Shares of Bharat Heavy Electricals Ltd. rose over 5% on Monday after it won bids for Talabira power project in Odisha.

The company has emerged as the lowest bidder for Rs 19,000 crore contract from NLC India Ltd.

NLC India on Monday awarded contract for a 800x3 MW ultra super critical power project in Odisha to BHEL, people in know told NDTV Profit.

The coal to be used for the project will be sourced from captive Talabira coal mines.

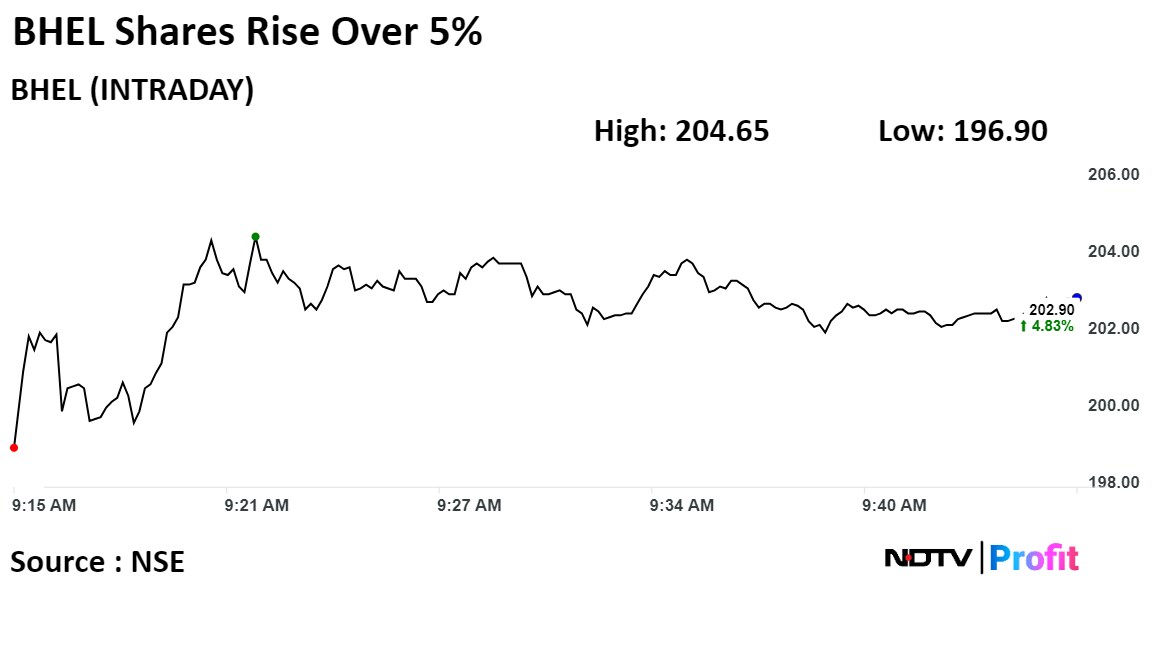

Shares of the company was trading 5.11% higher at Rs 203.45 apiece as of 9:35 a.m. This compares to a 0.14% decline in the NSE Nifty 50.

The stock had surged 5.73% to Rs 204.65 apiece so far today, the highest percentage jump since Dec. 28. It has risen 4.93% on a year-to-date basis. Total traded volume so far in the day stood at 8.6 times its 30-day average. The relative strength index was at 75, indicating the stock may be overbought.

Out of 19 analysts tracking the company, five maintain a 'buy' rating, one recommends a 'hold,' and 13 suggest a 'sell', according to Bloomberg data. The average 12-month consensus price target implies an upside of 157.6%.

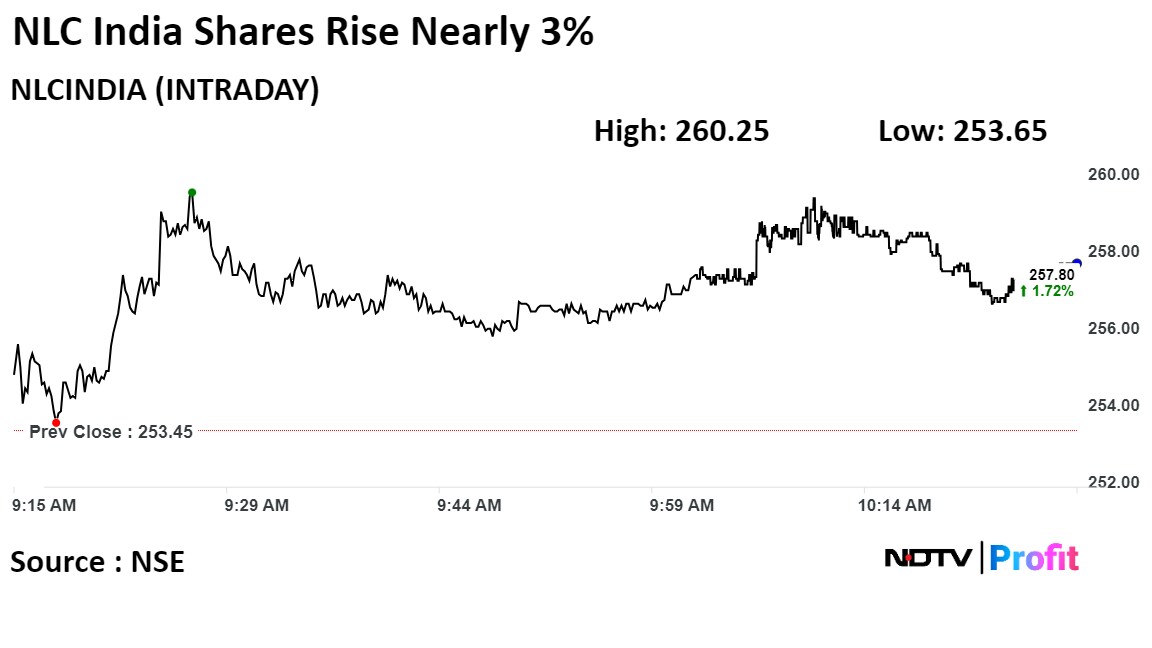

Shares of NLC India Ltd. also rose as much as 2.68% to Rs 260.25 apiece, the highest level since Dec. 27. It pared gains to trade 1.58% higher at Rs 257.45 apiece as of 10:26 a.m. This compares to a 0.10 decline in the NSE Nifty 50 Index.

It has risen 1.66% on a year-to-date basis. Total traded volume so far in the day stood at 0.9 times its 30-day average. The relative strength index was at 83.

The one analysts tracking the company maintains a 'buy' rating, according to Bloomberg data. The average 12-month consensus price target implies an upside of 210.8%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.