Shares of Axis Bank Ltd. fell over 6% on Tuesday after its profit rose 3.7% in the third quarter amid a compression in net interest margin.

The private lender's net profit rose 3.7% year-on-year to Rs Rs 6,071 crore in the quarter ended December, according to an exchange filing. That compares with Rs 6,117 crore estimated by analysts in a Bloomberg's survey.

The bank reported a net interest margin of 4.01% in Q3, a 10 basis point compression from the previous quarter.

The capital adequacy ratio took a hit of 168 basis points on a sequential basis, falling to 14.88% as on Dec. 31. The dip is due to the increase in risk weights for unsecured consumer loans by the Reserve Bank of India in November. Higher risk weights typically lead to a fall in capital adequacy as the bank has to set aside additional capital against such loans.

Axis Bank Q3 Result Key Highlights

Net interest income up 9.45 at Rs 12,532 crore. (YoY)

Net profit up 3.7% at Rs 6,071.1 crore. (Bloomberg estimate: Rs 6,117 crore). (YoY)

Gross NPA at 1.58% vs 1.73% (QoQ).

Net NPA at 0.36% vs 0.36% (QoQ).

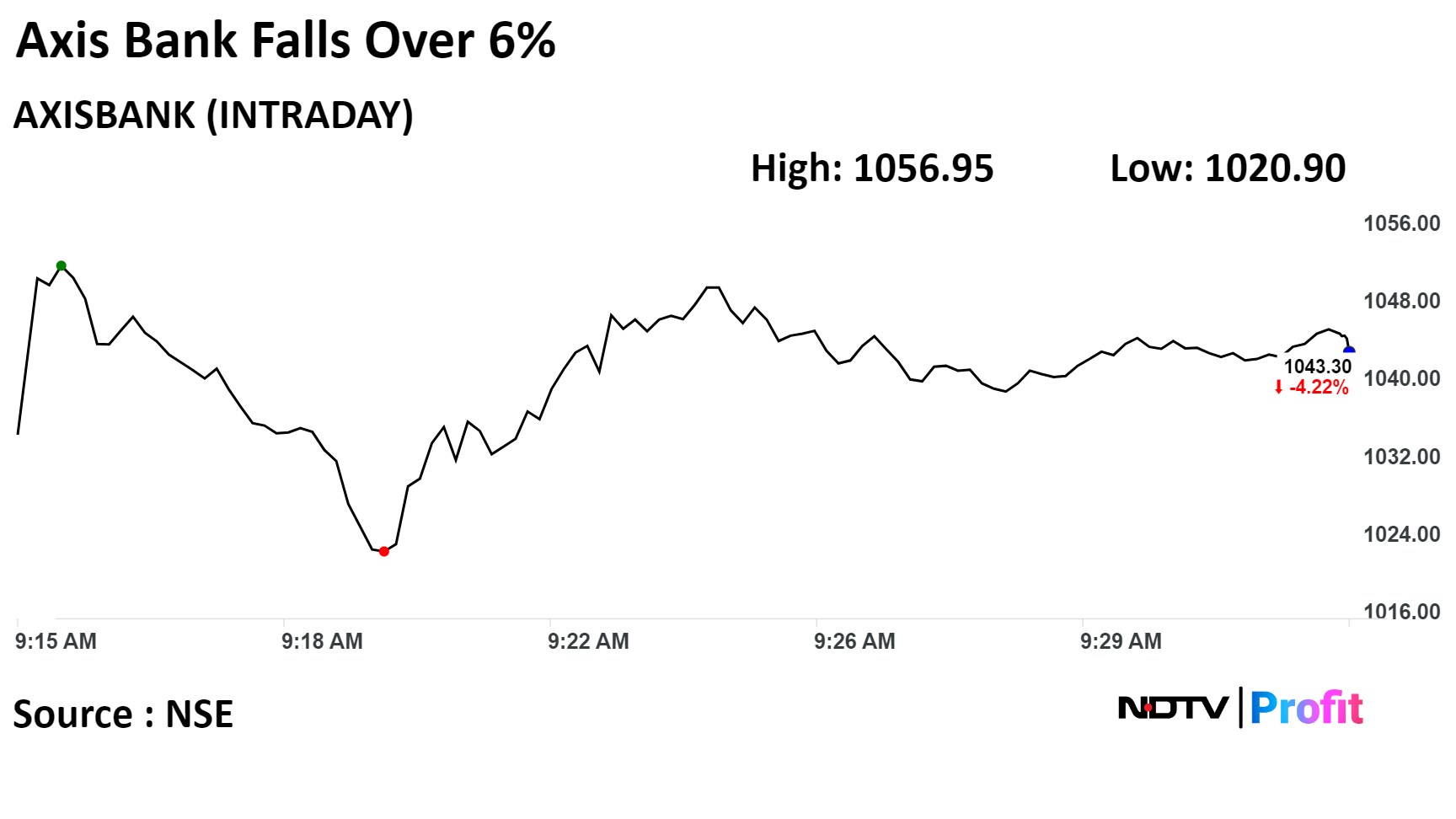

The scrip fell as much as 6.27% to Rs 1,020.90 apiece, the lowest level since Nov 28. It trading 4.6% lower at Rs 1,039.10 apiece, as of 09:38 a.m. This compares to a 0.09% advance in the NSE Nifty 50 Index.

It has risen 14.75% in 12 months. Total traded volume so far in the day stood at 5.4 times its 30-day average. The relative strength index was at 34.98.

Out of 48 analysts tracking the company, 46 maintain a 'buy' rating, eight recommend a 'hold', according to Bloomberg data. The average 12-month consensus price target implies an upside of 21.9%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.