Shares of Ambuja Cements Ltd. hit an all-time high after the company plans to buy Penna Cement Industries Ltd. Ambuja Cements announced on Thursday its complete acquisition of Hyderabad-based Penna Cement for an enterprise value of Rs 10,422 crore, aiming to strengthen its presence in southern India.

Penna Cement currently has a cement capacity of 14 million tonne per annum, with 10 MTPA already operational. The remaining capacity is under construction across Andhra Pradesh, Telangana, and Rajasthan, expected to be completed within the next six to twelve months, according to a statement to the exchanges.

Approximately 90% of Penna Cement's capacity benefits from railway sidings, complemented by captive power plants and waste heat recovery systems. An additional 3 MTPA cement grinding capacity is anticipated at the Jodhpur plant, augmenting the existing 14 MTPA capacity, the statement said, adding that Adani Cement's total capacity will reach 89 MTPA, supporting its target to achieve 140 MTPA by 2028 after the acquisition.

Ambuja is now poised to expand its market presence in the south by 8% and in pan-India by 2% after the acquisition, according to Citi.

Citi, which reiterated its 'neutral' rating on the shares of Ambuja Cements, said that the acquisition is valued comparably to the construction cost of a new greenfield cement project. The research firm has set a price target of Rs 675 apiece on the stock, implying an upside of 1.7% from Thursday's close.

Homegrown brokerage firm Motilal Oswal, which also has a 'neutral' rating on the stock, has set a target price of Rs 640. Ambuja Cements is focusing on further cost reduction by increasing the share of green power and alternate fuels and raw materials, Motilal Oswal said in a note. "A successful execution of these plans could result in a positive surprise."

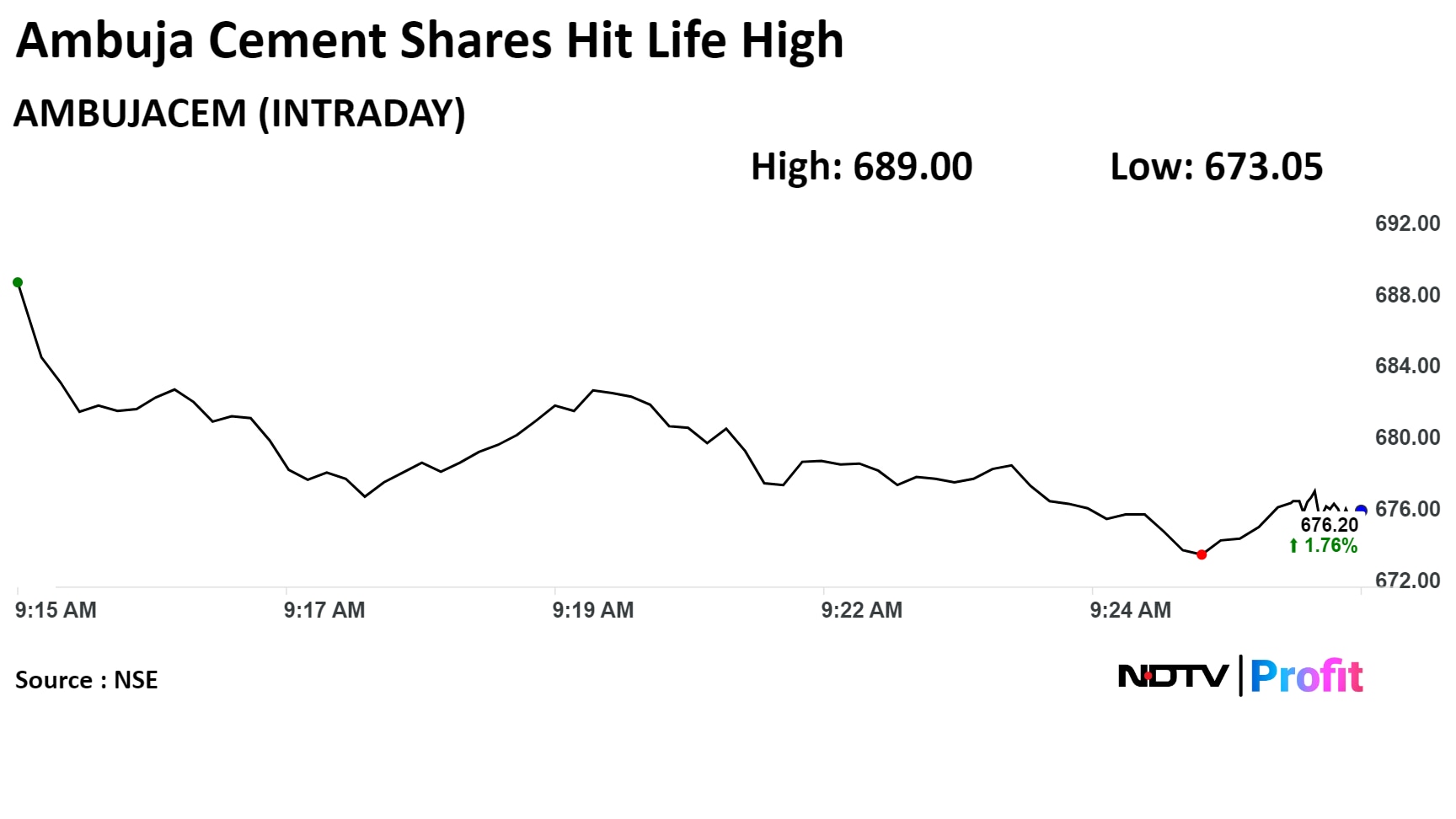

Shares of the Adani-group-owned cement company rose as much as 3.69% during the day to hit an all-time high at Rs 689 apiece on the NSE. The stock, however, pared some gains and traded 2.3% higher at Rs 679.50 apiece, compared to a 0.16% gains in the benchmark NSE Nifty 50 as of 11 a.m.

The stock has risen 46.14% in the last 12 months. The total traded volume so far in the day stood at 38 times its 30-day average. The relative strength index was at 60.91.

Twenty-two out of the 40 analysts tracking Ambuja Cements have a 'buy' rating on the stock, nine recommend a 'hold' and nine suggest a 'sell', according to Bloomberg data. The average of 12-month analyst price targets implies a potential downside of 7.2%.

Disclaimer: NDTV is a subsidiary of AMG Media Networks Limited, an Adani Group Company.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.