Shares of Avenue Supermarts Ltd. declined on Wednesday after Citi Research forecast a weak third quarter due to slow store growth in smaller towns.

The brokerage maintained a 'sell' rating on the DMart operator, with a target price of Rs 3,100 per share.

The company's revenue per square feet remains impacted by inferior product mixes and new store additions in smaller towns, according to Citi Research. It remains cautious about the current valuation, given the risks around store additions.

On Tuesday, Avenue Supermarts said its revenue rose 17.2% year-on-year to Rs 13,247 crore in Q3 FY24. The number of stores stands at 341 as of Dec. 31

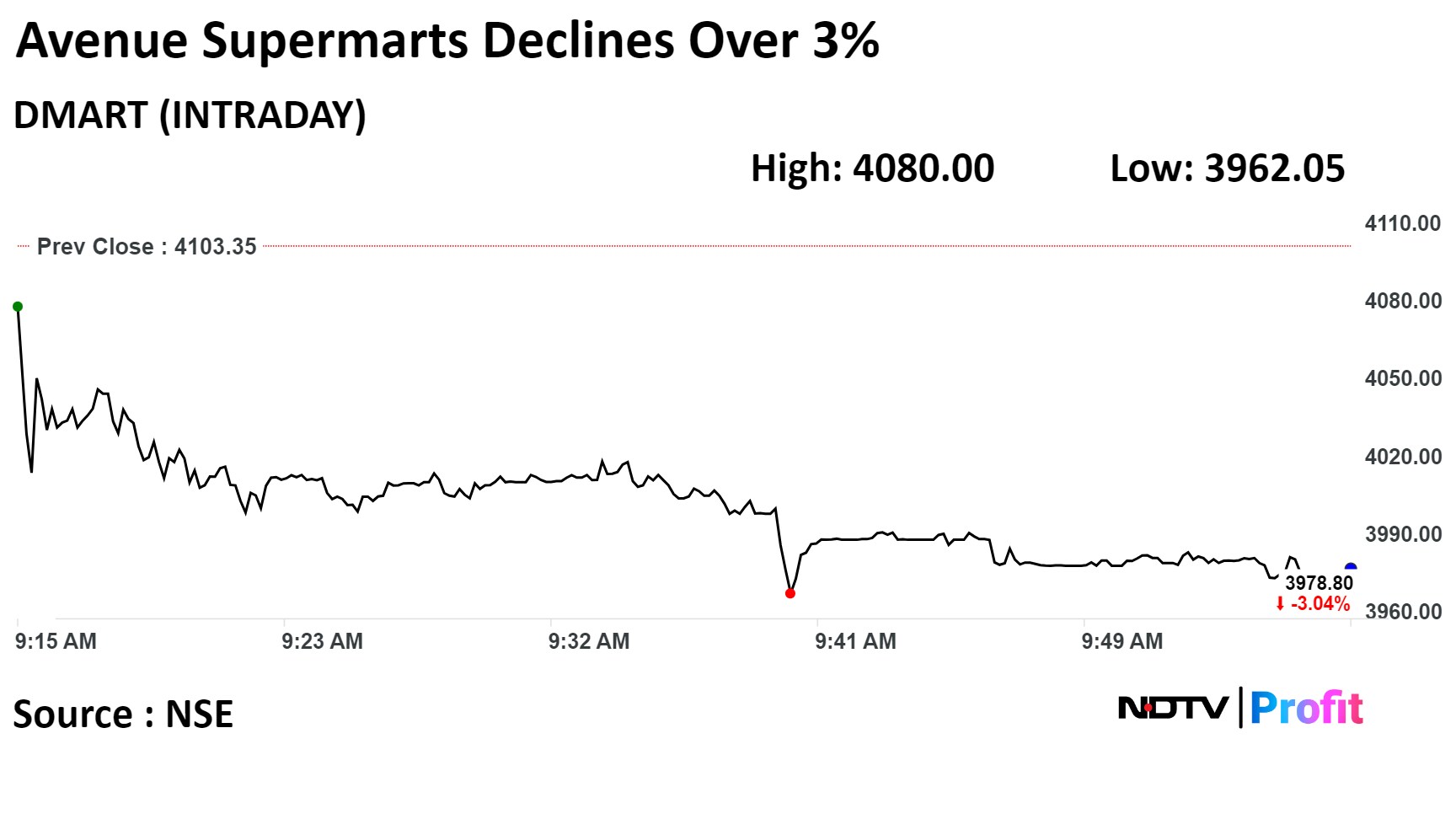

Shares of Avenue Supermarts fell 3.44%, the lowest since Dec. 29, 2023, before paring some loss to trade 3.25% at 10:02 a.m. This compares to 0.38% fall in NSE Nifty 50.

The stock has fallen 2.27% year-to-date. Total traded volume so far in the day stood at 5.2 times its 30-day average. The relative strength index was at 49.50.

Of the 25 analysts tracking the company, 11 maintain a 'buy' rating, six recommend a 'hold,' and eight suggest a 'sell', according to Bloomberg data. The average 12-month analysts' consensus price target implies an upside of 0.8%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.