattish standalone EBITDA growth, the release said.

"Godrej Consumer's Q2 update aligns with Nuvama's preview, with volume growth in India expected to be around 7-8%, despite challenges in deodorants, soaps, and the home insecticides business.

Strong growth in air fresheners, hair colour, and liquid detergents helped balance the overall performance," said Abneesh Roy, executive director at Nuvama Institutional Equities.

The brokerage has a 'buy' rating on the stock and a target price of Rs 1,323 and is awaiting quarterly earnings results for further clarity on the portfolio's performance.

Roy also highlighted that Dabur's weak Q2 performance appeared to be an anomaly, with Godrej, Marico Ltd., and Adani Wilmar Ltd. reporting positive updates. He expects Dabur to return to growth in the next quarter.

Despite the pressures on margins, Godrej Consumer has taken a strategic decision to absorb some input cost increases while also investing in future growth initiatives.

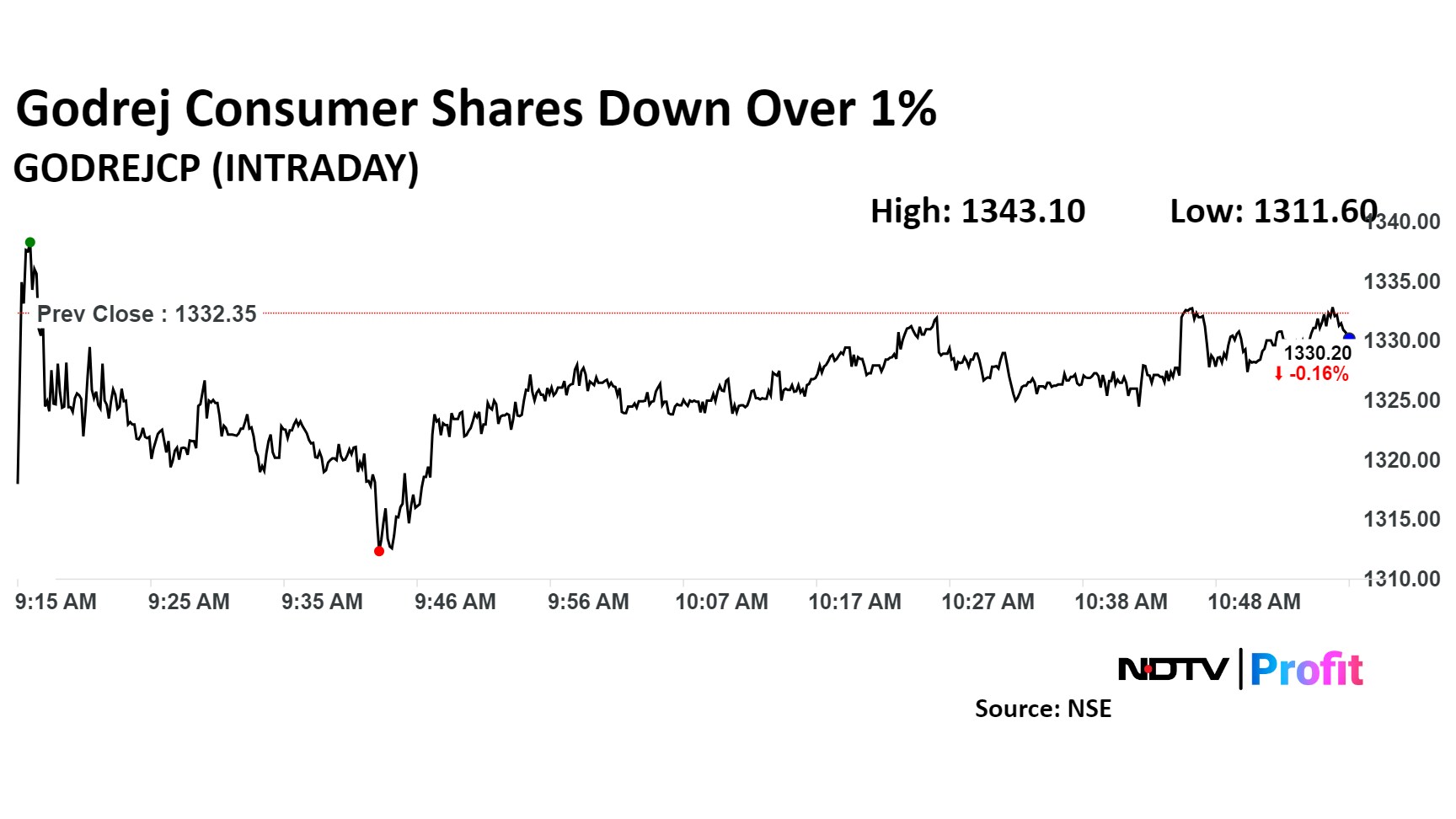

Godrej Consumer Share Price Today

Godrej Consumer stock fell as much as 1.56% during the day to Rs 1,311.60 apiece on the NSE. It was trading 0.24% lower at Rs 1,329.20 apiece, compared to a 0.40% advance in the benchmark Nifty 50 as of 10:59 a.m.

It has risen 37.27% in the last 12 months and 17.71% on a year-to-date basis. The total traded volume so far in the day stood at 2.0 times its 30-day average. The relative strength index was at 28.

Twenty six out of the 35 analysts tracking Godrej Consumer have a 'buy' rating on the stock, six recommend a 'hold' and three suggest a 'sell', according to Bloomberg data. The average of 12-month analyst price targets implies a potential upside of 15.9%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.