Shares of Britannia Industries Ltd. jumped to their highest level in three months on Monday after it said it was aiming to capture double-digit volume growth in the second half of the ongoing financial year.

"Route-to-market 2.0 pilot is planned in the second half of FY25. With route-to-market 2.0, Britannia is looking to multiply adjacent business revenues," said Varun Berry, executive vice chairman and managing director, in the earnings' conference call.

The company also plans to grow its adjacency business by 1.5 times in the core biscuit category. It's not looking to launch any new categories this year but to build the existing ones, Berry said.

The popular Jim Jam makers' revenue rose marginally in January–March, while its Ebitda, and net profit declined. However, its volumes grew two times more than the revenue growth during the quarter.

Britannia Industries Q4 Earnings Highlights (Consolidated, YoY)

Revenue up 1.14% at Rs 4,069 crore. (Bloomberg estimate: Rs 4,109 crore).

Ebitda down 1.67% at Rs 787 crore. (Bloomberg estimate: Rs 782 crore).

Margin down 55 bps at 19.35%. (Bloomberg estimate: 19%).

Net profit down 3.76% at Rs 537 crore. (Bloomberg estimate: Rs 542 crore).

Recommended final dividend of Rs 73.5 per share.

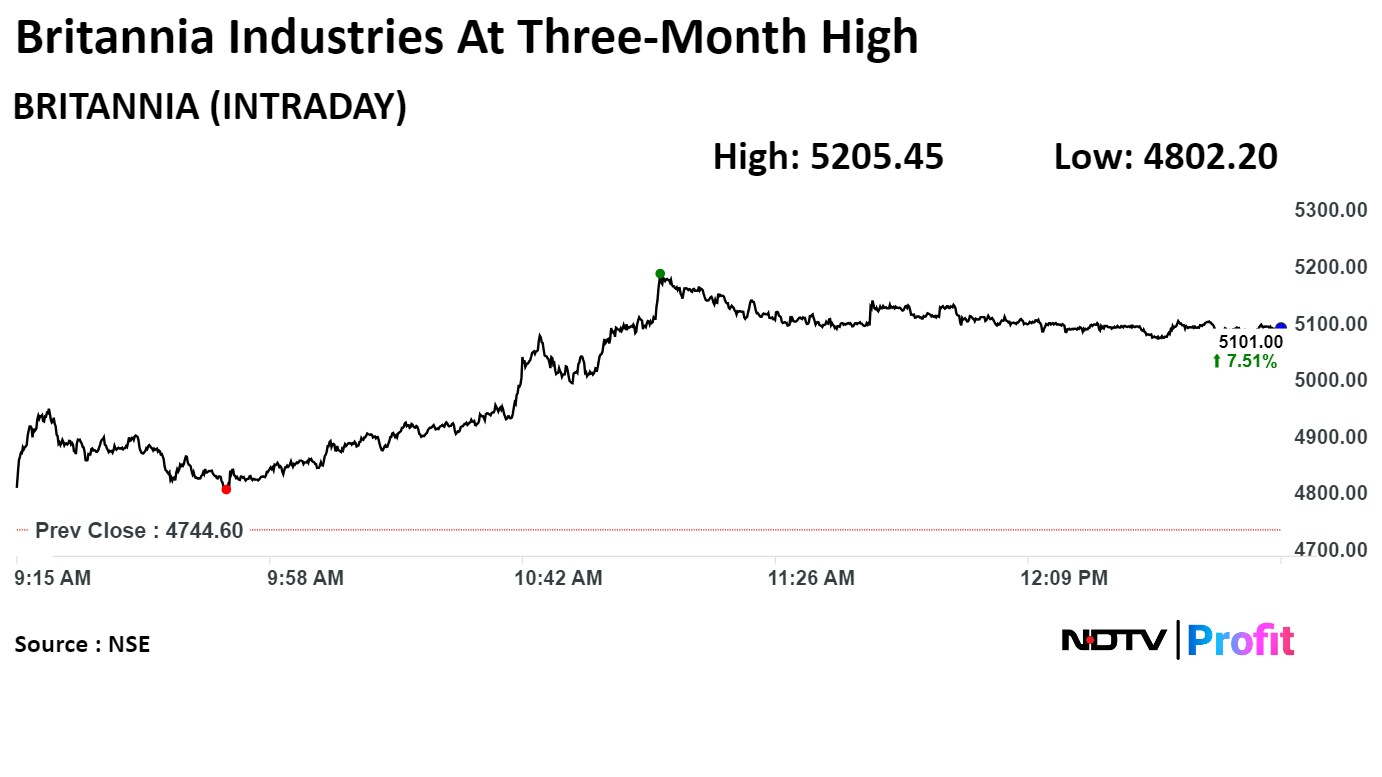

Shares of Britannia Industries rose as much as 9.71% to Rs 5,205.45, the highest level since Feb 5. It was trading 7.49% higher at Rs 5,100 as of 12:54 p.m., compared to 0.05% decline the NSE Nifty 50 index.

The stock gained 10.91% in last 12 months but declined 4.29% on year-to-date basis. The total traded volume so far in the day stood at 12 times its 30-day average. The relative strength index was at 69.62.

Out of 41 analysts tracking the company, 21 maintain a 'buy' rating, 13 recommend a 'hold,' and seven suggest a 'sell', according to Bloomberg data. The average 12-month consensus price target implies an upside of 3.4%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.