Shares of Dr Reddy's Laboratories Ltd. fell on Friday after the pharma major was named as a defendant in a complaint in the U.S. District Court for New Jersey.

The Hyderabad-based company along with its U.S. subsidiary were named as defendants in a complaint filed by Walgreen Co., Kroger Specialty Pharmacy, and CVS Pharmacy, it said in an exchange filing.

The complaint asserts claims under federal antitrust law alleging that Dr. Reddy's, acting in connection with Celgene Corp., Bristol-Myers Squibb Co., Natco Pharma Ltd., and Teva Pharmaceuticals USA Inc., improperly restrained competition and maintained a shared monopoly in the sale of brand and generic 'Revlimid' through their respective settlements of patent litigation.

The complaint seeks damages for purported overpayments and equitable relief, according to the filing. The court has consolidated a lawsuit with several other lawsuits making similar allegations against the company.

The company said that it believes that the allegations against it lack merit and will vigorously defend the litigation.

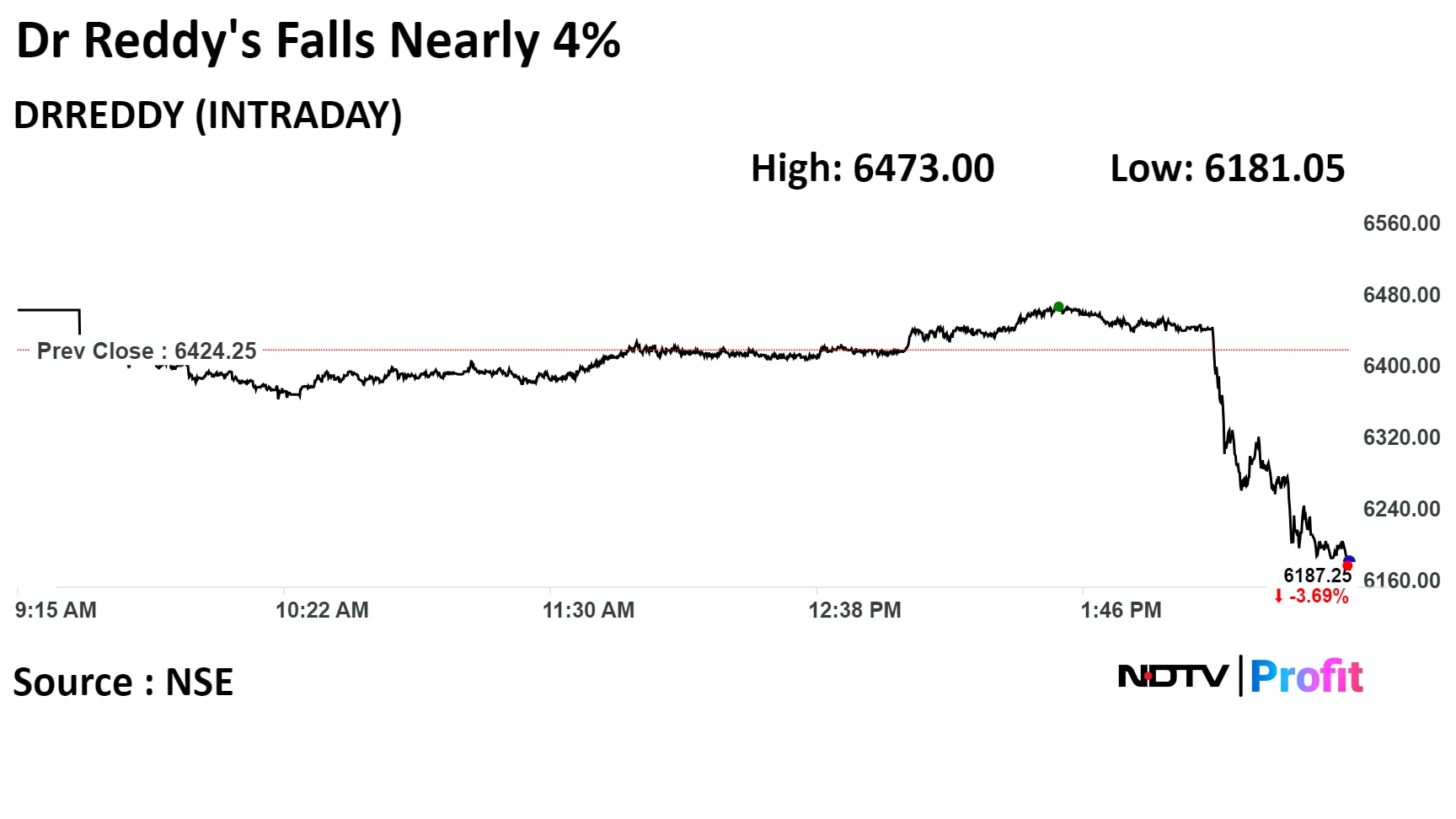

Shares of the company fell as much as 3.8% to Rs 6,180 apiece, the lowest level since Feb. 14. It pared losses to trade 3.5% lower at Rs 6,200 apiece as of 2:57 p.m. This compares to a 1.6% advance in the NSE Nifty 50 Index.

It has risen 34.38% in the last twelve months. Total traded volume so far in the day stood at 0.98 times its 30-day average. The relative strength index was at 49.75.

Out of 42 analysts tracking the company, 17 maintain a 'buy' rating, 11 recommend a 'hold,' and 14 suggest a 'sell,' according to Bloomberg data. The average 12-month consensus price target implies a downside of 5.1%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.