Shares of Bikaji Foods International Ltd. hit a life high on Friday after Nuvama initiated coverage on the company with a 'buy' rating. The brokerage has a set target price of Rs 885 apiece, implying a potential upside of 23% from the previous close as the company is set to outgrow savoury snack industry growth at a compound average growth rate of 18% over fiscal 2024–2027.

Bikaji Foods' strong presence in core regions shows its ability to retain a loyal customer base, the brokerage said. The savoury snack manufacturer is eyeing untapped potential in Uttar Pradesh, Punjab, Haryana, Delhi, Karnataka, and Telangana.

Nuvama On Bikaji Foods: Key Highlights

Strong presence in core regions shows ability to capture, retain a loyal customer base.

Company eyeing untapped potential in Uttar Pradesh, Punjab, Haryana, Delhi, Karnataka, Telangana.

Expects frozen food revenue to hit Rs 200 crore in next three–four years versus Rs 30–33 crore now.

Company to outgrow savoury snack industry growth at 18% compound annual growth rate over FY24–27.

Expects western snacks sale contribution to grow from 8% to 10–12%.

Growing ethnic snack popularity, consolidation in the unorganised sector to help the company.

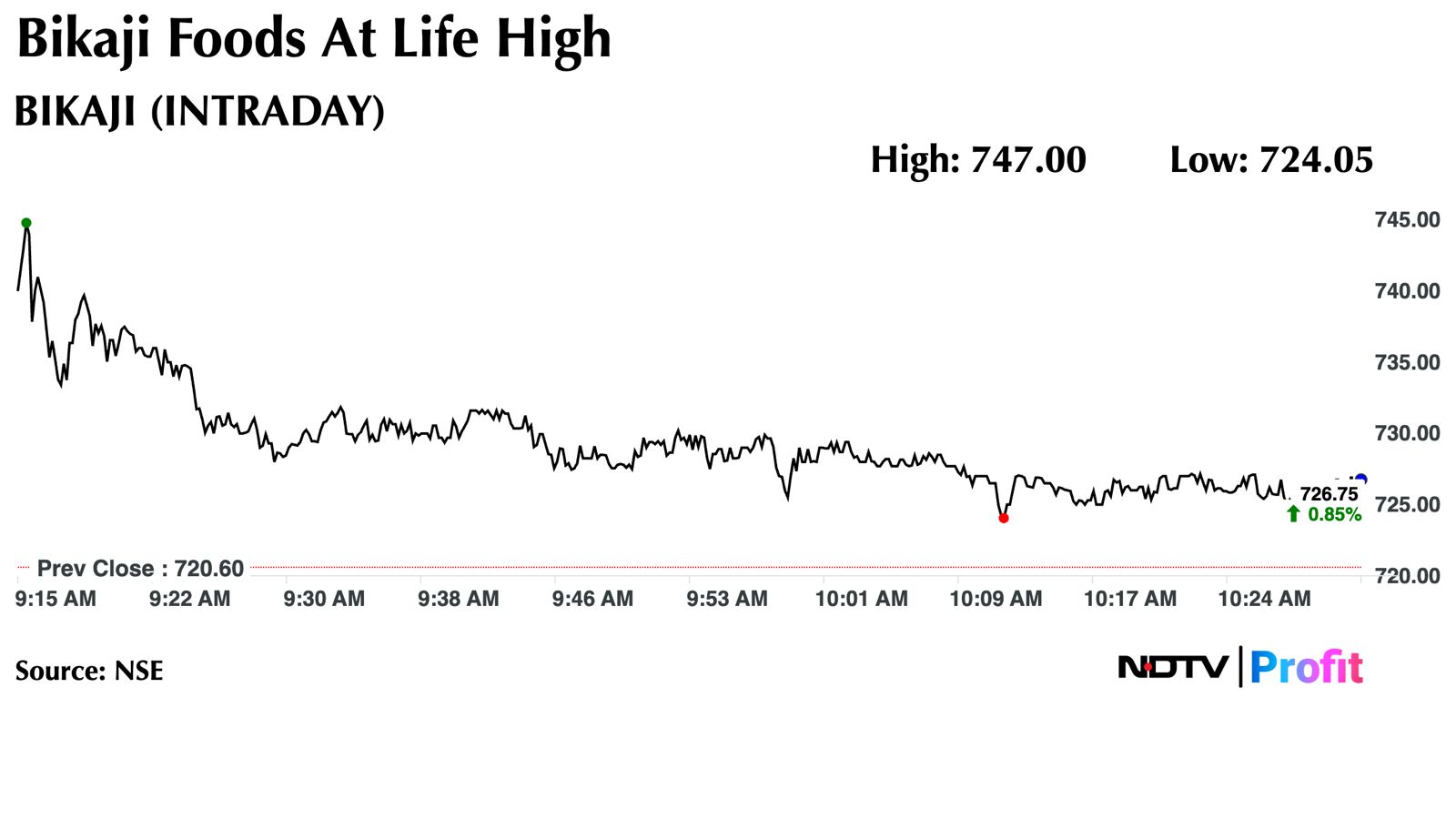

Shares of Bikaji Foods rose as much as 3.66% during the day to Rs 747 apiece on the NSE. It was trading 0.78% higher at Rs 726.20 apiece, compared to a 0.08% advance in the benchmark NSE Nifty 50 as of 10:33 a.m.

The stock has risen 77.95% in the last 12 months. The total traded volume so far in the day stood at 1.6 times its 30-day average. The relative strength index was at 78.21 implying that the stock is overbought.

All six of the analysts tracking Bikaji Foods International recommend a 'buy' rating on the stock, according to Bloomberg data. The average of 12-month analyst price targets implies a potential downside of 5.8%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.