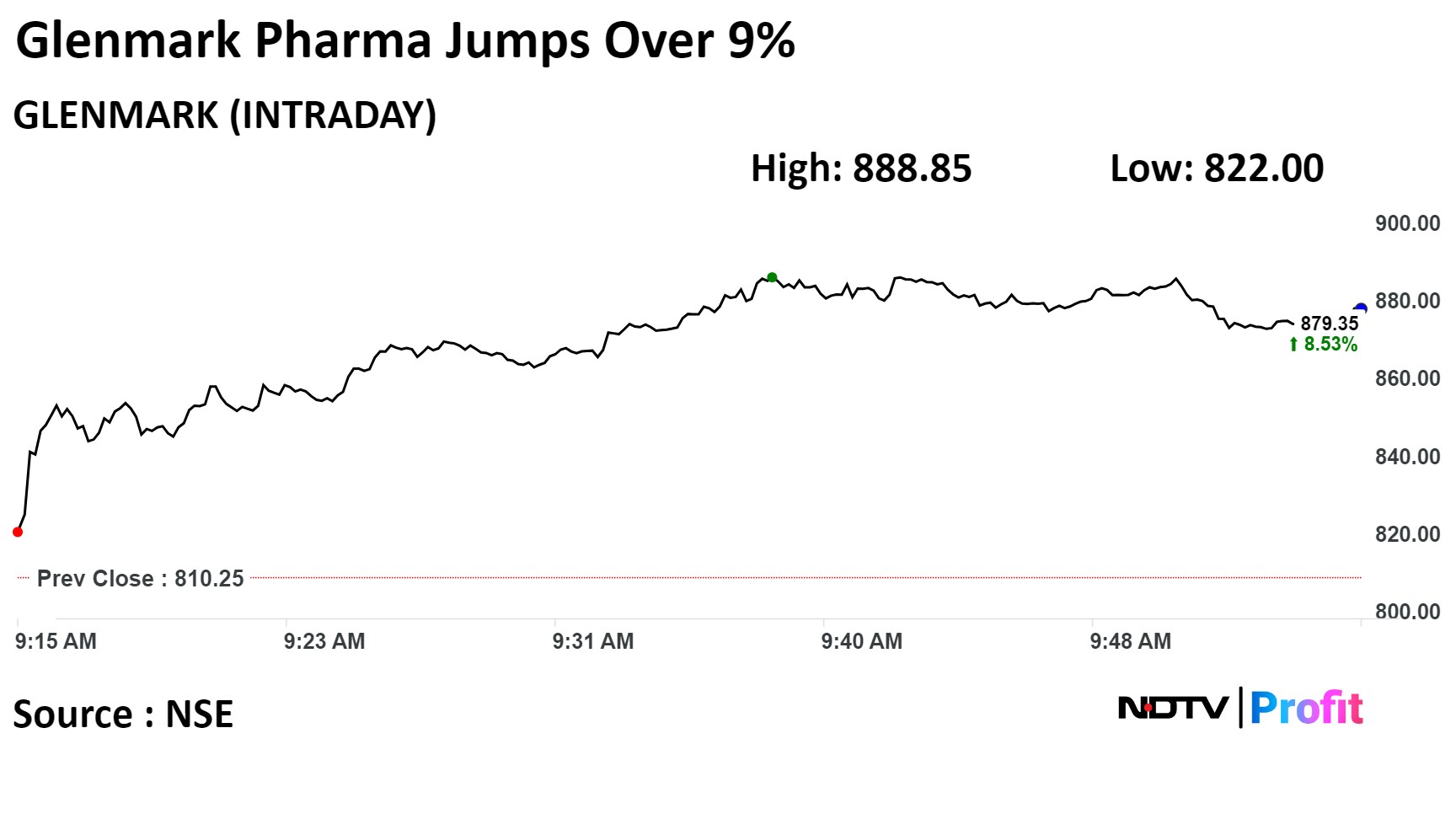

Shares of Glenmark Pharmaceuticals Ltd. jumped over 9% on Friday, extending gains for the second consecutive session as it presented a positive outlook even after posting a net loss in the third quarter.

"The lower sales in the current quarter are mainly on account of a one‐time impact on the company's India business," the bulk and generic drugmaker had said in an exchange filing on Wednesday evening.

In the quarter, Glenmark implemented changes in its overall distribution model of its India business through consolidation of stock points and rationalisation of channel inventories. This led to a temporary dip in sales for the India business, it said in its investor's call.

Glenmark Pharma Q3 FY24 Earnings Highlights (YoY)

Revenue fell 19% to Rs 2,507 crore (Bloomberg estimate: Rs 3,464 crore).

Operating loss of Rs 209 crore vs operating profit of Rs 474 crore (Bloomberg estimate: Rs 578 crore).

Net loss of Rs 331 crore vs net profit of Rs 291 crore

Glenmark expects commercialised injectable products and launches to positively impact the US business in the fourth quarter. The India business is also expected to normalise in the March quarter with a sales run rate of Rs 1,000 crore per quarter.

The company expects a better working-capital cycle in the last quarter. Annual growth in its India business is expected to be 10–12% over the last financial year.

In the next fiscal, the margin will be better and an addition of $30–35 million to the bottom line can be expected due to lower research & development costs, according to Glenmark.

On the NSE, Glenmark's stock rose as much as 9.7% during the day to Rs 888.85 apiece, the highest since Feb. 7. It was trading 7.38% higher at Rs 870.05 per share, compared to a 0.57% advance in the benchmark Nifty 50 at 11 a.m.

The share price has risen 101.45% in the last 12 months. The total traded volume so far in the day stood at 11 times its 30-day average. The relative strength index was at 55.35.

Out of 15 analysts tracking the company, four have a 'buy' rating on the stock, eight recommend 'hold' and three suggest 'sell', according to Bloomberg data. The average of 12-month analyst price targets implies a potential downside of 5.3%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.