Shares of Brigade Enterprises Ltd. jumped to a record high on Tuesday after it signed an agreement with the Tamil Nadu government to invest more than Rs 3,400 crore to set up residential and commercial buildings.

"The company signed two MoUs, one with the Chennai Metropolitan Development Authority and the other with ELCOT, Information Technology and Digital Services Department, Government of Tamil Nadu," an exchange filing by the company said.

The MoU with Chennai Metropolitan Development Authority is for Chennai expansion and setting up two high-rise residential buildings in the IT belt of Sholinganallur, with an investment of over Rs 2,000 crore.

The second MoU is with ELCOT and IT&DS, which entails an investment of around Rs 1,400 crore for high-rise commercial and residential developments across different micro-markets, including Mount Road.

"These projects are expected to be completed within the next three-four years," according to the exchange filing.

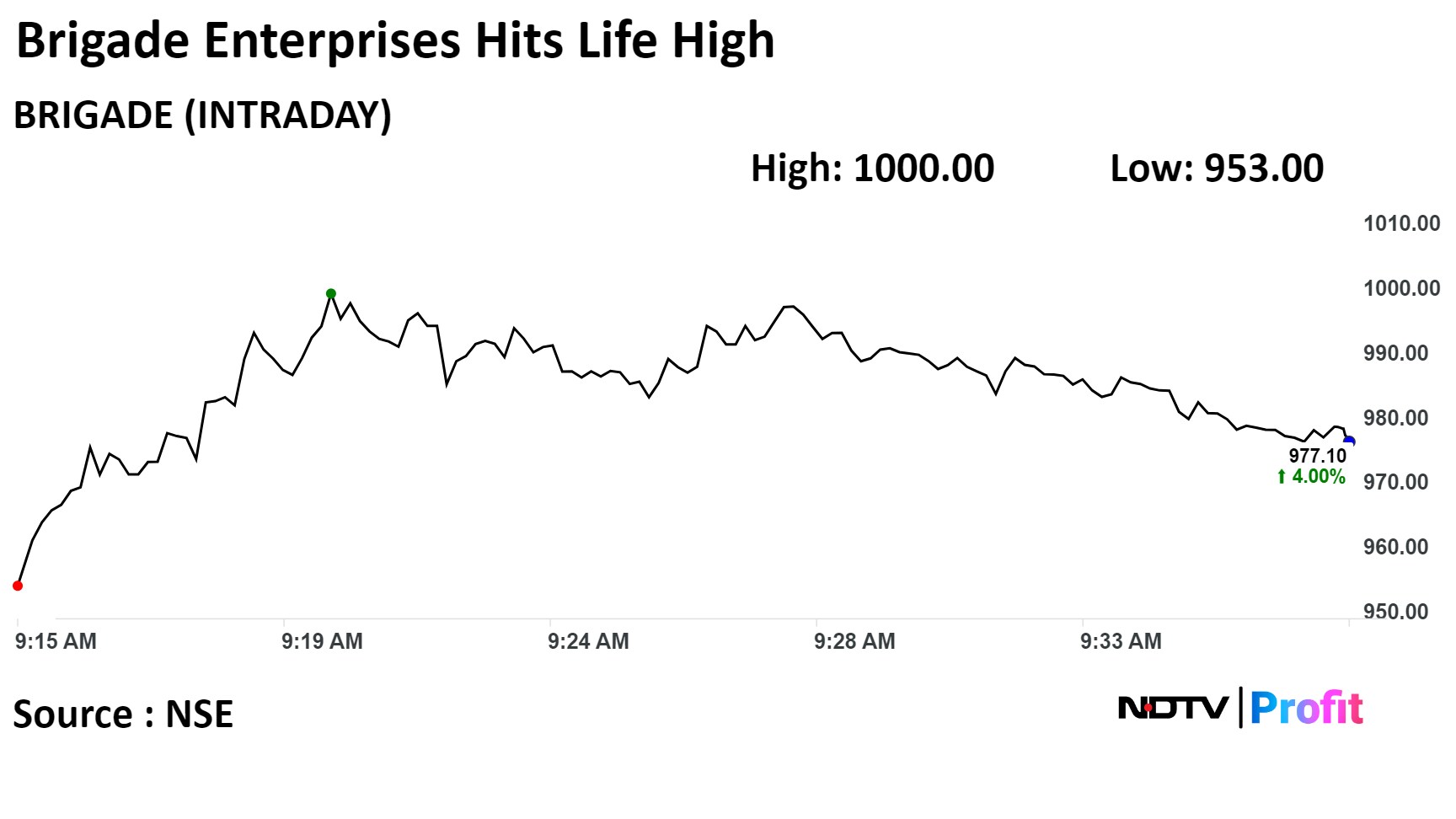

Shares of the company surged 8.07% to hit record high of Rs 1,000 apiece. It pared gains to trade 4% higher at Rs 976.90 apiece as of 09:41 a.m. This compares to a 0.5% advance in the NSE Nifty 50 Index.

It has risen 113.61% in the last 12 months. Total traded volume so far in the day stood at 5.8 times its 30-day average. The relative strength index was at 77.45, indicating that the stock may be overbought.

Out of 15 analysts tracking the company, 14 maintain a 'buy' rating and one suggests a 'sell', according to Bloomberg data. The average 12-month consensus price target implies a downside of 16.3%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.