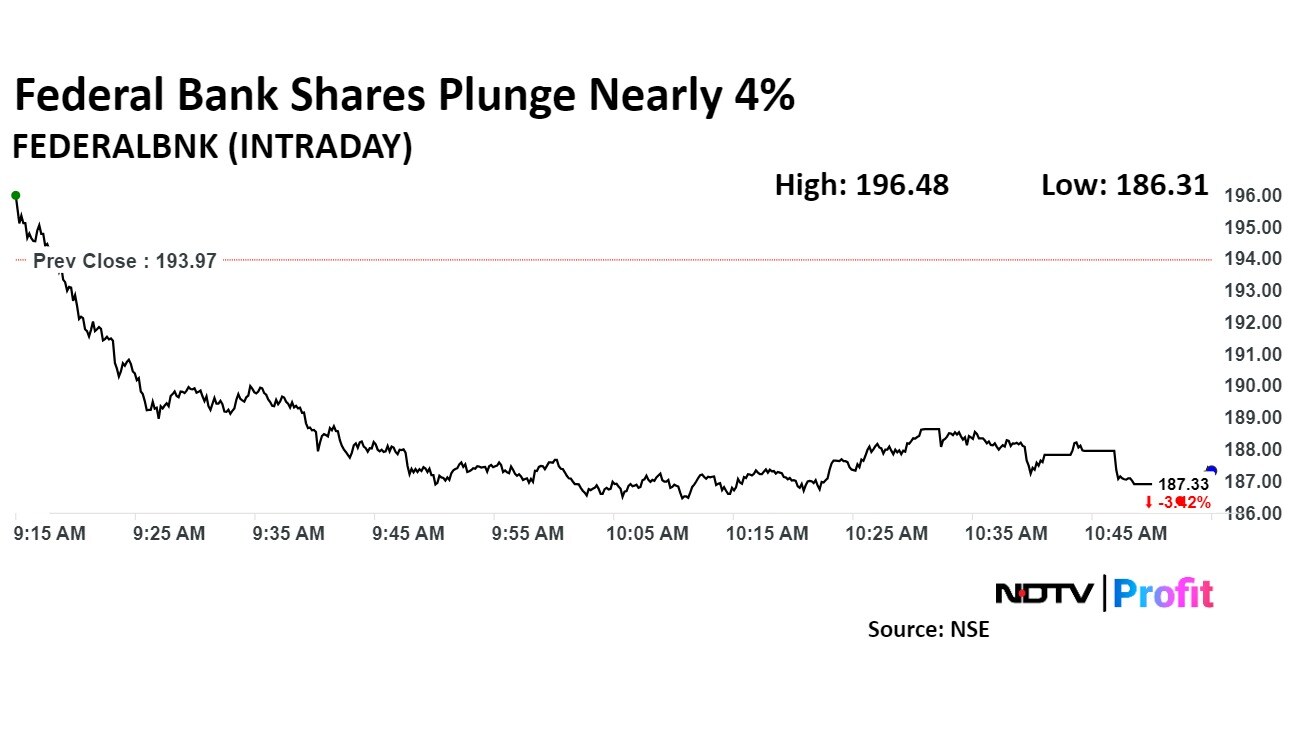

Federal Bank share price fell nearly 4% on Monday after the private lender released its provisional Q2 updates and Morgan Stanley assigned an 'underweight' rating to the stock.

On Friday, Federal Bank reported that its total deposits rose by 15.6% year-on-year to Rs 2.69 lakh crore as of Sept. 30, compared to Rs 2.32 lakh crore in the year-ago period. Customer deposits, which constitute the majority of total deposits, increased by 16% to Rs 2.53 lakh crore.

The lender's gross advances also saw a growth, jumping 19.3% YoY to Rs 2.34 lakh crore in the second quarter. However, the CASA ratio—a measure of low-cost deposits—declined by 110 basis points to 30.07% from 31.17% a year earlier, indicating a potential increase in reliance on higher-cost funding.

Following the business update, Morgan Stanley reiterated an 'underweight' rating on Federal Bank with a target price of Rs 185, implying a downside from the current level. The brokerage highlighted concerns about the bank's liquidity coverage ratio for the quarter, which moderated to 113% in the previous quarter from 128% earlier, as well as slower retail deposit growth.

The brokerage noted potential upside risks including a sharp improvement in deposit growth, a focus by the new CEO on driving the loan mix towards higher-margin loans, and better-than-expected operating leverage.

Downside risks included a sharp slowdown in economic growth impacting loan growth, higher-than-expected asset quality challenges, and a greater impact of ECL and LCR guidelines.

Nomura noted that Federal Bank has shown strong loan growth but soft quarter-on-quarter deposit growth in Q2, and has a 'buy' rating on the stock with a target price of Rs 240, implying a potential upside of 23.71%.

Federal Bank's share price fell as much as 3.80% on Monday to Rs 186.31 apiece on the National Stock Exchange. As of 10:47 a.m., the stock was trading 3.35% lower at Rs 187.08, compared to a 0.36% decline in the benchmark Nifty 50.

The stock has gained 29.87% in the last 12 months and 20.37% on a year-to-date basis. The total traded volume so far was 2.9 times its 30-day average, and the relative strength index stood at 43.50.

Out of the 44 analysts tracking Federal Bank, 36 have a 'buy' rating, six recommend a 'hold', and two suggest a 'sell', according to Bloomberg data. The average 12-month target price implies a potential upside of 19.1%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.