Shares of Bajaj Finance Ltd. rose on Thursday after its assets under management crossed the Rs 3 lakh crore mark.

The company's AUM for the December quarter surged 35% year-on-year to Rs 3.11 lakh crore, according to an exchange filing. The AUM grew by Rs 20,700 crore in the third quarter.

The deposit book also grew by 35% year-on-year to Rs 58,000 crore in the December quarter. It booked 98.6 lakh new loans in the quarter with a growth of 26% year-on-year. The liquidity surplus in the quarter stood at 11,600 crore.

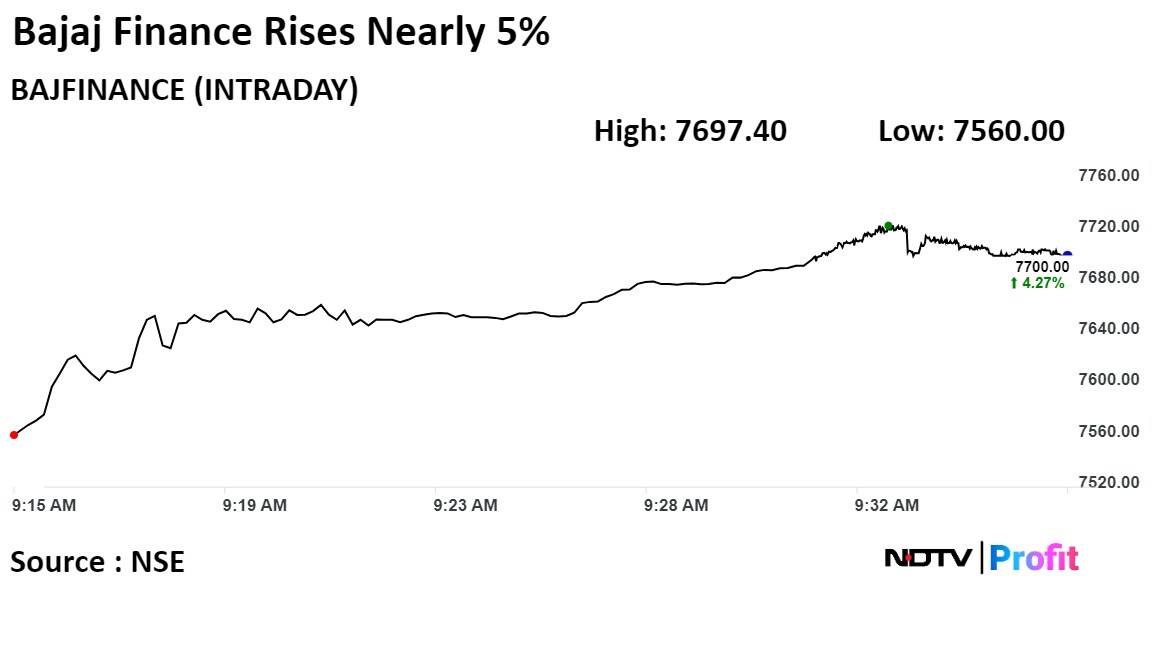

Shares of the company rose 4.59% to 7,723.95 apiece, the highest level since Dec. 20. It was trading 4.45% higher at Rs 7,713 apiece as of 9:35 a.m. This compares to a 0.38 advance in the NSE Nifty 50 Index.

It has risen 16.57% in the past 12 months. Total traded volume so far in the day stood at 6.3 times its 30-day average. The relative strength index was at 63.27.

Out of 35 analysts tracking the company, 27 maintain a 'buy' rating, four recommend a 'hold,' and four suggest a 'sell', according to Bloomberg data. The average 12-month consensus price target implies an upside of 15.5%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.