Shares of Bajaj Auto Ltd. rose nearly 4% to a record high on Thursday after its third-quarter net profit rose 37% year-on-year, beating analysts' estimates.

The company's net profit rose to Rs 2,041.9 crore in the quarter ended December from Rs 1,491.4 crore a year ago, according to an exchange filing. Analysts polled by Bloomberg estimated the net profit at Rs 1,930 crore.

Bajaj Auto Q3 FY24 Earnings Highlights (Standalone, YoY)

Revenue rose 30% to Rs 12,113.5 crore (Bloomberg estimate: Rs 11,777 crore).

Ebitda grew 37% to Rs 2,430 crore (Bloomberg estimate: Rs 2,285 crore).

Operating margin expands 98 basis points to 20.05% versus 19.07% (Bloomberg estimate: 19.4%).

Net profit up 37% at Rs 2,041.9 crore vs Rs 1,491.4 crore (Bloomberg estimate: Rs 1,930 crore).

Jefferies Financial Group Inc. maintains a 'buy' rating for the stock with a target price of Rs 9,000. It likes the two-wheeler maker's rising focus on electrification with a market share of 13% and three-wheelers getting a good reception.

Two-wheelers are poised for strong rebound and it expects a 15% volume compound annual growth rate during financial year 2024–26, according to Jefferies Financial Group Inc.

Morgan Stanley is 'overweight' on the stock and raised the target price to Rs 8,082 from Rs 7,112 earlier, implying a potential upside of 8.35% from the current market price.

Bajaj's portfolio of premium brands are likely to outperform industry growth, pointing out that the recovery in exports would be the next margin tailwind, it said.

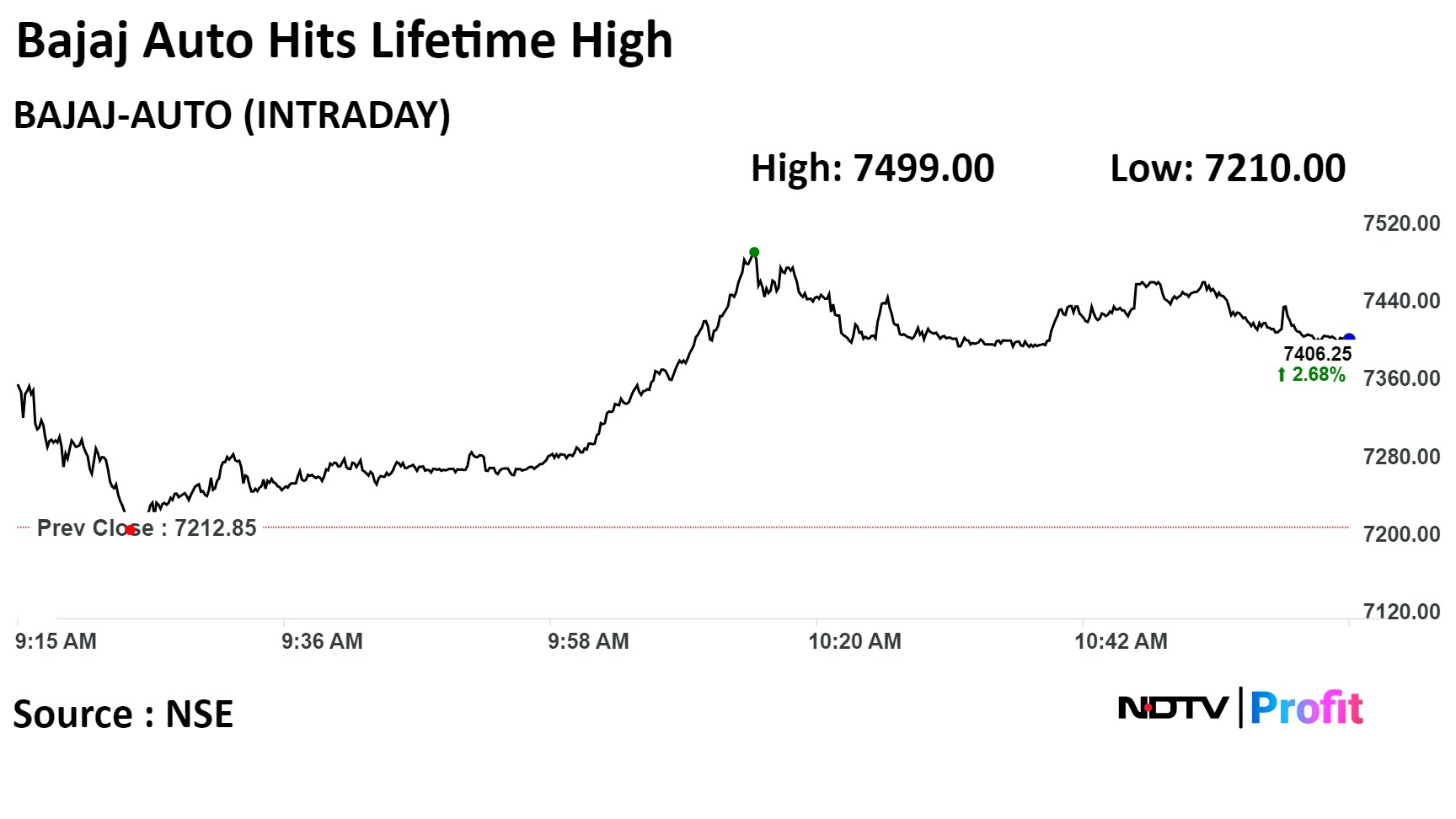

Bajaj's stock rose as much as 3.97% during the day to Rs 7,499 apiece on the NSE. It was trading 3.04% higher at Rs 7,432.00 per share compared to a 0.9% decline in the benchmark Nifty 50 at 11:08 a.m.

The share price has risen 100% in the last 12 months. The total traded volume so far in the day stood at 3.9 times its 30-day average. The relative strength index was at 72.75, indicating that the stock may be overbought.

Twenty-four out of 46 analysts tracking the company have a 'buy' rating on the stock, 12 recommend a 'hold' and 10 suggest a 'sell', according to Bloomberg data. The average of 12-month analyst price targets implies a potential downside of 4.7%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.