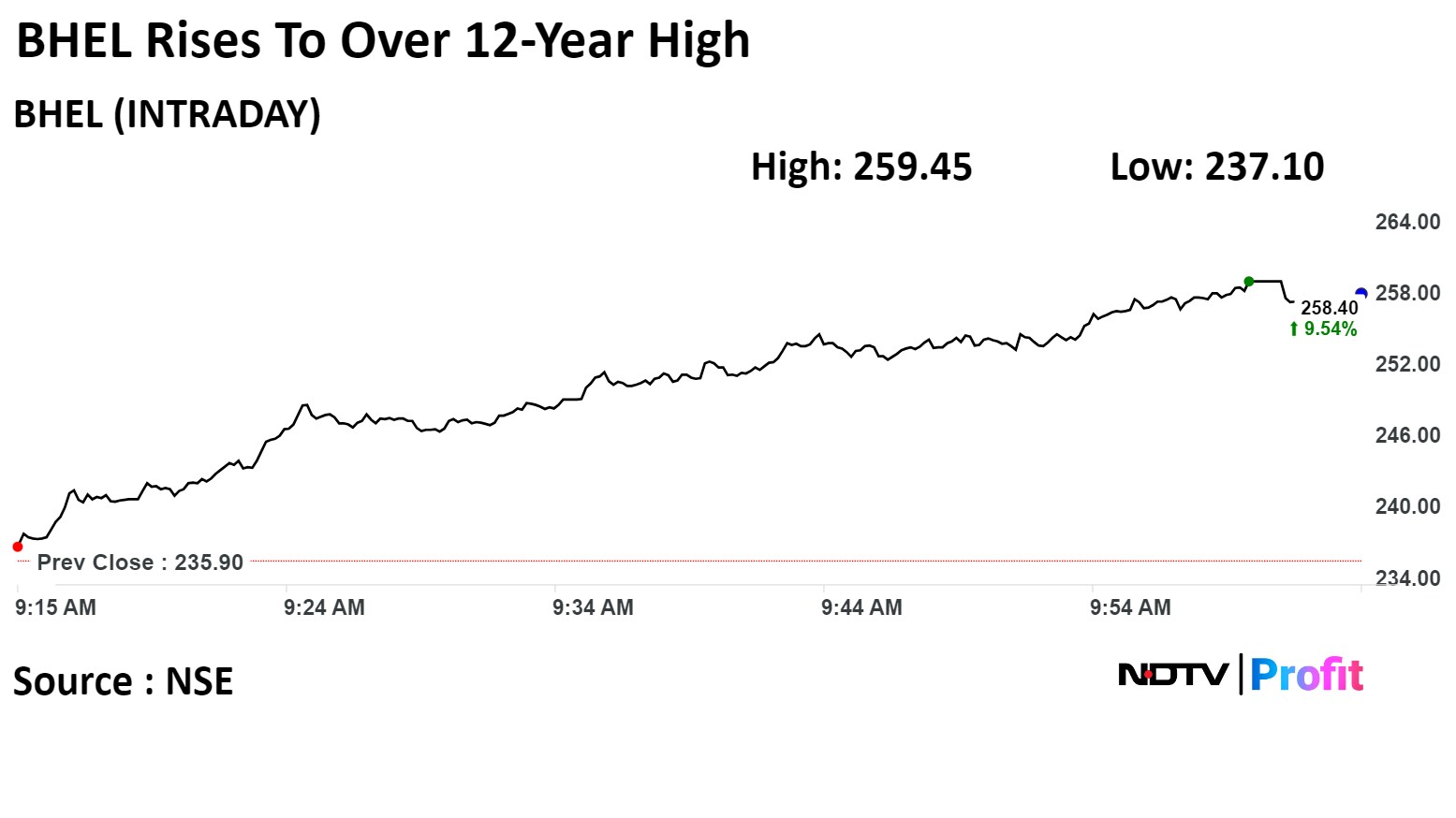

Bharat Heavy Electricals Ltd. surged 14% to its highest in over 12 years on Monday after multiple large trades, adding to its over threefold surge in the past year.

At least 40.7 lakh shares of BHEL, or 0.1% equity, changed hands in three large trades in a price range of Rs 258.65–259.45 apiece, according to Bloomberg. The buyers and sellers were not known immediately.

During the day, BHEL clarified that although it has placed a bid for a NTPC tender on Feb. 21, but it has not received any reply yet. As it is a normal process of business, it didn't require to inform bourses, the company said in an exchange filing.

While the company announced a coal-to-chemicals joint venture with Coal India Ltd. last week, Morgan Stanley retained its price target at Rs 220 apiece, implying near 18% downside from current levels. The stock is trading in line with the brokerage's base case expectations.

The JV will initially set up coal-to-2,000 tonne-per-day ammonium nitrate plant. Coal India will ensure ammonium nitrate offtake of at least 75%.

Shares of BHEL surged 14.01% to Rs 268.95 apiece on the NSE, the highest since July 26, 2011. Earlier, it hit a 10% upper circuit, after which the stock's upper band was revised to 15%. The stock was trading 13.29% higher at Rs 267.25 per share, compared to a 0.14% advance in the benchmark Nifty 50 at 10:53 a.m.

The share price has risen 246% in the last 12 months. The total traded volume so far in the day stood at 5.5 times its 30-day average. The relative strength index was at 73.65, implying that the stock may be overbought.

Of the 19 analysts tracking the company, five have a 'buy' rating on the stock, three recommend 'hold' and 11 suggest 'sell', according to Bloomberg data. The average of 12-month analyst price targets implies a potential upside of 36.2%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.